In a major shift in the satellite TV industry, DirecTV is acquiring Dish Network in a move aimed at competing more effectively with video streaming services. Both companies have faced a steady decline in subscribers as more consumers cut the cord in favor of streaming platforms. This merger seeks to give the combined entity the scale and negotiating power needed to offer better deals, content, and flexibility to customers. The deal will also see DirecTV gain control of Sling TV, Dish’s live streaming service.

What’s Happening & Why This Matters

The Merger of Two Satellite Giants

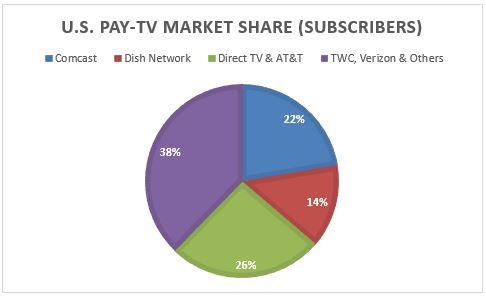

DirecTV, one of the largest satellite TV providers in the U.S., is acquiring Dish Network’s video distribution business from EchoStar, Dish’s parent company. DirecTV aims to create a stronger, more competitive entity in the TV service industry. According to DirecTV’s CEO, Bill Morrow, the merger will enable the company to work more effectively with content providers and deliver tailored, lower-cost TV packages to consumers. Currently, DirecTV’s cheapest plan costs $69.99 per month, and the company is hoping to negotiate better content deals to lower prices.

AT&T, which holds a 70% stake in DirecTV, is exiting the satellite TV business through this deal, selling its shares to private equity firm TPG. AT&T will receive $7.6 billion from the transaction, which will further distance the telecom giant from satellite television.

Streaming Market Impact

As part of the acquisition, DirecTV will take over Dish’s Sling TV, which has been competing in the streaming arena alongside services like Hulu Live and YouTube TV. This addition bolsters DirecTV’s presence in the live streaming market and complements its existing efforts to invest in streaming services. The company plans to make streaming a central part of its strategy going forward.

With both DirecTV and Dish having lost millions of traditional TV subscribers in recent years, this merger is a response to the shifting viewing habits of consumers, especially younger generations who prefer on-demand content through streaming. DirecTV hopes that by combining its assets with Dish, it will be able to better compete with streaming giants and offer more attractive options to customers.

Dish’s Focus on 5G and Wireless

While Dish Network is stepping away from the TV business, EchoStar will retain its 5G cellular operations through Boost Mobile. By selling the TV segment, EchoStar plans to focus on becoming a major player in the wireless market. CEO Hamid Akhavan noted that the company would use the proceeds from this sale to enhance and expand its 5G network, providing consumers with more choices in the U.S. wireless market.

The Financials and Regulatory Approval

The financial terms of the deal show that DirecTV will acquire Dish’s TV and Sling TV businesses for just $1, but it will also take on $9.8 billion in debt. However, this merger will require regulatory approval, with antitrust concerns likely to be a significant hurdle. DirecTV expects the deal to close by Q4 of 2025, provided it passes regulatory scrutiny.

TF Summary: What’s Next?

This merger between DirecTV and Dish Network represents an effort by both companies to survive in a changing media market dominated by streaming services. For consumers, it could lead to more affordable TV packages and better streaming options. For Dish, this merger allows the company to focus on its wireless and 5G ambitions, while DirecTV strengthens its position in both traditional and streaming TV markets. As the deal awaits regulatory approval, the telecom competitors and subscribers will be watching closely to see how this affects competition and content pricing.

— Text-to-Speech (TTS) provided by gspeech