Europe Builds Its Own Space Connection

Vodafone and AST SpaceMobile are going head-to-head-to-head with SpaceX’s Starlink, building a new satellite operations hub in Germany as part of a joint European connectivity venture. The project — dubbed SatCo — seeks to deliver space-based mobile internet to carriers across Europe. Their goal is to reduce the continent’s dependence on Elon Musk’s SpaceX.

Vodafone’s CEO, Margherita Della Valle, says the plan anchors Europe’s communications infrastructure in European hands. The operations center, likely to be based in Hannover or Munich, will control AST’s BlueBird satellite constellation and connect directly with Europe’s 4G and 5G networks.

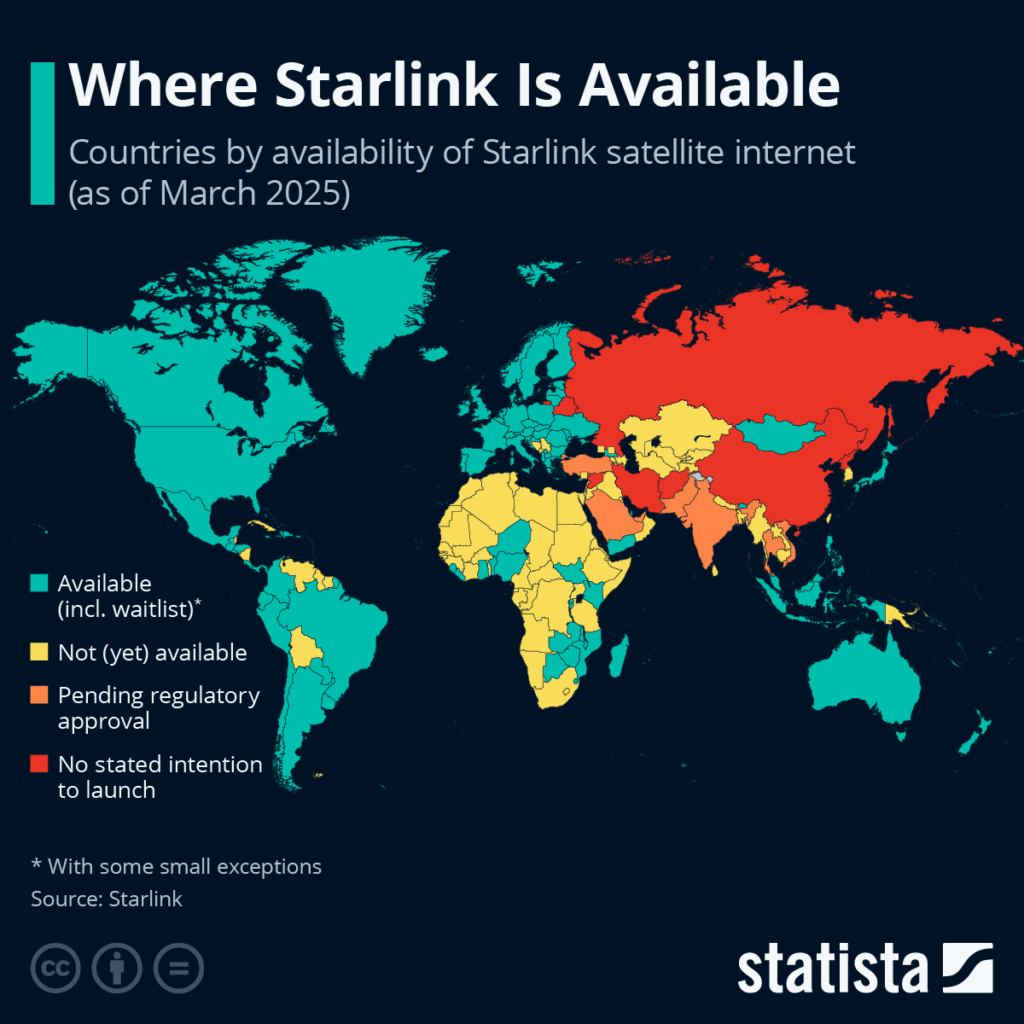

The move signals Europe’s determination to establish its own satellite connectivity ecosystem, offering an alternative to Starlink, which currently dominates the low-Earth orbit (LEO) broadband market.

What’s Happening & Why This Matters

Vodafone and AST Build SatCo to Challenge Starlink

In March, Vodafone and Texas-based AST SpaceMobile announced SatCo, a jointly owned European satellite company designed to serve mobile carriers across the region. The companies expect their satellites to start delivering mobile broadband service in 2025 and 2026, with initial operations supported through the new German control center.

The hub will allocate satellite capacity, manage signal mapping, and host gateway stations linking the space network to terrestrial systems. It also serves as a base for emergency services and disaster relief coordination, helping authorities maintain communication in crisis zones or rural areas.

“By establishing a satellite constellation in the EU and our principal command center in Germany, we are ensuring the next frontier of communications infrastructure is firmly embedded in Europe,” said Della Valle.

The new network’s architecture will complement existing cellular systems rather than replace them — a design that allows mobile carriers to extend service to hard-to-reach regions using regular smartphones instead of specialized satellite hardware.

Europe’s Tech Play

The EU’s political leadership has made satellite independence a strategic priority. While Starlink proved vital during the war in Ukraine, its control by Elon Musk raised concerns about geopolitical and operational risk.

European officials are itching to build “sovereign” space infrastructure that can operate without reliance on foreign companies. The Iris² project, the EU’s official satellite broadband program, carries an estimated cost of €10 billion ($10.8 billion) but may not be fully operational until the early 2030s.

Until then, Vodafone and AST’s SatCo offers a faster, more commercially viable bridge.

AST SpaceMobile currently partners with AT&T and Verizon in the United States and collaborates with Blue Origin, India’s ISRO, and SpaceX itself for satellite launches. Its BlueBird satellites are designed to provide direct-to-phone broadband service without new antennas or devices.

This gives AST a practical head start on integrating its service into existing networks — and gives Europe a realistic alternative before Iris² becomes operational.

A Crowded Sky Ahead

Starlink, Eutelsat, and now SatCo are all racing to capture Europe’s satellite broadband market. French operator Eutelsat, already a developing force in the corporate and government sector, publicly criticized SpaceX’s upgrade proposals to deploy more satellites in low orbit. Eutelsat claims SpaceX crowds European airspace and risks interference.

Meanwhile, Vodafone’s partnership with AST helps it pivot from a traditional telecom provider into a space-enabled network operator. The collaboration offers more than broadband. It is a statement: Europe intends to own its digital future rather than lease it from [American] tech billionaires.

“The next generation of connectivity will not be defined by one company,” said an AST executive, “but by partnerships that combine space technology with terrestrial infrastructure.”

TF Summary: What’s Next

The Vodafone–AST alliance contests SpaceX’s Starlink dominance by fusing European telecom power with American satellite expertise. The establishment of a German operations base cements Europe’s commitment to self-reliant space communications.

MY FORECAST: Expect the EU to back SatCo as a complementary system to Iris², accelerating its rollout through regulatory support and funding incentives. By 2026, Europe may have true direct-to-phone connectivity competing head-on with Starlink — this time with European control and global reach.

— Text-to-Speech (TTS) provided by gspeech