Nvidia Straddles the Fence Between China and the U.S. in AI Arms Race

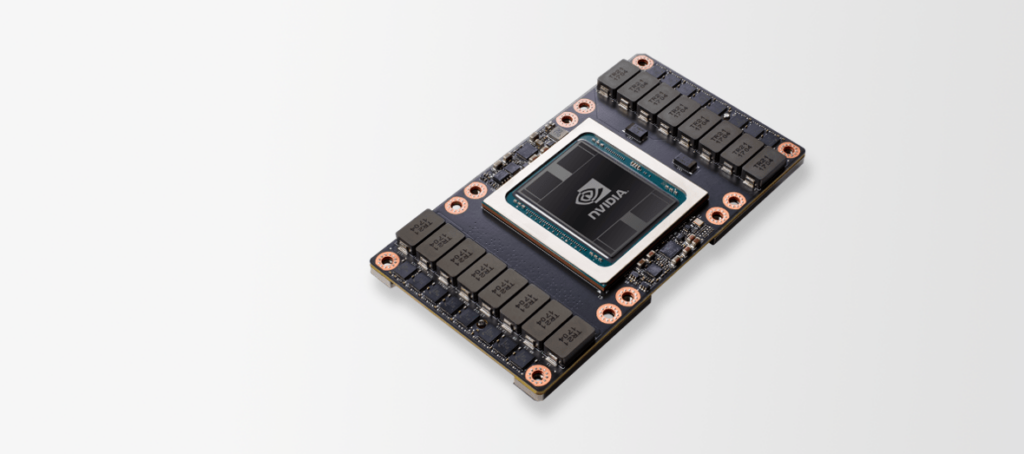

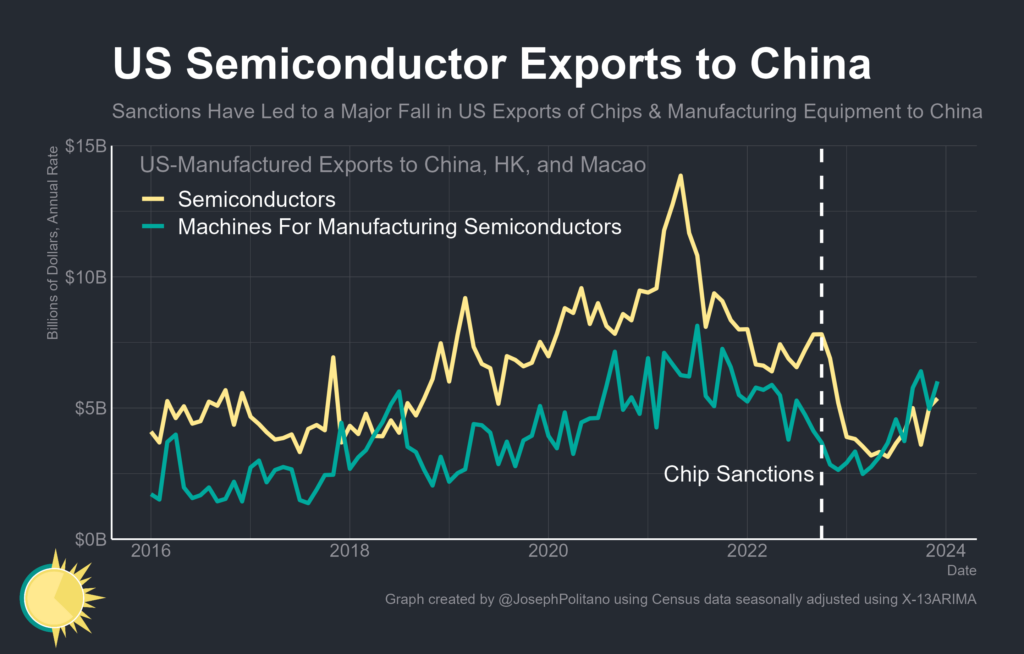

The U.S. government has reopened a narrow but meaningful channel for advanced artificial intelligence hardware exports to China. After months of uncertainty, Washington now allows Nvidia to sell its H200 AI chips to approved Chinese customers. The move marks a recalibration rather than a retreat. It reflects economic pressure, industry lobbying, and a growing recognition that blanket restrictions create unintended consequences.

This decision arrives during an intense phase of the global AI race. Chips sit at the centre of that contest. Governments treat them as strategic assets. Companies treat them as oxygen. The new policy tries to serve both instincts at once.

What’s Happening & Why This Matters

A Policy Reset Under Tight Control

U.S. regulators previously blocked sales of Nvidia’s H200 processor due to national security concerns. Lawmakers are worried about the military use and the accelerated AI development in China. That posture now softens. The U.S. Department of Commerce approves exports on a case-by-case basis, replacing an automatic denial standard.

