Global markets break rhythm at the cost of advancement.

The mood across global markets feels tense. AI demand stays hot. Geopolitics stays messy. The U.S. talks tariffs again. Asia reacts fast. Stocks swing red. Analysts scramble to explain the drop. Investors chase clarity that never seems to arrive. Meanwhile, workers in the professional sector see new pressure as automation knocks on doors once considered safe.

Every thread ties back to the same pressure point: technology drives value, fear, risk, and reaction at the exact same time. Markets sense it. Employers act on it. Governments try to shape it. And everyone else tries to understand where the line goes next.

What’s Happening & Why This Matters

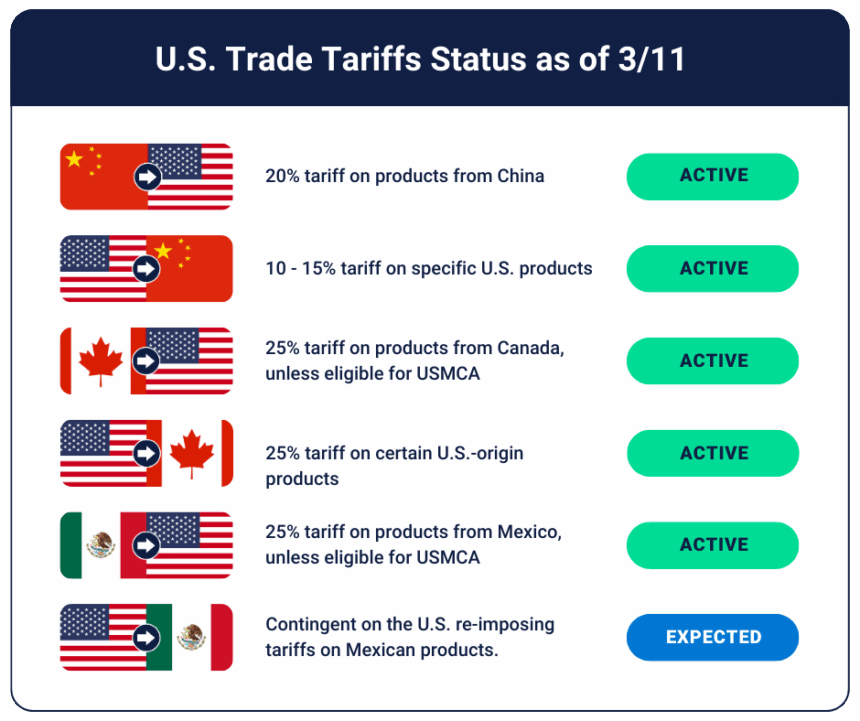

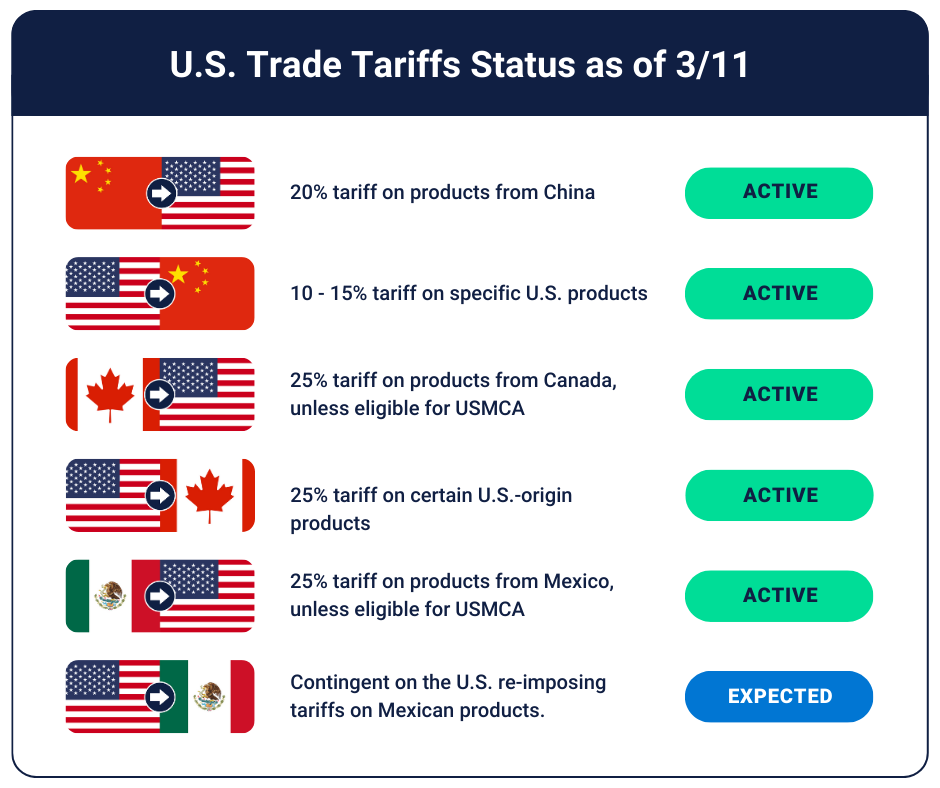

Tariff Talk Shakes Investor Confidence

New U.S. tariff proposals circulate again through Washington. The White House pushes back on one plan targeting Nvidia and other chipmakers, arguing that regulatory punishment slows innovation. At the same time, senior officials send mixed messages about how to treat high-risk semiconductor exports. Traders read the situation as a conflict inside the government. Confusion leads to selloffs.

Asian markets mirror the wave within hours. Hong Kong tech stocks drop first. Seoul and Tokyo follow. Analysts call the slide a reaction to unclear U.S. direction mixed with rising anxiety over AI supply chains. The connection between China and the U.S. remains strained. Chip independence becomes political currency.

One Tokyo strategist summed it up cleanly: “Volatility rises every time Washington talks semiconductors.”

Corporate Warnings Fuel the Downturn

Firms with exposure to AI hardware slice guidance ranges. Some fear rising import costs if tariff shifts stick. Others worry that China proceeds with countermeasures that hit U.S. platforms. Traders hear “uncertain inputs,” and the red candles follow.

