President Donald Trump escalates trade tensions by imposing tariffs on India, a key U.S. trading partner. The tariffs, totaling 50%, respond to India’s continued import of Russian oil despite U.S. sanctions. Meanwhile, Trump signals looming tariffs on foreign semiconductors, raising questions about the future of global chip supply chains and American electronics costs.

What’s Happening & Why This Matters

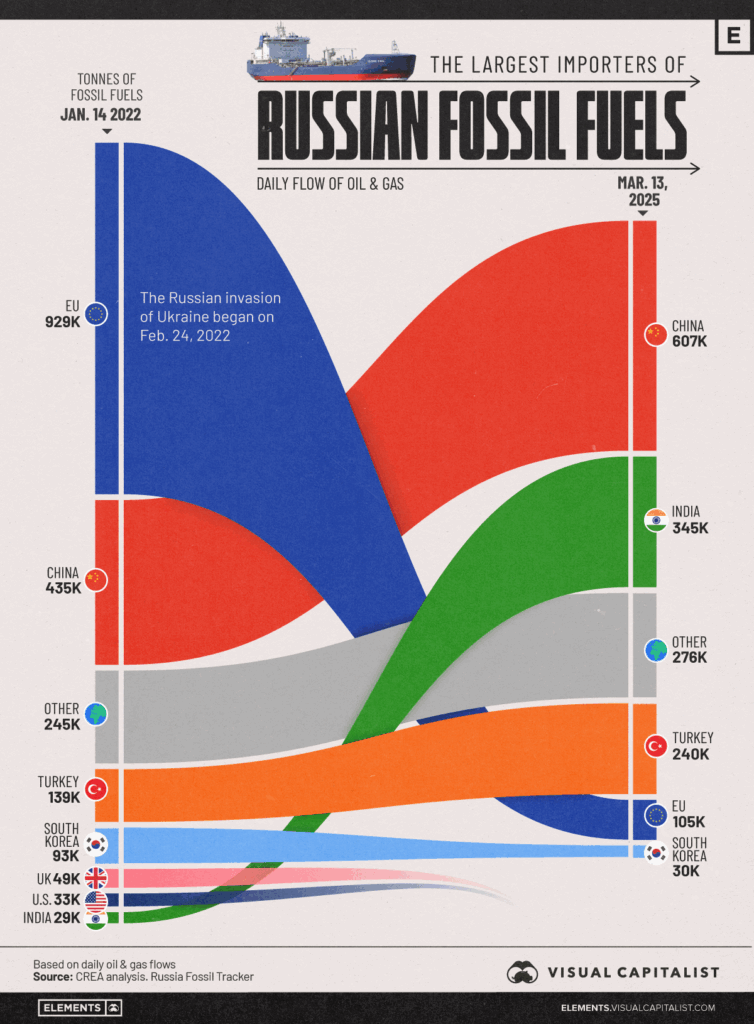

Trump announces a 25% tariff effective immediately on Indian goods, followed by an additional 25% tariff set to activate later this month. These new tariffs target India’s oil imports from Russia, which the U.S. accuses of fueling Moscow’s war efforts in Ukraine. The order is an escalation in U.S.-India trade relations, employing secondary sanctions to pressure India.

India rejects the accusations, stressing its energy security needs for its 1.4 billion people. The country insists it will protect its national interests, hinting at possible retaliatory tariffs against U.S. exports. India’s Ministry of External Affairs states, “Our imports are based on market factors, similar to actions taken by other nations.”

The tariffs apply to almost all Indian exports except smartphones, which include major products like Apple’s iPhones assembled in India. The U.S. trade deficit with India has grown, driven partly by tariff tensions with China. Companies have shifted production to India, complicating the trade dynamics.

Parallel to this, Trump teases upcoming tariffs on foreign chips and semiconductors, expected within weeks. This category is separate from existing 15% tariffs on goods from the EU, Japan, and others. Trump emphasizes a desire for chips to be made in the U.S. to reduce dependency on hostile nations, specifically China.

Major chip producers like TSMC operate facilities in both Taiwan and the U.S. While TSMC opened a fab in Arizona, most production remains in Taiwan. The company has warned that tariffs hurt U.S. chip demand and delay further investment in Arizona fabs. TSMC urged for exemptions to avoid disrupting supply chains critical to American tech firms.

The semiconductor tariffs raise concerns about increased prices for PC processors and consumer electronics. Firms such as Apple, AMD, Qualcomm, and Nvidia rely heavily on foreign chip manufacturing, especially through TSMC. A tariff on chips could impact these companies’ supply costs and product pricing.

Trump’s tariff pressure is a component in an established strategy of economic nationalism and supply chain security. His administration states on social media that the U.S. must not be “held hostage” by foreign countries, especially adversarial ones like China.

TF Summary: What’s Next

The Trump administration’s 50% tariffs on India mark a new phase in trade friction, pressuring India over Russian oil imports while risking retaliatory measures. Concurrently, anticipated tariffs on foreign chips could reshape the semiconductor landscape and raise consumer costs.

Watch for India’s response and the unfolding impact on U.S. tech industries. The chip tariffs may accelerate domestic manufacturing efforts but strain global supply chains. Similar policies influence international trade and technology sectors throughout 2025 and beyond.

— Text-to-Speech (TTS) provided by gspeech