Each shipment faces strict review. Independent labs test chip performance. Exporters verify customers and intended use. Supply thresholds protect domestic availability. China receives no more than half of the U.S.-market production. The U.S. government also collects a 25% surcharge on each approved sale.

The policy covers Nvidia’s H200 and comparable chips from rivals such as AMD. It does not cover Nvidia’s more powerful Blackwell architecture or its next-generation Rubin processors.

A Nvidia spokesperson frames the shift as pragmatic. “This decision allows American industry to compete while supporting high-paying jobs at home,” the company says, adding that the policy “strikes a thoughtful balance.”

Why Nvidia Pressed So Hard

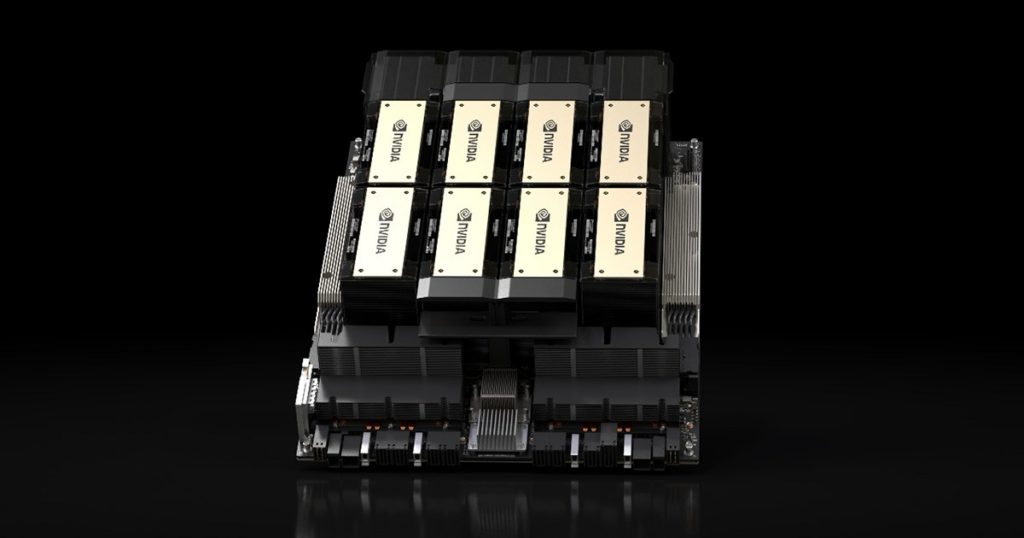

Nvidia dominates the global AI accelerator market. Data centres rely on their hardware. Cloud providers build roadmaps around their chips. China represents a massive customer base, even under restrictions.

Nvidia CEO Jensen Huang spent much of the past year lobbying Washington. His argument was measured and consistent. When U.S. firms exit markets, competitors fill the gap. Restrictions push China toward domestic substitutes faster. That dynamic weakens long-term American leverage.

Industry analysts echo the concern. China already orders millions of AI processors for future deployments. According to Reuters reporting, Chinese firms place orders exceeding Nvidcriticisesterm inventory levels.

Beijing’s Careful Pushback

Cpoliticisationcritiweaponisationision. Officials oppose what they call the “politicisation and weaponisation” of technology trade. They argue export controls disrupt supply chains and damage global innovation.

At the same time, Beijing plays defence. After earlier restprioritiseased, Chinese authorities reportedly encouraged domestic firms to prioritise local chipmakers. The message stays clear. Foreign supply brings risk. Self-reliance is the long-term goal.

For now, demand for Nvidia’s H200 remains strong. Domestic Chinese alternatives still lag performance benchmarks. Until that gap closes, U.S. chips retain appeal.

The Trade-Off

This policy reflects a larger truth. Semiconductors power everything. Smartphones. Medical equipment. Autonomous systems. Advanced AI models.

Total isolation rarely works. Total openness seldom is safe. The Umonetiseses a middle path. It keeps top-tier chips restricted, monetises controlled access, and enforces oversight at every step.

That balance shapes the next phase of tech geopolitics. It also signals how Washington handles other sensitive exports as AI adoption accelerates worldwide.

TF Summary: What’s Next

The U.S. now allows Nvidia’s H200 AI chips into China under strict oversight, quotas, and financial conditions. The move supports American chipmakers while maintaining security guardrails. It also acknowledges market realities that previous bans struggled to contain.

MY FORECAST: Controlled-access models expand to other strategic technologies. Governments lean on licensing, testing, and revenue sharing rather than outright bans. The AI race continues. It just runs through narrower gates.

— Text-to-Speech (TTS) provided by gspeech