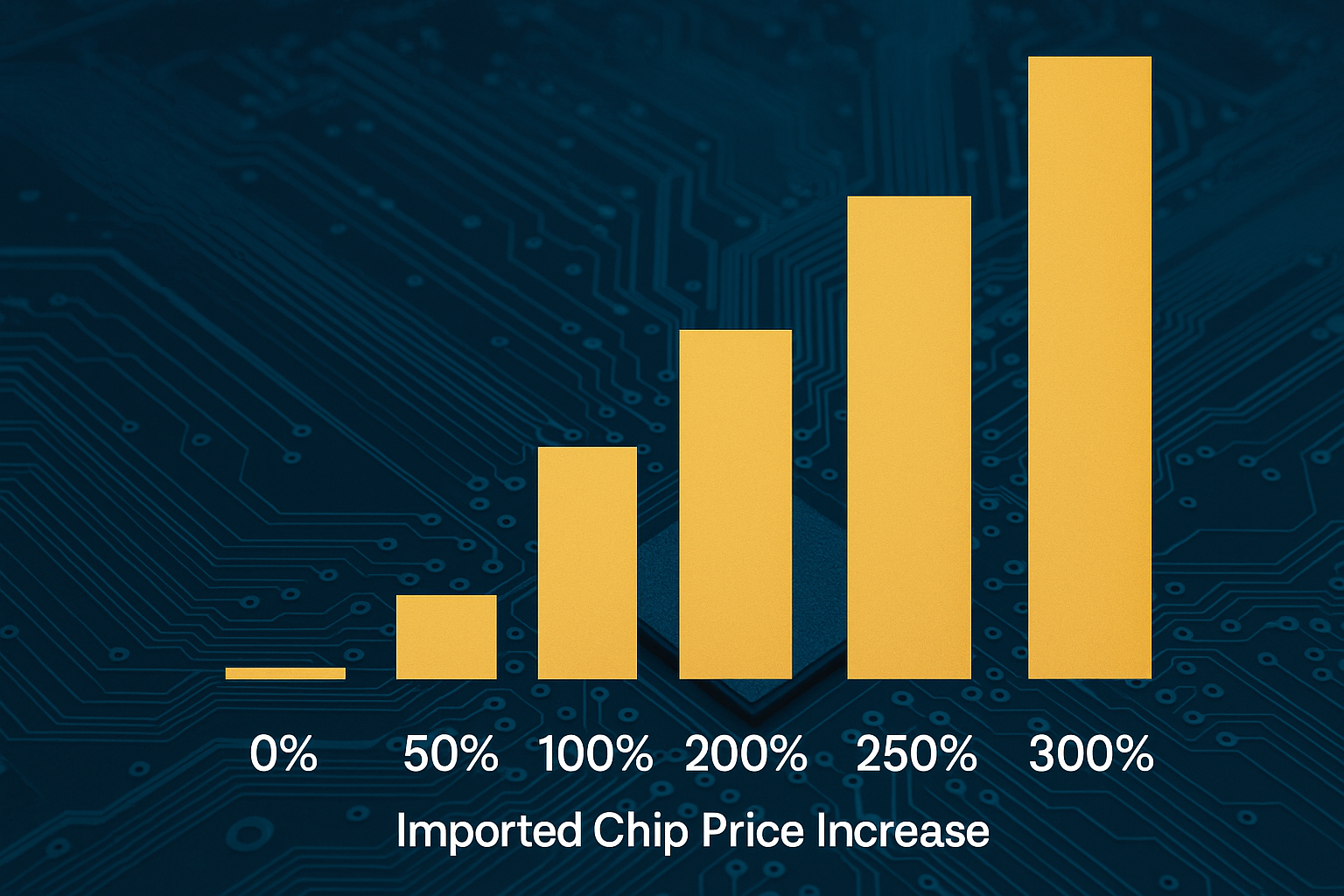

President Donald Trump is preparing tariffs that could push the cost of imported chips to double or even triple the levels first announced. While the administration initially floated a 100% tariff on foreign semiconductors. Trump now suggests the rates could climb to 200% or 300%, sparking concern across the tech industry.

What’s Happening & Why This Matters

Tariffs on the Rise

Speaking aboard Air Force One en route to a Friday meeting with Russian President Vladimir Putin, Trump outlined his plan to roll out tariffs on chips and semiconductors gradually. He explained that tariffs would start low, giving companies time to set up operations in the U.S. However, they will rise sharply later.

Trump told reporters:

“We’re gonna have a rate that is going to be lower at the beginning. That gives them a chance to come in and build. And very high after a certain period of time. And if they don’t build here, they have to pay a very high tariff.”

The clear message: if chipmakers like Apple, Nvidia, TSMC, and Samsung want to avoid tariffs, they must manufacture in the U.S.

Tech and Consumers Impact

Last week, Taiwan and South Korea expected exemptions for TSMC and Samsung, but those may only last a limited time. Trump confirmed that only companies actively building U.S. facilities would escape tariffs.

This policy could reshape supply chains. If tariffs climb as threatened, the price of PC processors, smartphones, and consumer electronics may rise. While some electronics like computers and monitors have previously been exempt from tariff hikes, semiconductor-focused measures could target them directly.

Industry watchers warn that tariffs of this scale may ripple across the global chip market. It could drive up costs not just for end-users but also for businesses. These include those relying on semiconductors to power AI systems, automotive technologies, and cloud infrastructure.

Why Increase Tariffs?

Trump framed the tariffs as a way to “bring factories home.” He cited a growing number of auto factories and AI-related facilities in the U.S. as proof that tariffs are pressuring global manufacturers to invest domestically. The administration sees this as a long-term play to make the U.S. less dependent on foreign supply chains, particularly from Asia.

However, critics argue that higher costs may hit U.S. consumers before new domestic production scales up. Some also question whether exemptions for select companies could create an uneven market.

TF Summary: What’s Next

The semiconductor showdown is just heating up. With Trump set to finalize tariffs in the coming weeks, global chipmakers face a tough decision. They must decide whether to invest in U.S. plants or risk tariffs that could reach 300%. For consumers, the outcome may mean higher prices on everything from laptops to cars.

The markets will observe the outlook closely. They need to see how exemptions are defined, how fast tariffs climb, and whether U.S. factories can ramp up production quickly enough to offset the shock.

— Text-to-Speech (TTS) provided by gspeech