Bigger antennas. More spectrum. Higher power. The low-Earth orbit race just escalated.

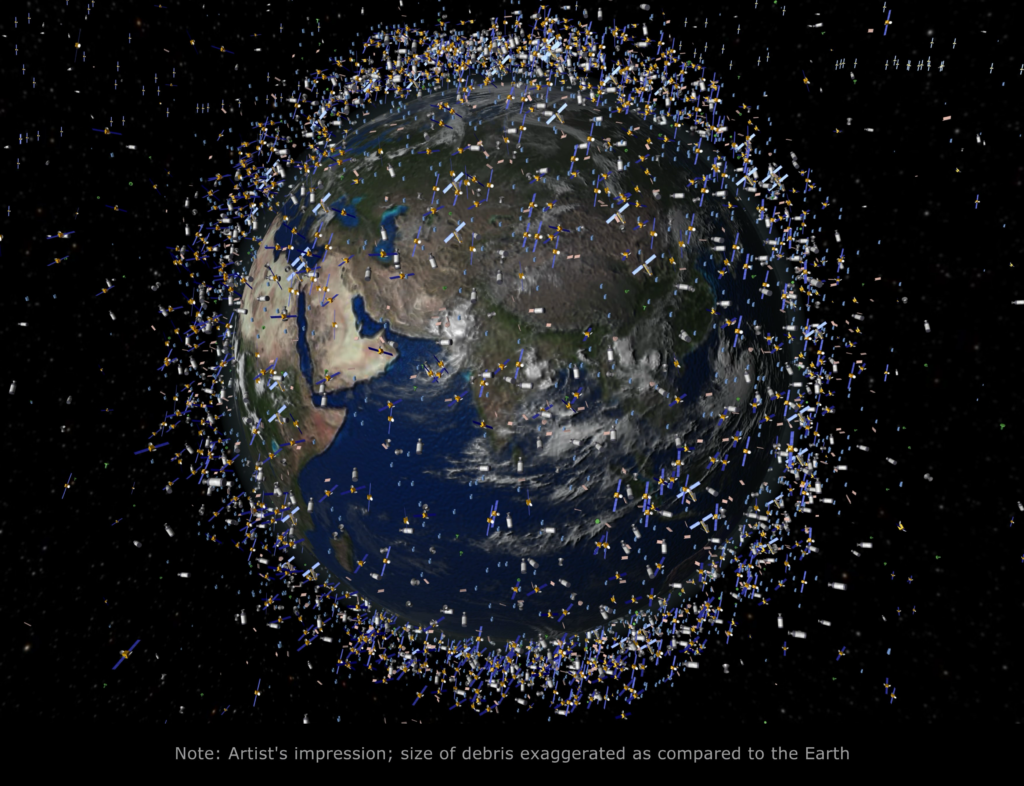

Low-Earth orbit is getting crowded. And very, very competitive.

This week, two major moves reshape the satellite internet battle. Amazon secures regulatory approval to expand its Project Kuiper constellation with thousands of second-generation satellites. At the same time, AST SpaceMobile successfully deploys the largest commercial communications array ever flown in orbit.

Both developments matter with performance limits. Both target the same prize: global broadband and direct-to-phone connectivity.

And both say one thing. The LEO satellite array arms race has entered its next phase.

What’s Happening & Why This Matters

The FCC Green-lights Amazon’s Next Generation

The Federal Communications Commission approves Amazon’s request to launch 4,504 additional low-Earth orbit satellites for its second-generation Kuiper system.

That approval expands Amazon’s authorized constellation to 7,736 satellites when combined with its first-generation fleet.

This is not incremental. It is structural.

The second-generation satellites gain permission to operate across more radio spectrum, including V-band and Ku-band frequencies. The FCC also grants a waiver from equivalent power-flux-density limits, allowing Kuiper to operate at higher power levels in the United States.

Higher power equals stronger signals. Stronger signals mean higher throughput. Higher throughput unlocks enterprise markets.

Rajeev Badyal, Amazon’s VP for Kuiper, calls Gen 1 performance “impressive.” He then points to Gen 2 as the leap forward. More capacity. More coverage. Polar reach. Enterprise-grade throughput.

The polar expansion matters. It targets Alaska and northern Canada. These regions lack terrestrial infrastructure. Satellite broadband fills the gap.

The timing reveals an underlying pressure.

Amazon was required to launch half of its 3,232 first-generation satellites by late July. So far, roughly 180 are in orbit, with expectations of reaching around 700 by mid-summer. Missing the threshold risks losing first-generation authority.

The FCC’s second-generation approval gives Amazon breathing room.

If Gen 1 falls flat, Gen 2 can still press ahead.

