Nvidia Wins Permission to Export H200 Chips

The U.S. spent two years tightening rules on advanced AI chip exports to China. The strategy pressured Chinese firms, reshaped global supply chains, and helped drive record demand for Nvidia’s custom “China-compliant” hardware. Then, everything changed. President Donald Trump cleared the sale of Nvidia’s H200 GPUs to Chinese buyers — a reversal that stunned markets and rewired expectations for tech policy under his administration.

The decision was a surprise. It also followed right as Chinese manufacturers sought ways past U.S. restrictions and as American firms waited for clarity on export rules. The action noted Trump’s strongest sign yet: tariffs stay, but AI hardware trade reopens on his terms.

What’s Happening & Why This Matters

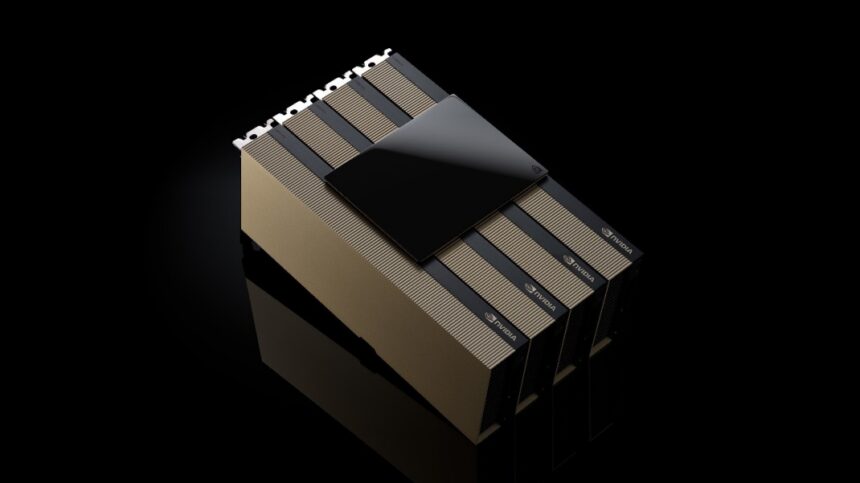

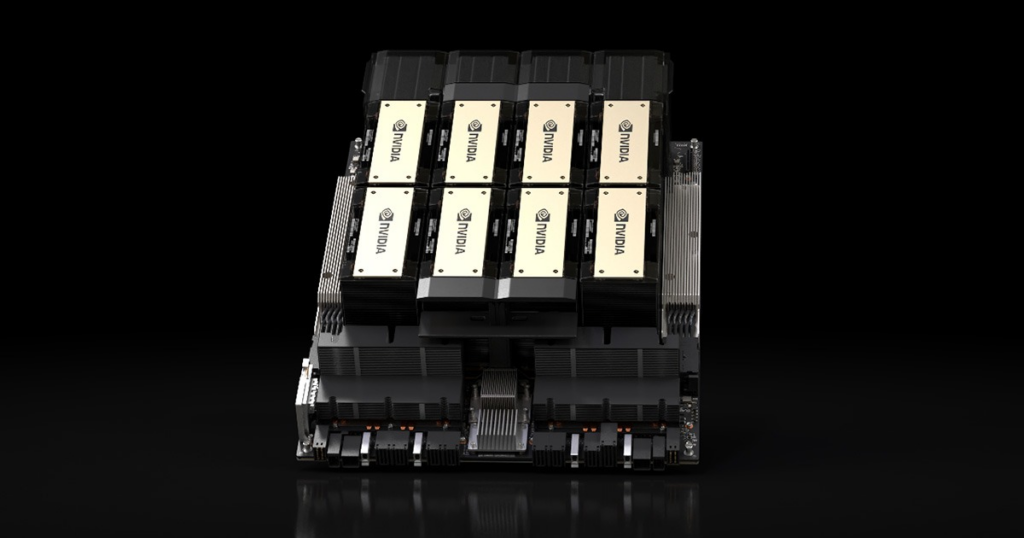

The Trump administration’s decision authorises Nvidia to sell its powerful H200 AI accelerators to Chinese companies. These chips sit near the top of Nvidia’s lineup, and demand has been intense as companies everywhere race to build larger, faster AI models. The administration framed the move as a “controlled permission,” not a blanket opening of the hardware pipeline.

Trump’s critics said he reversed years of national security doctrine. Supporters called it “smart leverage,” arguing that allowing tightly managed chip exports strengthens U.S. influence over global AI development.

Nvidia publicly welcomed the clarity. One industry analyst told Reuters that “Nvidia gains immediate access to billions in deferred demand.”

Tariffs Stay, but Tech Restrictions Loosen

The U.S. maintained the 25% tariffs on a wide set of Chinese imports. However, the administration separated tariffs from tech-security rules. The message: China still faces economic pressure, but American AI companies get room to operate.

Trump said during a press briefing, “We want American technology to lead. That means American companies stay competitive.”

The strategy breaks from the Biden administration’s method, which tied tariffs, export controls, and supply-chain measures together.

Beijing Responds With Cautious Optimism

Chinese state media called the decision “a rational correction,” but officials stressed that “predictable policy is essential for stable cooperation.” China wants access to advanced AI hardware but remains wary of rapid changes in U.S. rules.

Chinese tech giants—including Baidu, Tencent, and Alibaba—have already placed inquiries with Nvidia for 2025 supply.

Investors React

Markets jumped. Nvidia shares rose on expectations of revived China revenue. Competitors such as AMD and Huawei watched closely. Analysts pointed out that the U.S. export-control regime is now looser than at any time since late 2022.

One semiconductor researcher reframed the event: “This is less about chips and more about signaling. The U.S. is reshuffling the economic chessboard again.”

Why It Matters

The approval resets the global AI race. It reopens one of Nvidia’s largest markets, boosting Chinese AI development. It is a modification in the U.S. strategy, from containment to selective engagement.

For companies building large models, the decision speeds up access to world-leading compute. For policymakers, it restarts arguments about national security, economic strategy, and America’s long-term role in AI leadership.

TF Summary: What’s Next

Nvidia’s China business reactivates. Chinese AI labs get relief. U.S.–China tech relations head in a direction defined by controlled access rather than outright bans. The administration uses the opening to advance leverage in trade talks this year and next.

MY FORECAST: Trump opens the door to more case-by-case tech export approvals through 2026. Nvidia secures multiple Chinese bulk orders. AMD follows with its own tailored China hardware. U.S.–China chip competition heats up again, but the rules veer toward regulation rather than restriction.

— Text-to-Speech (TTS) provided by gspeech