President Trump Calls Netflix-WBD a “Problem”

20 JAN 2025 UPDATE: Netflix amended its $72Bn deal for Warner Bros. Discovery to all-cash. It is an attempt to fight off Paramount’s hostile takeover bid. Netflix originally agreed to buy the company with a cash-stock mix.

The streaming world entered a new, chaotic chapter in recent days. Netflix announced plans to acquire Warner Bros. Discovery (WBD) for $82.7 billion. The deal stunned Hollywood. It also ignited an immediate fight. Paramount–Skydance stormed in with a hostile $108.4 billion bid, positioning itself as the “superior and certain” buyer. The move threw pressure, politics, and industry loyalties into the mix.

The moment set off a regulatory storm, drew in the White House, and triggered sharp public responses. The friction turned the WBD sale into a full-contact contest between two giants that view the future of entertainment very differently.

Netflix wants WBD for streaming dominance. Paramount wants it for theatres, scale, and legacy power. Washington wants answers. Hollywood unions want assurances. And WBD shareholders want clarity.

The stage now carries all of that tension at once.

What’s Happening & Why This Matters

Paramount Strikes Back

Netflix dropped the first bomb. It moved for WBD with an $82.7B offer and expressed confidence in the regulatory review. The company told the press the transaction “is pro-consumer, pro-innovation, pro-worker, pro-creator, pro-growth,” and said it expects closure in 12–18 months.

Yet the offer carried a catch: WBD’s Global Networks division must spin off into a separate public company by Q3 2026. Shareholder approval and cross-border regulatory sign-off also sit on the path.

Paramount saw an opening. It responded with its own plan: buy all of WBD, including Global Networks, with a direct $30-per-share offer totalling $108.4B. According to the company, Netflix’s proposal gives shareholders “inferior and uncertain value” and forces them into a “protracted and uncertain multi-jurisdictional regulatory clearance process.”

Paramount also claims WBD ran a “myopic process with a predetermined outcome” that avoided serious engagement with earlier Skydance proposals. In its filing, Paramount said it made six proposals over the last 12 weeks without receiving meaningful responses. Monday’s hostile bid exists to “ensure WBD shareholders have the opportunity to pursue this clearly superior alternative.”

The White House’s Feedback

Politics now sits in the centre. President Donald Trump met with Netflix co-CEO Ted Sarandos for roughly two hours, according to reporting from The Hollywood Reporter. The White House declined to comment on whether the meeting took place, but sources say it was real and lengthy.

Trump then suggested the Netflix–WBD combination “could be a problem” due to its market share. He also said he “would be involved” in the review process. His stance shifted again days later when he criticised Paramount on Truth Social over an unrelated 60 Minutes segment, creating a strange triangle of praise, caution, and scolding across both bidders.

The mix matters because the deal requires federal approval. Trump’s comments signal political unpredictability for both companies.

Hollywood, Theatres Brace for Impact

The theatrical world leans toward Paramount. The industry fears that Netflix may shorten or deprioritise cinema release windows if it acquires WBD. Paramount leaned into that anxiety, noting its century-long history with theatres and promising “a greater number of movies in theatres” under a merged structure.

Netflix, for its part, said it intends to maintain WBD’s current release cadence through 2029. Yet the perception gap remains wide.

Writers, actors, and other unions also weigh in. They view Netflix’s consolidation plans with concern. That scepticism further muddies the regulatory picture.

Streaming Consolidation Reaches a Breaking Point

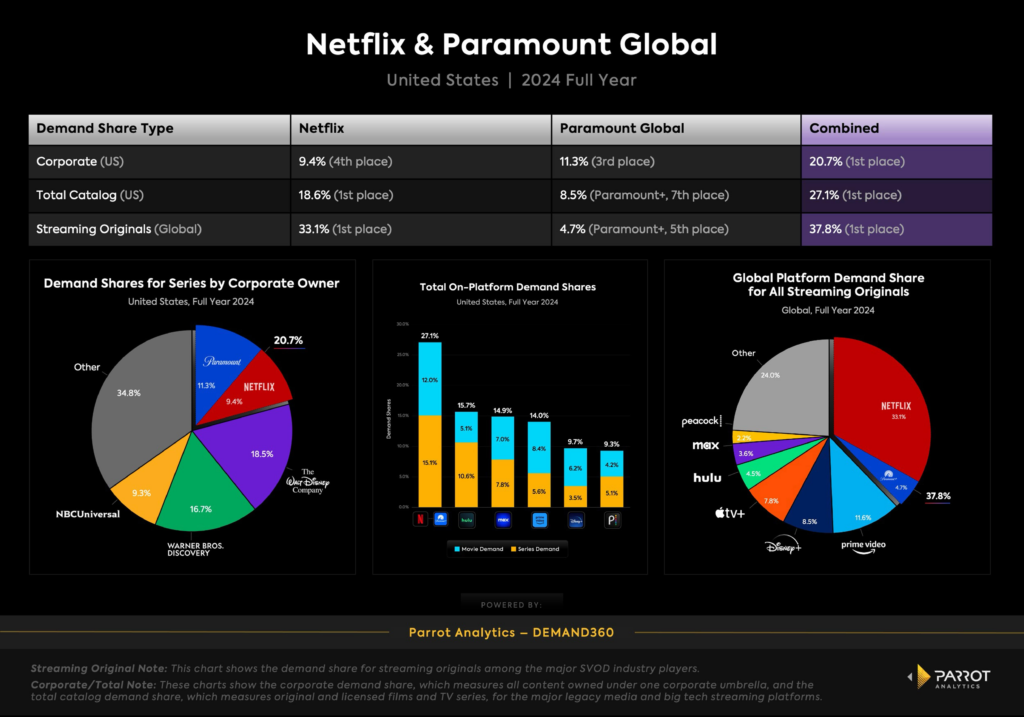

A merged Netflix–WBD creates a global titan. Netflix already exceeds 300 million subscribers. Adding HBO Max’s 128 million subscribers, along with franchises like Game of Thrones, Harry Potter, Friends, The Sopranos, and The Wire, reshapes the competitive landscape overnight.

Paramount’s plan envisions folding HBO Max into Paramount+. The company openly teased this idea in its public filing. That move would create a direct counterweight to Netflix’s vision of its own mega-platform.

Both scenarios consolidate power, restructure Hollywood, and force regulators to evaluate competition, distribution, and content control.

TF Summary: What’s Next

The takeover battle enters a sharper phase now. Netflix defends its offer. Paramount escalates pressure. WBD leadership faces criticism for “predetermined” processes. The White House signals unpredictable involvement. And regulators assess two dramatically different visions of the entertainment future.

MY FORECAST: The media wars are on fire. Paramount upped the stakes through public messaging and alliances. Netflix flexes its muscle, scale, and political diplomacy. Regulators drag the timeline. WBD fractures into camps. The final verdict arrives later than anyone wants. The winning bidder inherits more than legacy assets, but a new Hollywood.

— Text-to-Speech (TTS) provided by gspeech