Large-cap U.S. tech names feel the shock, too. Indexes dip. Volumes jump. The message from investors stays consistent: clarity matters more than headlines. And lately, clarity feels scarce.

AI Impact on White-collar Work

While markets drop, another story builds inside the business world. Professional employment—once insulated from automation—is now in the crosshairs. A leaked internal review from PwC outlines early expectations for cost-cutting in graduate-level roles as AI tools take over routine tasks.

Recruiters say junior analysts, auditors, and researchers face the sharpest pressure. Generative AI cuts time, cost, and error rates in large service firms. That efficiency drives executive interest. Rising client expectations add even more pressure to automate.

One HR director put it bluntly:

“The tools handle more work each quarter. Management sees it, and budgets adapt fast.”

Graduates entering 2026 pipelines expect tighter hiring cycles and heavier tech-skills requirements. Business schools track the pattern. Students ask for more AI coursework. Employers ask for more technical fluency.

TF Summary: What’s Next

Markets react to policy uncertainty, not policy itself. Washington’s semiconductor debate lands in that zone. Any tension around Nvidia, export controls, or tariff expansions moves traders quickly. The outcome shapes supply chains, national strategy, and long-term innovation.

AI’s impact on employment runs in parallel. Graduate roles shrink or shift. White-collar work stretches in new directions. Companies want speed and efficiency. Tools deliver both. Workers adapt or risk falling out of the pipeline.

MY FORECAST: Expect more turbulence in tech stocks, more policy battles in Washington, and sharper shifts in early-career hiring cycles. AI sits at the center of each storyline, and the pressure pumps up as adoption accelerates.

— Text-to-Speech (TTS) provided by gspeech