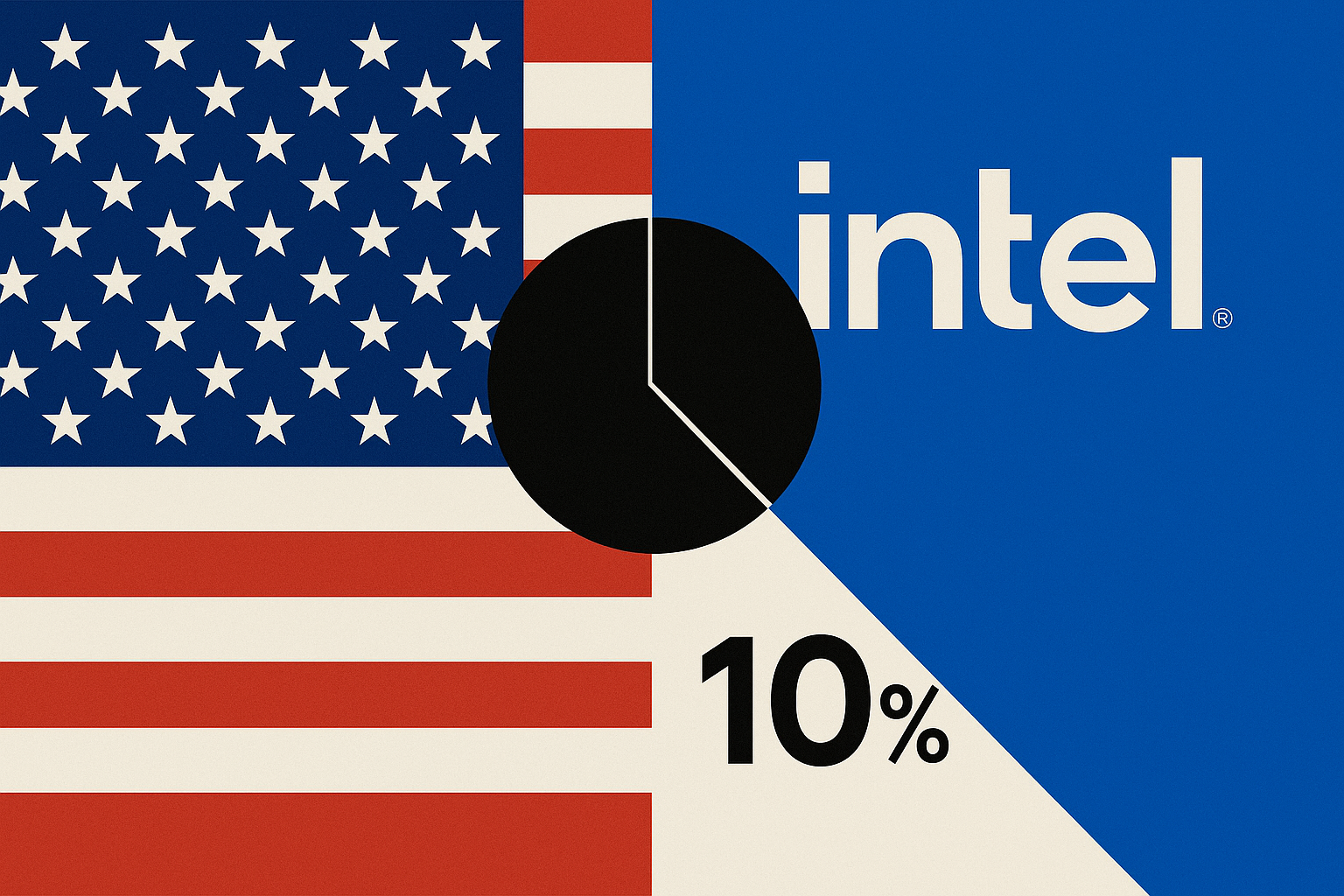

The United States government now owns a 10% stake in Intel, marking one of the largest public interventions in the semiconductor industry in decades. The $9 billion investment comes as part of an effort to secure domestic chip production. It also aims to strengthen supply chain resilience against geopolitical risks.

What’s Happening & Why This Matters

The Trump Administration finalized the $9 billion purchase using funds connected to the CHIPS and Science Act. Congress passed this to boost American semiconductor research, design, and manufacturing. Intel, already the nation’s leading chipmaker, now has direct government backing to scale its operations. This aims to reduce reliance on overseas foundries, particularly in Taiwan and South Korea.

The White House confirmed that the deal secures Washington a formal stake in Intel. It gives the company capital to expand its advanced manufacturing footprint. This decision comes after months of speculation and debate around the possibility of a government shareholding. Although rare in U.S. industrial policy, this move underscores Washington’s determination to treat semiconductors as a strategic asset, much like defense or energy.

Intel CEO Lip-Bu Tan praised the deal, saying it accelerates Intel’s capacity to “rebuild America’s leadership in semiconductor manufacturing.” The company has already broken ground on major fabs in Ohio and Arizona. These projects will now advance faster with federal backing.

At the same time, the purchase stirred political reactions. Some industry analysts welcomed the deal as a necessary step to protect national security and innovation. Others questioned whether the government should hold equity in a private company. Senator Bernie Sanders, long a critic of corporate subsidies, surprised many by voicing cautious support. Sanders argued that if taxpayers fund industrial expansion, they should benefit from ownership stakes rather than providing unchecked subsidies.

The geopolitical backdrop cannot be ignored. U.S.–China tensions around technology continue to rise, and Washington is determined to curb Beijing’s access to advanced semiconductors. By holding equity in Intel, the U.S. gains a stronger hand in safeguarding its technological edge. It insulates critical infrastructure from external shocks.

This investment also sends a message to allies and rivals alike: the United States views chipmaking capacity as a cornerstone of economic and military strength. With global demand for processors expected to grow exponentially, from powering AI systems to driving next-generation vehicles, securing domestic production has become a top-tier priority.

TF Summary: What’s Next

The U.S. now officially sits at the Intel shareholder table with a $9 billion investment. The question is how this stake will influence Intel’s decision-making. Furthermore, whether similar arrangements follow with other strategic companies remains to be seen. For Intel, this means faster expansion and greater financial stability. For Washington, it presents a willingness to blur the line between public policy and private industry. The deal’s intentions is to safeguard technological leadership.

Expect the debate over government ownership in private enterprise to intensify. But for now, Intel gains a clear boost, and the U.S. gains leverage in the global chip race.

— Text-to-Speech (TTS) provided by gspeech