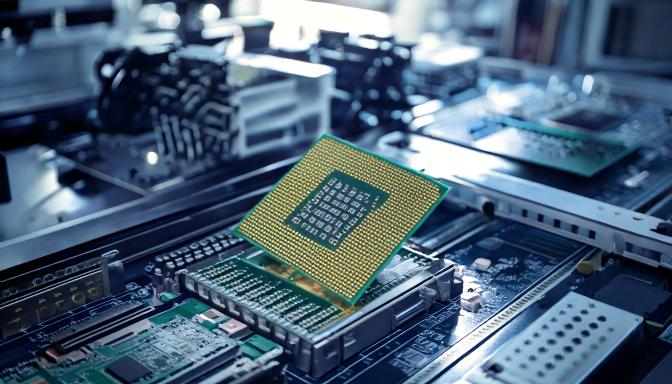

In the all-important semiconductor chips industry, unexpected disruptions and strategic planning are presenting some shake ups. Taiwan Semiconductor Manufacturing Company (TSMC), a major player in the chip market, recently faced a unique hurdle. While Advanced Micro Devices, Inc. (AMD), a direct U.S.-based competitor, made workforce changes amid shifting economic projections.

What’s Happening & Why This Matters

TSMC’s Unexpected Discovery

On November 11, Taiwan Semiconductor Manufacturing Company (TSMC) experienced a moment of suspense when workers at a new chip factory site in Kaohsiung, Taiwan, discovered a 500-pound unexploded bomb. The site, previously home to the Kaohsiung Refinery, is now a hub for TSMC’s expansion. The bomb, possibly dating back to World War II, was located in an industrial park undergoing excavation. Emergency responders, including the military’s bomb disposal team, were quickly called in. Fortunately, the authorities have confirmed there are no safety concerns, and construction continues on schedule.

This unexpected find follows a previous discovery of 1,000 pounds of WWII-era explosives at the same site just a few months ago. The bomb’s discovery adds an additional layer of complexity to TSMC’s already strained operations. Tensions with China and a chip shortage have placed immense pressure on TSMC, which manufactures semiconductors for major companies like Apple and Nvidia.

AMD Layoffs: A Strategy Amid Declining Sales

Meanwhile, rival AMD is also facing a tough time. The company is laying off about 1,000 employees (roughly 4% of its global workforce) as it attempts to align its resources with the biggest growth opportunities in the market. AMD has seen a 69% decline in its gaming division and has struggled to gain traction in AI chip making. The AI marketplace is dominated by Nvidia. AMD is still competitive in the desktop CPU market with a 10% yearly increase in shipments. However, it trails behind Nvidia, which controls 88% of the GPU market.

This strategic cost-cutting measure is expected to save AMD approximately $200 million. Yet the company’s stock has only risen by 1.5% this year; Nvidia’s stock has skyrocketed by more than 200%. Despite this, AMD is still launching new products, like the Ryzen 7 9800X3D and Ryzen 9 9900X, to strengthen and stay competitive in the market.

TF Summary: What’s Next?

Both TSMC and AMD are working to overcome differing hurdles this week. For TSMC, the combination of production delays due to bomb scares and ongoing geopolitical tensions makes its expansion efforts more timely than ever. Meanwhile, AMD is strategically-focused on new product launches and cost-cutting measures to regain momentum in a hyper-active, ultra-innovative industry.

With AI driving growth and profits, the best bets are on ALL chip markers doing whatever it takes to have edge.

— Text-to-Speech (TTS) provided by gspeech