Alibaba is doubling down on its artificial intelligence (AI) ambitions, announcing a boost in its AI spending as global competition heats up. This move comes amid mounting pressure from both Chinese tech rivals and U.S. companies, all racing to dominate the AI space.

What’s Happening & Why This Matters

Shares of Alibaba surged by nearly 9% in Hong Kong following a major announcement from CEO Eddie Wu. Speaking at a company conference in Hangzhou, China, Wu revealed plans to increase the company’s AI budget, signaling a deeper commitment to staying competitive in the global AI arms race.

Previously, Alibaba pledged 380 billion yuan (€45 billion) toward AI-related infrastructure over the next three years. This massive investment covers everything from building data centres to scaling compute resources required to train and deploy advanced AI models. Wu did not specify the exact amount of this additional boost, but his message was clear: Alibaba intends to secure its position as a global AI powerhouse.

The announcement coincided with the launch of Alibaba’s most powerful AI model to date, the Qwen3-Max. According to Chief Technology Officer Zhou Jingren, this model boasts over 1 trillion parameters. These parameters enable the system to process complex information and deliver cutting-edge predictions.

Alibaba claims the Qwen3-Max outperforms top global competitors like Anthropic’s Claude and DeepSeek-V3.1, citing independent third-party benchmarks. If accurate, this would put Alibaba’s technology on par — or even ahead — of leading Western AI developers, bolstering its credibility as a key player in the field.

Wu stressed the urgency of these investments:

“The industry’s development speed far exceeded what we expected, and the demand for AI infrastructure also far exceeded our anticipation,” Wu said. “We are actively proceeding with the 380 billion investment and plan to add more.”

