Satellite internet is charging up the final frontier. SpaceX, Globalstar, and EchoStar are fiercely competing for sub-space dominance. SpaceX recently secured an important deal with EchoStar, while Globalstar races to upgrade its network with Apple’s backing. The stakes are high as these companies vie for control of global connectivity.

What’s Happening & Why This Matters

SpaceX, through its Starlink division, has cemented its lead in satellite internet. EchoStar CEO Hamid Akhavan publicly acknowledged this during an investor presentation, calling SpaceX the “undisputed leader” in the market. This recognition comes after EchoStar agreed to a $17 billion deal to sell a 50MHz block of valuable radio spectrum to SpaceX. The spectrum will supercharge SpaceX’s cellular Starlink service, aiming to deliver 4G LTE-level performance directly from orbit.

Currently, cellular Starlink supports satellite-powered texting and limited data services through T-Mobile and other carriers. With the new spectrum, SpaceX plans to roll out broader capabilities, reducing latency and boosting speeds for customers worldwide. However, it will take at least two years to deploy the necessary satellites and smartphone radio support fully.

The deal is an important realignment for EchoStar. Once a major player through its Hughesnet brand, EchoStar has seen its consumer satellite base dwindle from 1.56 million customers in 2020 to just 819,000 today. As a result, EchoStar is pivoting toward enterprise markets, even as BoostMobile gains access to Starlink’s service.

Globalstar Strikes Back

As SpaceX builds momentum, Globalstar, an Apple partner, is preparing its own response. The company has revived plans for a massive new constellation, HIBLEO-XL-1, which could deploy up to 3,080 low-Earth orbit satellites. This effort complements Globalstar’s C-3 network, funded by Apple’s $1 billion investment, which currently includes 48 satellites.

Globalstar’s new system taps additional frequency bands beyond its current L, S, and C-bands, enabling faster, more reliable satellite-to-phone connections. If successful, this increases Globalstar’s spectrum capacity nearly fivefold. However, the plan carries risk. Globalstar must negotiate spectrum-sharing agreements with competitors Viasat, Thuraya, AST SpaceMobile, and EchoStar to prevent regulatory conflicts.

For Apple users, continued access to free satellite messaging and emergency SOS services on iPhones, remains free for at least another year.

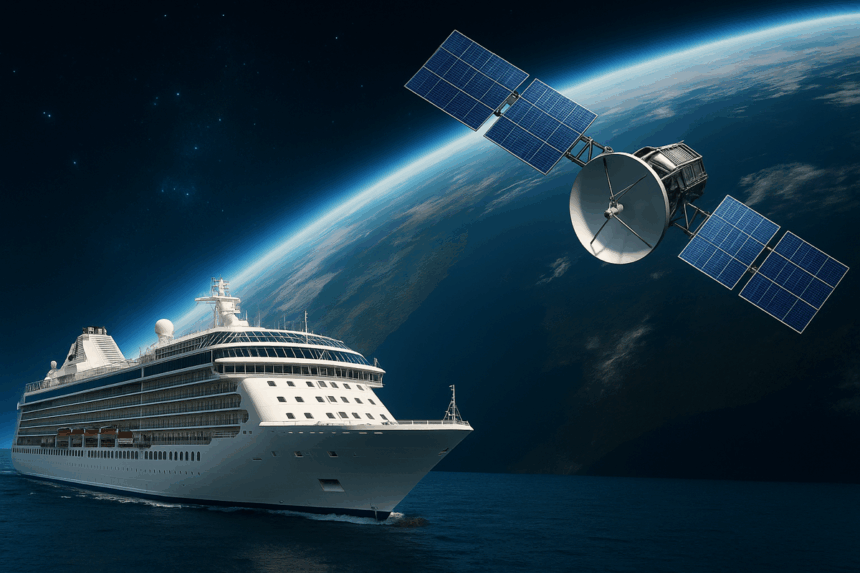

Cruise Ships and Premium Connectivity

As competition escalates, cruise lines and other premium service providers are entering the fray. SpaceX’s growing network, with thousands of satellites launching regularly, is uniquely positioned to serve remote customers like cruise passengers and airline travellers. EchoStar even admitted that they once approached SpaceX to build satellites for them — a deal Elon Musk declined years ago.

With SpaceX now launching rockets three times a week and building seven satellites a day, their production and deployment speed gives them a formidable advantage.

TF Summary: What’s Next

SpaceX’s aggressive expansion and EchoStar’s strategic pivot mark a new chapter in satellite internet. As SpaceX integrates its newly acquired spectrum, Starlink could soon offer speeds and reliability rivalling terrestrial networks. Globalstar’s response, fueled by Apple, suggests the battle is far from over. Consumers can expect faster, more reliable satellite services, while regulators will need to navigate complex spectrum negotiations.

MY FORECAST: The next two years will determine whether SpaceX maintains its lead or if competitors and emerging players disrupt the power structure.

— Text-to-Speech (TTS) provided by gspeech