Court Draws a Hard Line Between Trade Policy and Tax Power

Tariffs look like simple knobs on a control panel. Turn them up, imports drop. Turn them down, trade flows. In reality, tariffs are taxes in disguise, and taxes sit at the beating heart of constitutional power. The recent Trump tariffs block is a central issue in the debates. The U.S. Supreme Court just reminded everyone of that fact with the subtlety of a neutron star collision.

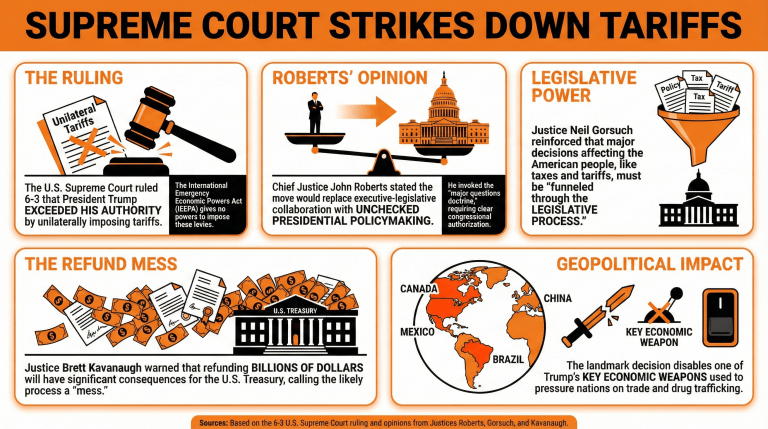

In a major ruling, the Court blocks the use of emergency powers to impose sweeping tariffs, concluding that the authority belongs to Congress, not the president acting alone. The decision scrambles trade strategy, threatens massive refunds to businesses, and forces a rethink of how economic pressure gets applied in a geopolitically tense world.

Meanwhile, the administration signals it will pursue new tariffs through different legal pathways. The tariff machine does not stop. It simply changes engines.

What’s Happening & Why This Matters

Emergency Tariffs Ruled Beyond Presidential Authority

The Court rules that the International Emergency Economic Powers Act (IEEPA) does not grant a president unlimited power to impose tariffs during peacetime. Tariffs, the justices stress, function as taxes. Under the Constitution, taxation authority rests primarily with Congress.

Chief Justice John Roberts writes that allowing unilateral tariffs of any scale or duration would represent a dramatic expansion of executive power. He notes that no previous president used the statute this way in its decades of existence.

Economists estimate that businesses could be owed more than $175 billion in refunds for tariffs already collected. The earlier projection reached into the trillions before later revisions brought the figure down.

The Court also expresses concern about precedent. If one president can impose massive tariffs unilaterally, future presidents could do the same for entirely different reasons. That scenario would destabilize trade policy and blur constitutional boundaries.

In short, the ruling is less about tariffs themselves and more about the separation of powers. Who controls the nation’s economic steering wheel?

Ripple Effects Across Global Trade

The decision introduces uncertainty for companies that structured supply chains around fluctuating tariffs. Businesses had already paid duties, raised prices, renegotiated contracts, and shifted manufacturing locations.

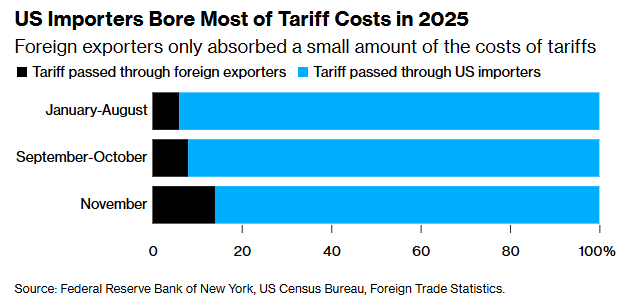

Many face the prospect of refunds, legal battles, or another round of policy changes. Some costs have already passed to consumers, meaning refunds to importers do not necessarily flow back to the public.

The ruling also threatens trade deals negotiated under tariff pressure. Agreements built on the duties rest on shaky ground. Undoing them could prove messy and politically explosive.

One justice warns that granting vast tariff powers would allow presidents to impose duties on nearly any goods at any level. Such authority, critics argue, would bypass the slow but deliberate legislative process designed to balance competing interests.

Administration Moves Quickly to New Tariff Tools

The White House responds almost immediately, signaling a shift to different legal authorities. A new global tariff is announced under Section 122 of the Trade Act of 1974, which permits temporary duties up to 15 percent for 150 days without congressional approval.

Longer-term tariffs are expected to rely on Section 301 and Section 232, statutes that require investigations, agency findings, and public comment periods. These mechanisms move more slowly but carry a clearer legal footing.

Officials also indicate that additional tariffs may be higher than the ones invalidated by the Court.

In effect, the ruling does not eliminate tariffs. It channels them into more structured pathways. The executive branch loses speed and flexibility but retains substantial tools.

Consumers and Technology Markets Feel the Burn

Tariffs act like friction in the gears of global commerce. When duties rise, prices tend to follow. Electronics, vehicles, and industrial equipment are especially vulnerable because their supply chains span many countries.

Previous tariffs already affected items like gaming consoles, components, and hardware. Manufacturers adjust by relocating production, absorbing costs, or raising retail prices.

Economists estimate that even without the invalidated emergency tariffs, the average effective tariff rate remains historically high. The result is persistent upward pressure on consumer prices.

Technology companies face an additional challenge. Many products rely on minerals, semiconductors, and assembly lines concentrated in specific regions. Sudden tariff shifts can disrupt entire ecosystems, not just individual firms.

Constitutional Balance vs. Economic Strategy

The deeper story involves governance rather than trade alone. The Court notes that major economic decisions affecting citizens’ financial obligations should flow through elected representatives.

Legislation moves slowly by design. It forces debate, compromise, and transparency. Emergency executive action moves quickly but risks overreach.

Supporters of strong executive power argue that modern crises require a rapid response. Opponents warn that bypassing Congress concentrates too much authority in one office.

The ruling reinforces a foundational principle: policy speed must not outrun constitutional guardrails.

TF Summary: What’s Next

The Supreme Court’s decision does not end tariff battles. It reshapes them. Future duties will emerge through established trade laws rather than emergency powers, meaning a slower rollout but stronger legal durability.

Businesses, investors, and consumers are in a period of adjustment. Supply chains may shift again. Trade negotiations may reopen. Lawsuits over refunds will unfold for years.

MY FORECAST: The lesson is almost philosophical. Economic power in a democracy behaves like energy in physics. It cannot vanish, only change form. Tariffs remain a favored instrument of national strategy. The method of deployment simply evolves.