Peloton is pushing hard into artificial intelligence with its latest product relaunch. It is reshaping its identity as more than just a bike company. The once pandemic-era darling is betting that AI-driven personal training, smarter equipment, and integrated fitness ecosystems can help it win back customers. It aims to reclaim lost market value.

What’s Happening & Why This Matters

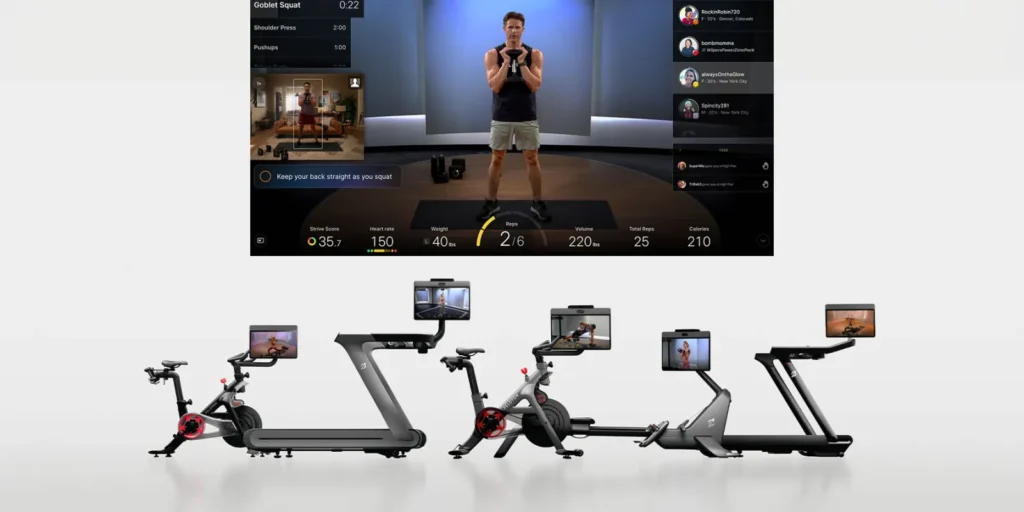

Peloton has overhauled its entire hardware lineup, introducing new versions of the Bike, Bike+, Tread, Tread+, and Row+. These are now rebranded as the Cross Training Series. Every piece of equipment is designed with versatility in mind. They feature swivelling screens that allow users to move seamlessly from cardio to strength training, yoga, and floor-based workouts.

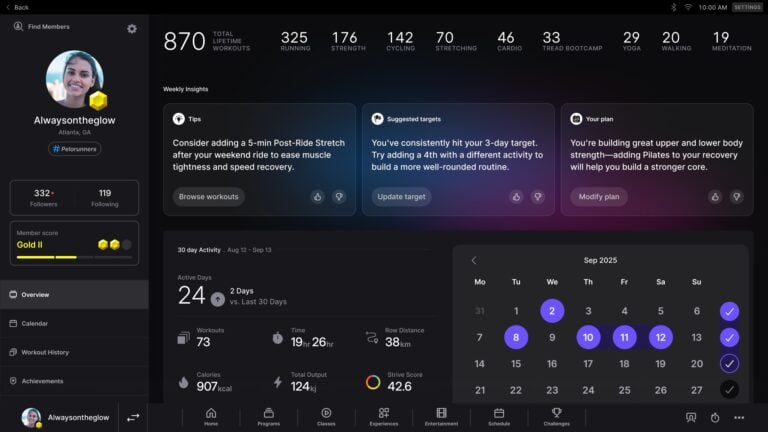

The real innovation, however, comes from Peloton IQ, an AI-powered system integrated into all Plus models. Acting like a personal trainer, Peloton IQ uses a built-in AI camera to track reps, correct form, and tailor workout plans. Unlike the short-lived Peloton Guide, the system goes further by embedding AI intelligence directly into the machines. Peloton Chief Product Officer Nick Caldwell explained: “The Guide was great; we learned a lot from it. Peloton IQ with Cross Training is next level”.

At launch, Peloton IQ can recognise and track 120 movements and provide real-time form feedback for 50+ exercises. It has ambitions to expand into yoga. For example, while performing dumbbell squats, the AI might suggest keeping the chest lifted. During presses, it can advise against swinging the body. It also builds personalised weekly workout plans using goals, performance metrics, and even connected data from devices like Apple Health or Fitbit.

On the hardware side, Plus models feature Sonos-tuned sound systems, integrated microphones for voice control, and ergonomic updates like adjustable fans and redesigned bike seats. Prices, however, are climbing:

- Bike: $1,695

- Bike+: $2,695

- Tread: $3,295

- Tread+: $6,695

- Row+: $3,495

In addition, Peloton has raised its All-Access Membership fee for the first time in three years, from $44 to $49.99 per month.

A Company in Transformation

This relaunch is the first major move under CEO Peter Stern, formerly of Ford and Apple. Stern faces a steep climb. Peloton stock has plummeted more than 90% since its 2020 peak. With this refresh, Stern is repositioning Peloton as a multi-modality fitness company, not just a cardio brand. “A lot of people still think of us as a bike company, even though our number-two modality is strength,” Caldwell noted.

Stern’s strategy includes revamping marketing and broadening distribution through Amazon and Dick’s Sporting Goods. He is trying to regain trust after past stumbles, including a $19 million fine in 2023 over treadmill recalls. The relaunch comes amid layoffs, restructuring, and cost-cutting. This freed $100 million for reinvestment into product development.

Industry analysts see promise. Brian Nagel of Oppenheimer commented: “We look favorably upon efforts on the part of new senior leadership at Peloton to reinvigorate the brand and cater to a wider array of target consumers.”

A New AI Fitness Era

For users, Peloton’s bet on AI could redefine home training. By fusing cardio and strength within one ecosystem and layering in real-time feedback, Peloton is competing directly with rivals like Tonal and Tempo. It is leveraging its loyal community and content-rich platform. The AI camera doesn’t just count reps — it can analyse posture, log weights via voice, and suggest intensity adjustments. It can even recommend recovery routines if it detects overtraining.

Peloton IQ effectively turns workouts into data-driven coaching sessions. For those already invested in the Peloton ecosystem, it’s a leap forward. For newcomers, it provides a reason to pick Peloton over cheaper fitness options or competing smart gyms. Still, the higher prices may deter casual buyers, leaving open the question: can Peloton’s AI-driven reinvention revive its fortunes?

TF Summary: What’s Next

If Peloton can market this transformation effectively and demonstrate that AI delivers real results, it stands a chance of rebuilding both its customer base and investor confidence. Otherwise, it risks becoming another cautionary tale of a pandemic boom brand unable to sustain momentum.

MY FORECAST: Peloton’s gamble is clear — it’s doubling down on AI to win back relevance. The fit-tech company is selling more than bikes and treadmills. It’s erecting an intelligent fitness platform that promises personalisation, accountability, and integrated wellness. Success depends on whether customers embrace AI coaching as a must-have, rather than a gimmick.

— Text-to-Speech (TTS) provided by gspeech