The battle for dominance in satellite connectivity has intensified, with two major players at the forefront: SpaceX and AST SpaceMobile. Both companies are developing innovative satellite services that provide global cellular connectivity. However, their paths diverge in terms of regulation, coverage, and the ongoing China factor. As these companies vie for control, their differing approaches and the scrutiny they face from regulatory bodies add complexity to their rivalry.

What’s Happening & Why This Matters

AST SpaceMobile and SpaceX are racing to build satellite networks that provide mobile phone service via low Earth orbiting (LEO) satellites. AST SpaceMobile’s ambition centers on its BlueBird satellites, which aim to deliver cellular connectivity to carriers such as AT&T and Verizon. On the other hand, SpaceX has been developing Starlink, a similar satellite service. Still, the competition between the two goes beyond just business—it touches on national security, space debris concerns, and regulatory hurdles.

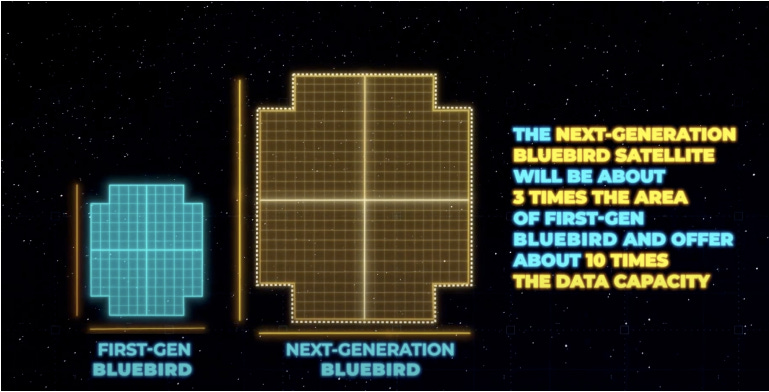

AST is seeking the FCC’s approval to launch a more powerful BlueBird satellite, the FM-1. This next-gen satellite is significantly larger than previous models, which has raised concerns about its potential impact on orbital safety. SpaceX has raised red flags over AST’s plan, questioning its orbital debris mitigation strategy. According to SpaceX, the FM-1 satellite might stay in orbit 6.6 years after its mission ends, violating FCC rules requiring quicker satellite disposal. Furthermore, SpaceX claims that the FM-1’s collision risk is ten times higher than reported by AST, increasing the risk of space debris and interference with optical astronomy.

AST SpaceMobile is eager to get its FM-1 satellite into orbit, as its partners want to offer satellite connectivity to customers by next year. However, the company faces delays in securing FCC approval. Despite SpaceX’s complaints, the FCC has asked AST to clarify several points about its satellite plan, including concerns about its data management and the risks of space debris. These regulatory hurdles threaten to delay the satellite’s July 2025 launch.

Meanwhile, FCC Chairman Brendan Carr has supported AST SpaceMobile, even though he has voiced backing for SpaceX’s Starlink. In a recent visit to AST SpaceMobile’s headquarters in Midland, Texas, Carr discussed the company’s efforts to challenge China’s satellite ambitions. According to Carr, the United States must stay ahead of China’s growing satellite network to secure national defense and technological leadership. AST’s role in providing U.S.-based satellite technology has been positioned as a critical piece of the national security puzzle, making it a key player in the ongoing geopolitical battle in space.

While Carr has recognized the importance of satellite services in the U.S., the path forward for AST is fraught with regulatory obstacles. The FCC’s approval process for AST’s larger satellites, including the FM-1 prototype, remains in limbo. AST SpaceMobile must launch at least 45 to 60 satellites before it can offer continuous U.S. coverage, making its timeline incredibly tight. SpaceX, meanwhile, continues to roll out its Starlink service in partnership with T-Mobile, with a full commercial launch planned for July 2025. This makes the race even more urgent, as both companies look to establish themselves as the dominant cellular satellite provider in the U.S. and beyond.

TF Summary: What’s Next

As the competition heats up between SpaceX and AST SpaceMobile, the companies are navigating a complex web of regulatory challenges, satellite safety concerns, and geopolitical tensions. While AST SpaceMobile seeks to expand its coverage, its FM-1 satellite faces critical questions from the FCC that could delay its launch. At the same time, SpaceX presses forward with Starlink, adding another layer to the rivalry.

The upcoming months will determine how these two companies address their regulatory and technical challenges. AST SpaceMobile must prove it can safely manage its satellite network and meet the FCC’s requirements. SpaceX’s future lies in further refining Starlink and continuing its expansion. As both companies fight for dominance, their ability to navigate the ever-evolving satellite landscape will have long-term implications for the mobile connectivity industry.

— Text-to-Speech (TTS) provided by gspeech