Coinbase, the largest cryptocurrency exchange in the United States, confirms that cybercriminals have stolen personal customer data and are demanding a $20 million ransom. The attackers bribed customer service agents working outside the U.S. to gain access to sensitive records, including customer names, birth dates, and partial national IDs.

What’s Happening & Why This Matters

The hackers reportedly use the stolen information to conduct social engineering attacks, tricking users into transferring crypto under the pretense of Coinbase support. This strategy exploits human error rather than breaching technical systems.

Coinbase CEO Brian Armstrong posted online that the company has refused to pay the ransom. Instead, it has offered a $20 million bounty for information leading to the hackers’ arrest. Armstrong warned: “For these would-be extortionists… know you have my answer.”

Coinbase filed a disclosure with the U.S. Securities and Exchange Commission (SEC) estimating that fallout from the breach — including reimbursements and fraud prevention — could cost between $180 million and $400 million. This does not include the ransom, which the company is unwilling to negotiate.

Although Coinbase has not revealed how many customers were affected, it has pledged to reimburse all users who lost money due to these schemes.

How the Breach Happened

The attackers did not gain access via traditional technical exploits. Instead, they paid contractors and support agents to extract customer information. The company identified internal staff accessing data without legitimate business purposes and immediately terminated those employees.

On May 11, Coinbase received a ransom email from an unidentified threat actor claiming to possess internal documents and private user data. The hackers threatened to release the stolen files if their demands weren’t met.

Coinbase chose not to respond with payment. The company emphasized its commitment to transparency, stating it had “reinforced our controls” and was working with law enforcement to pursue the attackers. It continues to operate normally and is preparing to be added to the S&P 500 index, a major milestone for the crypto industry.

The Bigger Picture

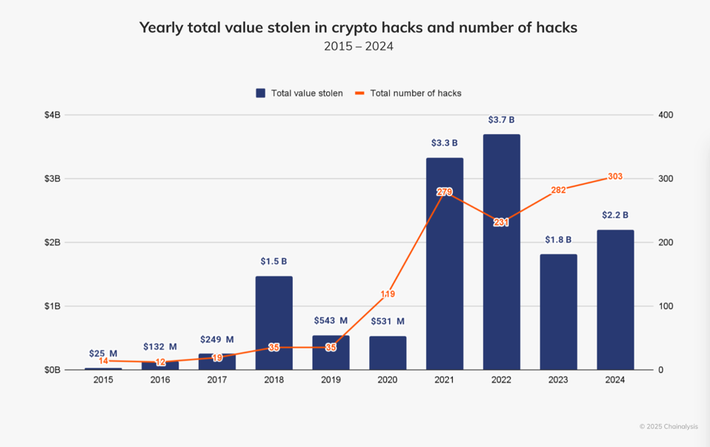

The breach comes as the crypto world faces growing scrutiny over its security practices. Last February, Bybit reported the theft of $1.5 billion in digital assets — the largest crypto heist in history. According to Chainalysis, total funds lost to hacks on crypto platforms in 2024 reached $2.2 billion, marking the fourth year thefts exceeded $1 billion.

These figures present a recurring issue: despite decentralized finance’s promises, central points of failure — like internal access and human trust — remain highly vulnerable.

TF Summary: What’s Next

Coinbase is facing a reputational and financial test as it navigates the aftermath of this internal betrayal. By refusing to negotiate with hackers and opting to work with global law enforcement, the company hopes to signal strength while attempting to restore user confidence. The crypto exchange’s entry into the S&P 500 could help buffer some of the fallout, but the industry must confront the persistent threat of social engineering and insider risk.

— Text-to-Speech (TTS) provided by gspeech