Amazon Builds the Ground Game First

Amazon entered the satellite internet race years after SpaceX’s Starlink, but it never planned to play small. This week, new technical disclosures show just how serious that intent is. Amazon’s low-Earth-orbit broadband network, known internally as Project Kuiper and now branded Amazon LEO, is preparing a massive global ground infrastructure rollout.

More than 300 gateway stations are already planned. These stations form the hidden backbone that connects orbiting satellites to fiber networks on Earth. Without them, satellite internet stays theoretical. With them, it becomes competitive.

This move signals something bigger than faster rural internet. It marks the opening phase of a full-scale satellite infrastructure war.

What’s Happening & Why This Matters

Amazon confirms plans to deploy 300+ satellite gateway stations worldwide, each equipped with multiple antenna arrays designed to route data between space and terrestrial networks. The gateways mirror the architecture SpaceX uses for Starlink. However, Amazon adds a strategic twist.

Each gateway connects to Points of Presence (PoPs) that connect directly to AWS fiber networks. Amazon LEO traffic flows straight into one of the world’s largest cloud ecosystems. Netflix, Twitch, enterprise platforms, and government systems already live there.

Satellite internet stops being an edge service. It becomes native cloud infrastructure.

Why Gateway Stations Decide Winners

Satellites get the headlines. Gateways decide performance.

Gateway stations handle:

- Signal routing between orbiting satellites and fiber networks

- Latency control

- Traffic prioritization

- Regional reliability

SpaceX already operates 100+ gateway sites in the U.S. alone, with more than 1,500 antennas supporting millions of users. Independent researchers track 300+ Starlink gateways worldwide.

Amazon clearly studied that blueprint. Then it scaled it.

An Amazon LEO engineer explains during AWS re:Invent that each site includes five satellite dishes, placed in remote regions to reduce interference and maximize uptime. Its design supports high throughput without crowding population centers.

The Competitive Equation

Starlink delivers speed. Amazon LEO integrates ecosystems.

Because gateway PoPs connect directly to AWS, Amazon LEO users access cloud services through private network interconnects rather than public internet hops. That matters for enterprise customers, defense agencies, emergency response systems, and logistics operators.

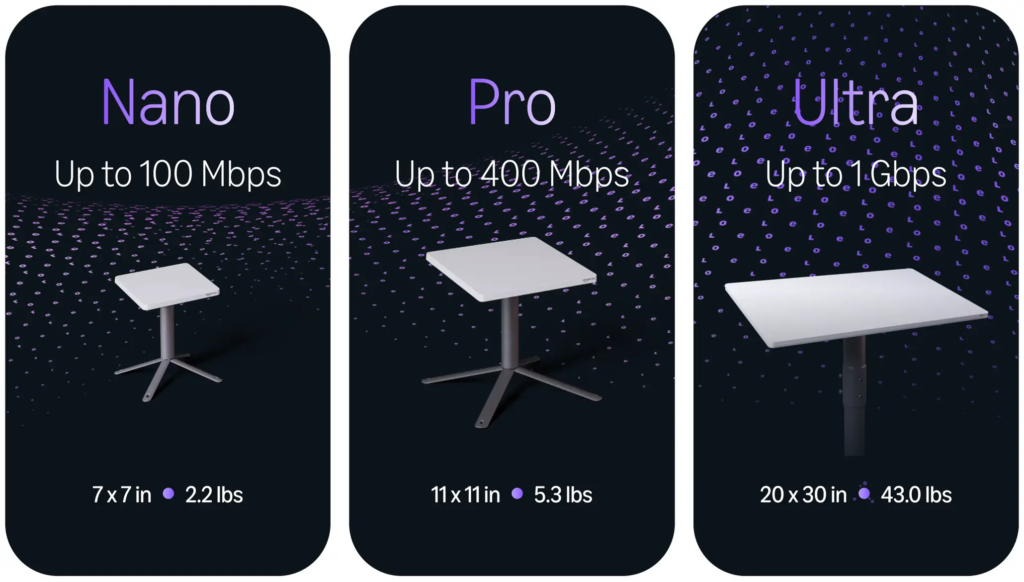

Latency targets stay below 50 milliseconds, slightly higher than Starlink’s typical 30 ms, but well within real-time application thresholds. Amazon plans multiple service tiers, ranging from 100 Mbps to 1 Gbps, depending on terminal hardware.

A computer science researcher tracking global satellite systems notes that Amazon’s architecture prioritizes stability and integration over first-to-market speed.

The Gap Amazon Still Must Close

Amazon LEO currently operates about 150 satellites. Starlink operates over 9,000 and serves more than 8 million global users.

Coverage remains limited at launch. Amazon executives confirm the initial service will not have full global reach. Hundreds of additional satellite launches remain necessary before parity becomes realistic.

This is not a sprint. It is infrastructure chess.

TF Summary: What’s Next

Amazon LEO shifts from theory to execution. Gateway stations transform from slides to soil. Satellite launches accelerate. Enterprise pilots expand quietly.

MY FORECAST: Amazon LEO becomes the preferred satellite network for cloud-dependent businesses, governments, and regulated industries. Starlink keeps consumer dominance. The real competition settles in enterprise contracts, defense infrastructure, and emergency connectivity. Space becomes just another cloud region.

— Text-to-Speech (TTS) provided by gspeech