The U.S. government doubles down on AI-driven automation and crypto-friendly policies, marking a turning point in digital governance and financial technology regulation. Under Elon Musk’s leadership, the Department of Government Efficiency (DOGE) has accelerated its AI expansion by rolling out a powerful chatbot designed to optimize federal operations. At the same time, Tether, the world’s largest stablecoin provider, is shifting from a regulatory outcast to a key player in U.S. financial markets, securing a position as one of the largest holders of U.S. government debt.

What’s Happening & Why This Matters

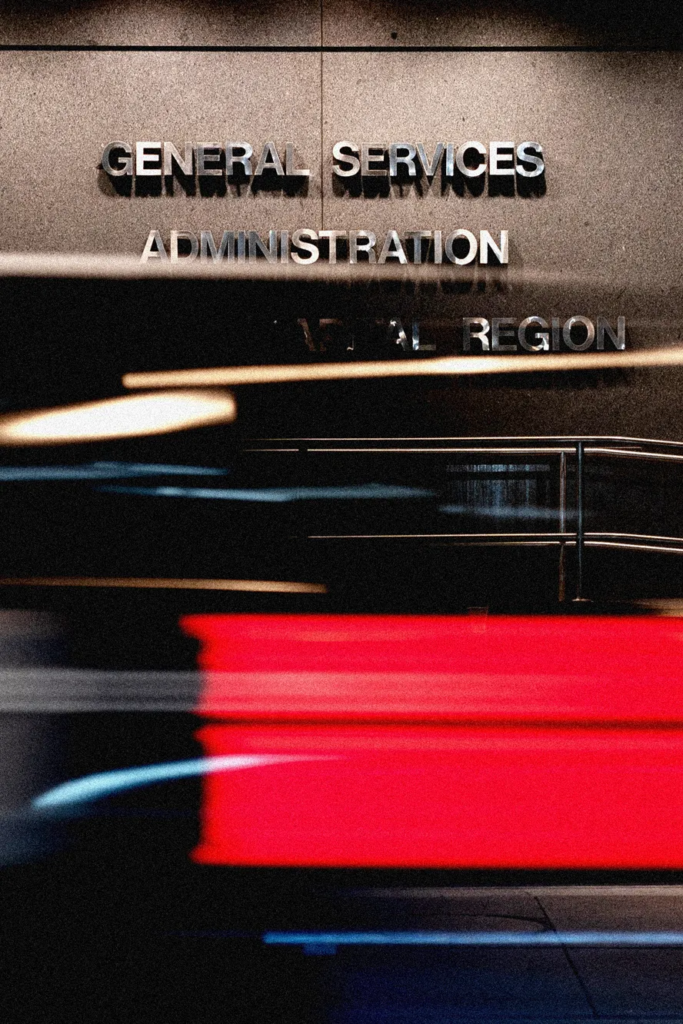

The Department of Government Efficiency (DOGE) expands its GSAi chatbot across the General Services Administration (GSA), increasing its deployment from an initial 150 employees to over 1,500 government workers. This AI system automates administrative functions, assisting with email composition, document summarization, essential code generation, and workflow optimizations. The chatbot uses Claude Haiku 3.5 as its default model, but employees can switch between Claude Sonnet 3.5 v2 and Meta Llama 3.2, offering flexibility and scalability across different government functions.

While the chatbot increases efficiency, its launch coincides with DOGE-led federal job cuts. In a controversial move, DOGE shuts down 18F, a well-known technology consulting unit within GSA, and enforces widespread layoffs under the guise of cost-cutting and workforce optimization. Critics argue that these moves favor automation over innovation, but Musk insists the shift is necessary for a leaner, more cost-effective government. As AI tools become more deeply integrated into federal operations, agencies such as the Treasury Department and the Department of Health and Human Services explore similar AI-driven automation strategies, indicating that AI-powered governance is no longer a distant vision but an evolving reality.

Meanwhile, the cryptocurrency industry is central to Washington’s economic strategy. Tether, once a target of U.S. regulators, is now among the 17 largest holders of U.S. government debt, putting it in the same financial league as sovereign nations like Saudi Arabia. The stablecoin issuer, which once clashed with authorities over allegations of opaque financial practices, has rebranded itself as an essential player in global economic stability.

Howard Lutnick, the newly confirmed U.S. Secretary of Commerce and CEO of Cantor Fitzgerald, has deep financial ties to Tether’s banking network, building concerns over potential regulatory favoritism. However, industry advocates argue that this new alignment signals a broader U.S. strategy to ensure stablecoins reinforce dollar dominance rather than challenge it. Tether CEO Paolo Ardoino frames the company as an asset to U.S. economic security, stating, “We have 400 million users in emerging markets. We are decentralizing U.S. debt while reinforcing the dollar’s global status.” Policymakers now view stablecoins as essential in keeping the U.S. dollar the world’s reserve currency rather than an unchecked financial risk.

Despite this shift, Tether still faces regulatory scrutiny. Senator Maria Cantwell raises concerns about Tether’s role in illicit transactions, citing reports that $19 billion in Tether holdings may have links to North Korea, Russian oligarchs, and Chinese money laundering networks. Lutnick defends the stablecoin sector, arguing that financial tools should not be blamed for bad actors and comparing Tether’s role to Apple’s iPhones being used for illegal activities.

Tether pushes back against criticism, highlighting its real-time compliance monitoring and faster-than-bank transaction tracking capabilities. Ardoino asserts that the company has already frozen illicit funds faster than traditional banks, making it a leader in financial security rather than a risk. The debate now centers on how aggressively the U.S. should regulate stablecoins. While crypto advocates push for a business-friendly environment, others within Washington seek stricter controls to prevent financial crime. The final regulatory framework, expected to be unveiled by September, will determine whether stablecoins remain integrated into mainstream finance or face a new wave of compliance challenges.

TF Summary: What’s Next

With DOGE’s AI-driven automation expanding and Tether’s rising influence in Washington, the U.S. government is moving significantly toward digitized governance and financial modernization. As federal agencies continue integrating AI-powered systems and crypto regulations take shape, the evolving landscape will define the future of AI-driven policy and decentralized finance in the U.S. Expect ongoing debates, increasing scrutiny, and rapid innovation as these industries continue reshaping global economic and technological infrastructures.

— Text-to-Speech (TTS) provided by gspeech