Intel is in the headlines again, but not for reasons it’d like. CEO Pat Gelsinger is stepping down after a series of disappointing quarters, leading to a leadership shakeup at the once-dominant chipmaker. After nearly four years at the helm, Gelsinger’s resignation highlights the financial struggles Intel faces in a rapidly changing tech world. With competitors like Nvidia gaining ground, the company is now searching for a new leader to steer it out of troubled waters.

What’s Happening & Why This Matters

Intel’s financial woes have been hard to ignore. In its most recent quarter, the company posted a $16.6 billion loss (around €15.7 billion), marking another blow to its already struggling performance. This loss follows a pattern of disappointing results, which has prompted Gelsinger to step down from his role as CEO and leave the company’s board. The resignation comes just two years after he rejoined Intel in 2021 to turn the company around.

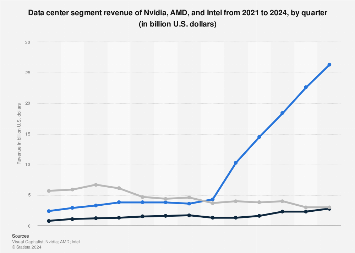

Intel has also faced stiff competition from Nvidia, which has gained dominance in the semiconductor space, particularly in chips used for artificial intelligence systems. Nvidia’s rise was recently underscored when the company replaced Intel on the Dow Jones Industrial Average, a major shift in the tech landscape. Despite Intel’s historical importance in the semiconductor industry, it now finds itself playing catch-up .

Interim Leadership and Future Plans

As the search for a new CEO begins, Intel has appointed David Zinsner, the company’s CFO, and Michelle Johnston Holthaus, CEO of Intel Products, as interim co-CEOs. Their job is to steer Intel through this uncertain period and stabilize the company. They will focus on cutting costs and restructuring the business to improve performance .

Gelsinger’s tenure included efforts to rejuvenate Intel’s manufacturing capabilities and invest in new technologies. However, these initiatives haven’t been enough to stave off mounting losses. In August, Intel announced plans to slash 15% of its workforce, roughly 15,000 jobs, as part of a broader cost-cutting strategy. These moves are intended to save $10 billion (€9.5 billion) by 2025 .

Government Funding, Setbacks, and Stock Performance

Intel’s troubles are compounded by changes in its federal funding. The U.S. government had promised Intel $8.5 billion (€8 billion) for chip production facilities across the country, but recent reports reveal that part of this funding could be reduced. The cuts are tied to Intel’s receipt of an additional $3 billion (€2.87 billion) for providing chips to the U.S. military, adding to the financial uncertainty the company faces .

Intel’s stock has also taken a hit, falling 42% over the past year. However, following the resignation announcement, shares rose by 2.6%, possibly reflecting investor hopes for a fresh start under new leadership. Despite this uptick, Intel remains in a tough position, and much will depend on how the new interim leadership handles the challenges ahead.

TF Summary: What’s Next?

Intel faces a critical moment as it navigates financial difficulties and leadership changes. With the departure of Gelsinger, the company is on the hunt for a new CEO to steer it back to profitability and regain market share from its competitors.

The next few months are crucial as Intel works to implement cost-cutting measures, restructure its operations, and maintain its role in the semiconductor market. If Intel can recover, it will need to adapt quickly to the changing tech landscape and restore investor confidence.

— Text-to-Speech (TTS) provided by gspeech