Amazon’s Scale Problem

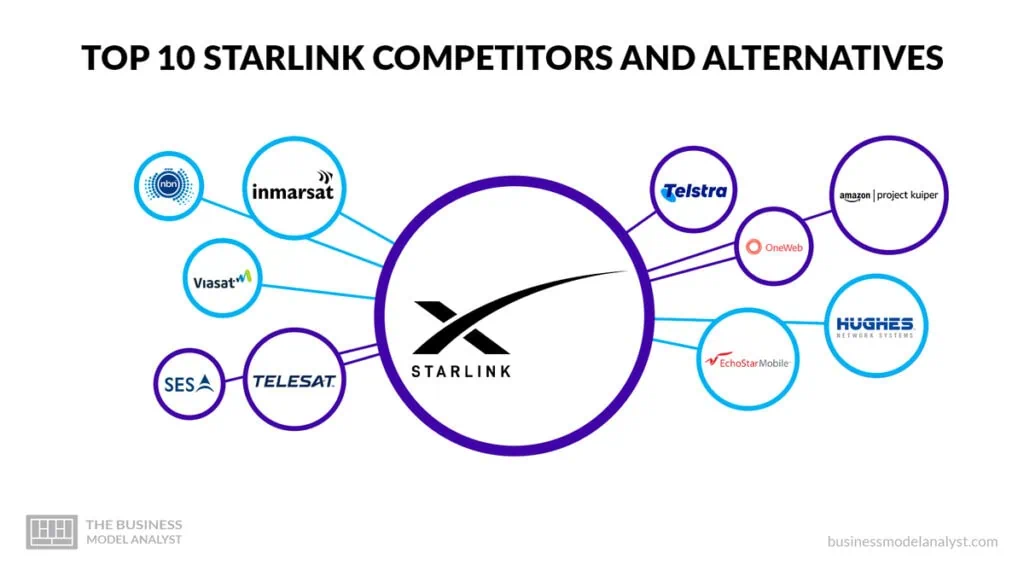

While Amazon expands authorization, SpaceX continues operating from a position of scale.

SpaceX’s Starlink serves more than nine million users globally. It operates roughly 8,300 satellites in active orbit.

Amazon is in private beta. The gap is enormous.

To close it, Amazon secured billions in launch contracts. It lines up flights across multiple providers, preparing another batch of 32 satellites for launch.

Kuiper promises speeds up to 1Gbps for enterprise customers. That ambition targets governments, corporations, and data-intensive users.

More than rural broadband is at stake. It is about owning orbital infrastructure for enterprise data flows. And that requires power, density, and spectrum.

AST SpaceMobile Goes Bigger

While Amazon boosted its constellation size, AST SpaceMobile scaled its surface area. AST successfully deployed its 2,400-square-foot antenna array in orbit.

That array, part of its BlueBird 6 satellite, is the largest commercial communications array ever deployed in low-Earth orbit.

The second-generation BlueBird satellites are roughly three times the size of AST’s first five deployed units. The expanded antenna increases bandwidth capacity by up to ten times.

CEO Abel Avellan calls it “a true breakthrough in space-based cellular broadband.”

The design philosophy differs from Amazon’s. Kuiper builds a dense broadband constellation. AST builds giant orbiting cell towers.

AST’s system connects directly to unmodified smartphones. No dishes or terminals. No new hardware. The satellite itself acts as the tower.

Peak speeds reach up to 120 Mbps, according to AST. Real-world speeds depend on congestion. But the strategic target is clear. Eliminate terrestrial dead zones.

The Cellular Starlink Challenge

AST competes directly with T-Mobile and SpaceX’s cellular Starlink collaboration.

SpaceX already operates around 650 satellites supporting its direct-to-phone service. It plans to scale that constellation to roughly 15,000 satellites for enhanced performance approaching 5G levels.

AST, by contrast, currently operates six BlueBird satellites plus its BlueWalker 3 test satellite. The numbers show an imbalance.

To catch up, AST plans to launch 45 to 60 satellites by the end of 2026. That volume could enable continuous U.S. coverage through partners including AT&T and Verizon.

Launch capacity becomes the bottleneck.

AST contracts with Blue Origin to use the New Glenn rocket, which has only completed two successful flights so far. In an ironic twist, AST also contracts SpaceX to launch some of its satellites.

Competitors depend on each other in orbit.

The Battlefield: Spectrum and Power

The deeper fight revolves around spectrum and power density. Amazon’s FCC approval includes expanded V-band access. That band allows higher data rates but requires careful interference management.

The waiver on equivalent power-flux density limits allows Kuiper to operate at stronger signal levels domestically. AST, meanwhile, bets on physical antenna size to capture and transmit stronger signals to ground devices.

Two strategies emerge. Amazon scales satellite count and spectrum rights. AST scales antenna size and bandwidth per satellite. Both attempt to solve the same equation: maximize throughput per square mile.

Astronomers’ Concerns

Bigger arrays reflect more light.

Astronomers already criticize Starlink for disrupting night-sky observations. AST’s 2,400 square-foot antenna could amplify those concerns.

Regulators will watch brightness levels carefully. The orbital economy grows. So does orbital tension.

The Strategic Endgame

The LEO satellite array arms race no longer revolves around novelty. The foci is infrastructure dominance.

Broadband satellites underpin:

- Rural connectivity

- Military communications

- Enterprise data flows

- Disaster recovery

- Direct-to-device cellular

Owning the sky means owning redundancy. Amazon builds density to compete head-to-head with Starlink broadband. AST builds scale per satellite to compete in cellular.

Both chase markets beyond consumer Wi-Fi. Governments. Defense. Critical infrastructure. Satellite internet coverage is digital sovereignty.

TF Summary: What’s Next

Amazon secures FCC approval for 4,504 second-generation Kuiper satellites, expanding spectrum and power capacity. AST SpaceMobile deploys a record-breaking 2,400 square-foot antenna to strengthen direct-to-phone connectivity. The race intensifies across the spectrum of rights, launch cadence, and antenna scale.

MY FORECAST: Constellation density and antenna scale converge by 2028. Direct-to-device cellular becomes standard in remote regions. Regulatory battles over spectrum and sky brightness intensify. The winner controls not just coverage, but resilience.

— Text-to-Speech (TTS) provided by gspeech | TechFyle