The Dow Jones Industrial Average (DJIA) reflects the health of the U.S. stock market by listing 30 prominent companies that span various economic sectors. A spot on the DJIA is a mark of corporate prestige. However, Intel’s long-standing presence on the DJIA has come to an end, with Nvidia stepping in to take its place. This shift underlines the transformative role AI is playing in the tech industry and the challenges Intel faces as it navigates the new landscape.

What’s Happening & Why This Matters

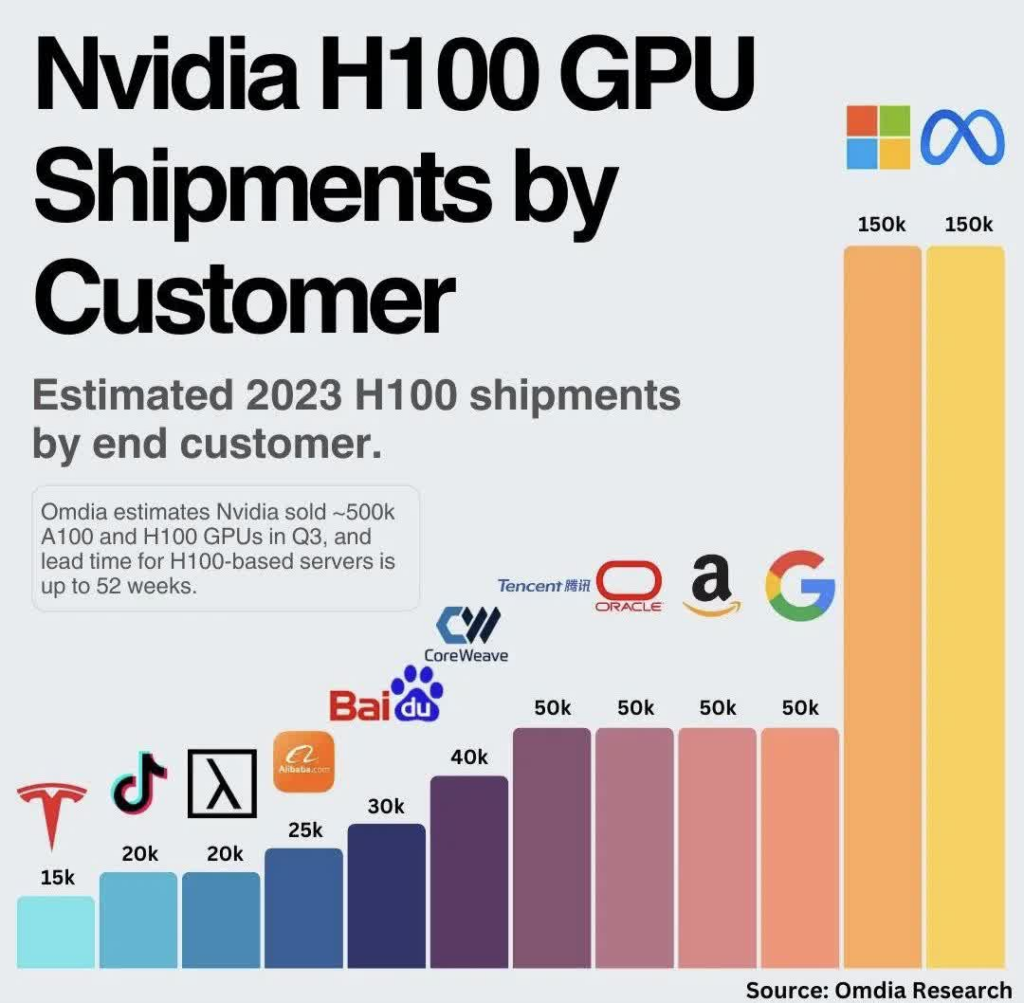

Intel, once a titan in the world of computing chips, now finds itself grappling with a rapidly changing tech scene. AI’s emergence has propelled Nvidia to unprecedented heights, pushing Intel out of the DJIA after 25 years. Nvidia’s GPUs are crucial for AI and machine learning applications, fueling the company’s rise as a leader in the tech sector.

Intel’s recent withdrawal of its $500 million AI-focused Gaudi chip forecast for 2024 signals the company’s struggles in the AI market. Originally, Intel’s CEO Pat Gelsinger had set an ambitious goal of $1 billion in Gaudi chip sales. However, the lowered target, coupled with Bank of America analyst Vivek Arya’s public questioning of Intel’s AI roadmap, indicates that Intel’s AI aspirations may be facing major hurdle.

Intel’s challenges extend beyond AI. The company’s reliance on x86 chip architecture — once the standard for personal computing — is under threat as processors move toward smaller, more power-efficient ARM-based alternatives. Apple’s decision to abandon Intel processors in favor of its own ARM-based chips (Apple Silicon) added pressure on the chips maker to innovate and regain its foothold.

The question remains: Can Intel pivot and reassert itself as an industry leader, or, will it continue to fall behind as competitors capitalize on explosive AI growth? For investors and industry insiders, Intel’s next steps are a critical point of interest.

TF Summary: What’s Next

Intel’s departure from the DJIA and Nvidia’s rise via AI processing dominance is changing the world. Investors should monitor Intel’s ability to adapt and stay relevant in a market where AI and machine learning are the driving forces. Whether Intel rebounds or Nvidia continues to lead the charge, the reshuffling of the Dow Jones parallels the ebbs and flows of technology’s rapid innovations.

— Text-to-Speech (TTS) provided by gspeech