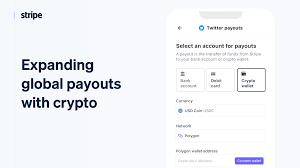

Stripe, a leading global payment processor, announced plans to resume accepting cryptocurrency transactions after a six-year pause. After a lengthy break, Stripe’s pivot indicates a more positive outlook for cryptocurrencies by financial technology (fintech) innovators.

What’s Happening & Why This Matters

Stripe stopped processing cryptocurrency in 2018 due to volatility concerns and inefficiencies. However, improvements in blockchain technology and a more stable regulatory environment have led Stripe to reintegrate crypto transactions into its service offerings. This decision allows Stripe to tap into the burgeoning market of crypto payments, meeting the demand from businesses and consumers increasingly interested in using digital currencies for everyday transactions.

“This is a forward-thinking move by Stripe that aligns with the future of global commerce,” explains a Goldman Sachs fintech analyst. “As digital currencies become more mainstream, the ability to process these payments will be crucial for payment platforms aiming to stay competitive.”

By incorporating cryptocurrencies, Stripe is expanding its payment infrastructure to support a wider array of payment methods which could lead to increased adoption rates and customer satisfaction. Stripe’s play is indicative of a larger trend within the payment processing industry. Traditional financial entities are increasingly embracing digital currencies as a legitimate and valuable form of payment.

TF Summary: What’s Next

Stripe’s reintroduction of cryptocurrency processing seems a likely development as cryptocurrency’s popularity is growing. Add crypto processing can further acceptance of digital currencies across more business and consumer sectors. Additionally, as Stripe dives deep into crypto, it may pave the way for new innovations in crypto payment solutions, potentially setting new standards for the integration of blockchain technology in traditional financial systems.