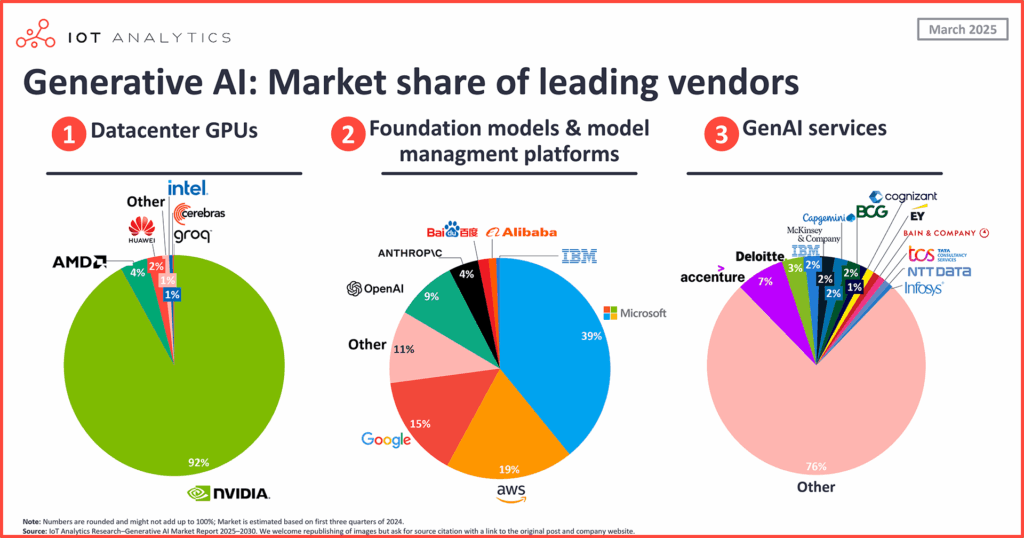

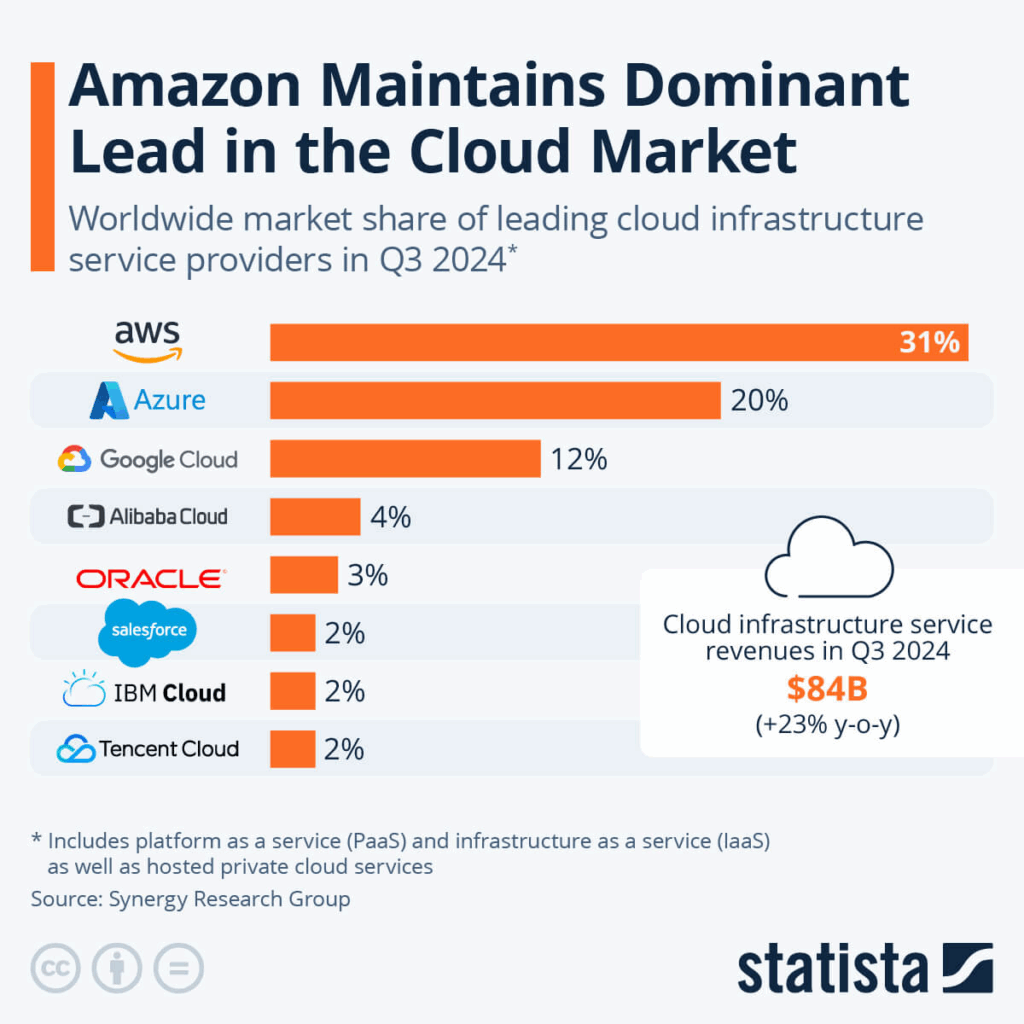

Wu also predicted that global AI investment will surpass $4 trillion (€3.4 trillion) within the next five years, underscoring the intense level of competition in the sector. Companies like Tencent, JD.com, and U.S. heavyweights such as Microsoft, Google, and OpenAI are already pouring billions into AI initiatives.

Roadblocks to Alibaba’s Plan

Despite Alibaba’s ambitious plans, geopolitical tensions pose serious challenges. China’s internet regulator recently banned major domestic tech firms from purchasing Nvidia’s AI chips, which are essential for training advanced models like Qwen3-Max.

This restriction follows earlier guidance discouraging companies from buying Nvidia’s H20 chip, a version specifically designed for the Chinese market. The guidance cited national security concerns over data protection and system control. These moves are part of Beijing’s broader strategy to strengthen its homegrown chip industry and reduce dependence on U.S. technology.

The U.S. government’s export restrictions further complicate the issue. Washington had previously banned the export of Nvidia’s H20 chips to China in April during escalating trade disputes. Although that ban was lifted, the regulatory back-and-forth highlights the fragile dynamics of U.S.-China tech relations, putting Alibaba and other Chinese firms in a precarious position.

Without access to Nvidia’s high-performance processors, Alibaba may face bottlenecks in scaling its AI infrastructure. This could slow progress on models like Qwen3-Max, even as demand for AI capabilities skyrockets worldwide.

Feeling The Global Impact

Alibaba’s push into AI reflects a larger global trend: governments and corporations are recognising AI as a strategic asset. Wu’s prediction of $4 trillion in worldwide AI investment shows just how high the stakes have become.

China views AI not only as a driver of economic growth but also as a vital component of national security. By boosting spending now, Alibaba positions itself as both a commercial leader and a key player in China’s technological ambitions. Meanwhile, Western companies are equally aggressive, setting up a technological cold war that could shape industries and policies for decades.

TF Summary: What’s Next

Alibaba’s increased spending marks a critical phase in the global race for AI dominance. With Qwen3-Max positioning itself as a viable competitor to Western models, Alibaba has an opportunity to establish itself as a leader in AI innovation. However, geopolitical barriers — especially around chip access — could hinder its growth.

If China successfully develops competitive domestic chip technologies, Alibaba may overcome these challenges and accelerate its global ambitions. The next three years will determine whether Alibaba’s strategy pays off or stalls under international pressures.

MY FORECAST: Alibaba will double down on AI partnerships across Asia and Africa to bypass U.S. export restrictions while aggressively lobbying Beijing to fast-track domestic chip innovation.

— Text-to-Speech (TTS) provided by gspeech