Google’s Gemini Adds a Betting Edge to Finance Predictions

Google is merging its Gemini AI with Google Finance, adding prediction market data from Kalshi and Polymarket to forecast financial trends. The update promises to make finance queries more dynamic, letting users tap into the “wisdom of crowds” — a data-driven blend of AI modelling and human speculation.

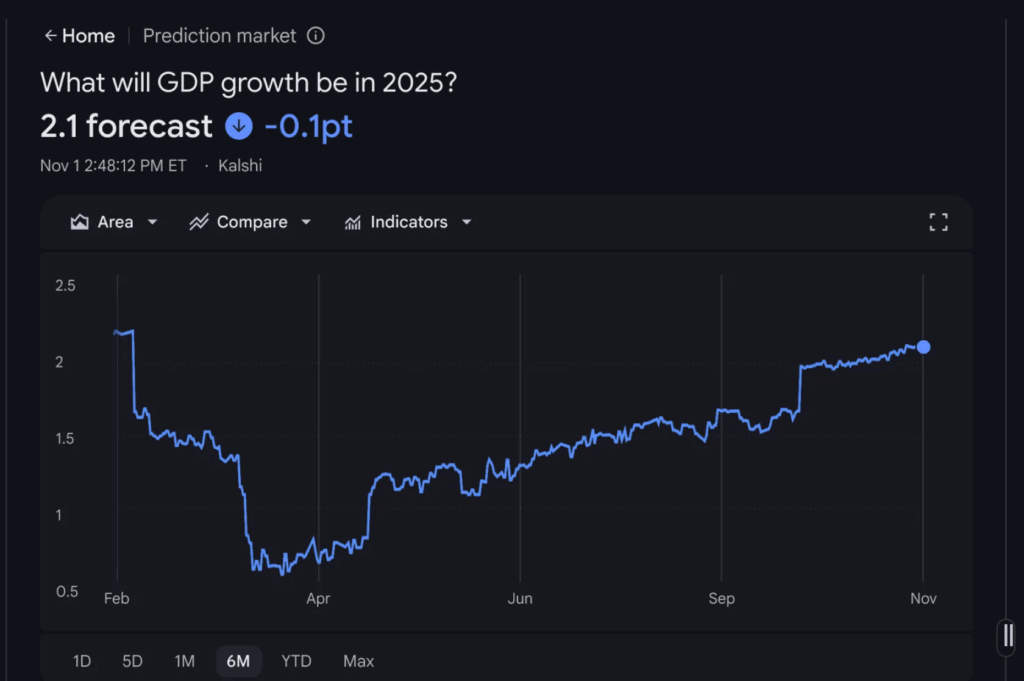

Essentially, Google wants users to ask questions like, “What will GDP growth be in 2025?” and get AI-driven projections based on the probabilities from thousands of active market participants. While Google admits that no algorithm can truly predict the future, it argues that aggregated human bets offer a unique signal worth analysing.

What’s Happening & Why This Matters

Prediction Markets Meet AI

In its latest update, Google Finance integrates real-time data from Kalshi and Polymarket, two major players in online prediction markets. These platforms let users place wagers on future events—from election outcomes to tech product launches—and Google believes the same approach can help its AI models refine insights for investors and analysts.

This means Gemini now factors in real-time human sentiment when generating financial analyses, blending AI-driven inference with the collective betting behaviour of thousands of participants. It’s not foolproof — only about 12.7% of Polymarket users actually show profits — but it’s a new way to quantify market confidence around major events.

Google says it plans to display this predictive data alongside charts, graphs, and probability breakdowns. Users searching for economic questions or stock forecasts will see Gemini’s responses augmented by aggregated “crowd probabilities” pulled from these betting exchanges.

“Prediction markets distill how people really think the future will unfold when stakes are involved,” said a Google Finance product lead, calling the move “an experiment in human-AI synergy.”

Finance Gets Conversational

The new features turn Google Finance into a more interactive and conversational tool, powered by Gemini Deep Research. Rather than scrolling through static charts, users can type open-ended questions and get synthesised, data-backed responses.

For example, you can ask:

- “What’s the probability of U.S. inflation dropping below 3% by 2026?”

- “How confident are investors about Nvidia’s next earnings beat?”

Gemini responds with real-time analysis drawn from prediction data, historical market trends, and AI reasoning models. The approach mirrors the logic behind sports betting odds, only applied to global markets.

This makes Google Finance feel less like a news feed and more like a living economic oracle, fueled by both algorithms and human psychology.

A Global Rollout

Google says the upgraded Finance experience launches first in the U.S., with India as the next test market. The full prediction-data integration will arrive within weeks, though users can already opt in early via Google Labs.

The move also highlights Google’s broader effort to bring Gemini AI across its product suite—from Maps and Docs to YouTube and Finance. With Gemini analysing live sentiment data, financial forecasting becomes more interactive, accessible, and potentially profitable—though still very much experimental.

Analysts see this as a clever step to differentiate Google Finance from Yahoo Finance and Bloomberg, which focus more on traditional market data. By contrast, Gemini’s integration allows Google to position Finance as a hybrid research assistant for traders, journalists, and the casually curious.

“You can’t outguess the market,” a Kalshi spokesperson said, “but you can observe how the crowd is thinking — and that’s often more valuable.”

TF Summary: What’s Next

The Gemini–Finance partnership drives AI deeper into financial forecasting. By incorporating prediction market data, it blends the analytical power of algorithms with the speculative instincts of human traders.

MY FORECAST: Expect Gemini Finance to evolve into a predictive research tool that challenges traditional market analytics. If Google can validate the reliability of crowd-sourced probabilities, it may redefine how people read market sentiment — blurring the line between betting and investing.

— Text-to-Speech (TTS) provided by gspeech