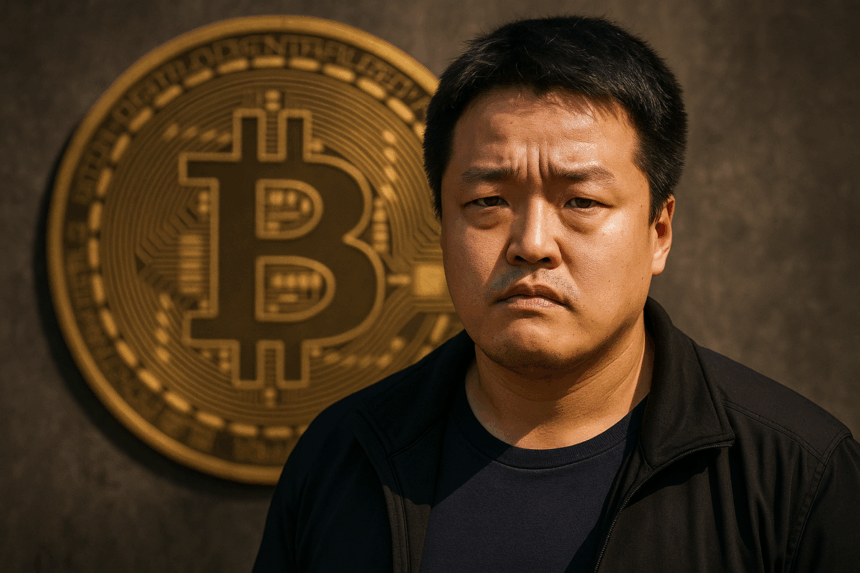

The dramatic collapse of TerraUSD and Luna in 2022 wiped out an estimated $40 billion in value. This event shook the crypto world. Now, the man behind it, Do Kwon, has pleaded guilty to two federal charges in the United States. The former crypto mogul admitted in a New York courtroom that he misled investors and manipulated markets. This ends a chapter that has haunted digital finance for years.

What’s Happening & Why This Matters

A Fall From Grace

Do Kwon, co-founder of Singapore-based Terraform Labs, once hailed as an innovator in blockchain, is now facing prison. At just 33, he stood before a federal judge and pleaded guilty to conspiracy to defraud and wire fraud. These charges stem from the catastrophic failure of TerraUSD — a stablecoin designed to stay at $1 — and its sister token, Luna.

The Market Manipulation

Prosecutors allege that in May 2021, when TerraUSD slipped below its $1 peg, Kwon publicly claimed the Terra Protocol algorithm had restored its value. In reality, a high-frequency trading firm had secretly purchased millions of dollars’ worth of TerraUSD. This was to prop up the price artificially. This misrepresentation fueled massive buying from both retail and institutional investors. As a result, Luna’s market value soared to $50 billion by spring 2022 — just before it crashed.

Kwon admitted in court:

“I made false and misleading statements about why it regained its peg by failing to disclose a trading firm’s role in restoring that peg. What I did was wrong.”

The Legal Outcome

Kwon faces a maximum sentence of 25 years. However, under a deal with the Manhattan U.S. attorney’s office, prosecutors will advocate for no more than 12 years if he accepts responsibility. Sentencing is scheduled for 11 December. He has been in custody since being extradited from Montenegro in late 2024.

This isn’t Kwon’s only legal battle. In 2024, he agreed to pay $80 million in civil fines. He also accepted a ban from all crypto transactions as part of a $4.55 billion settlement with the U.S. Securities and Exchange Commission. Furthermore, he faces criminal charges in South Korea and may apply to serve part of his sentence there after completing half of his U.S. term.

Ripple Effects in Crypto Markets

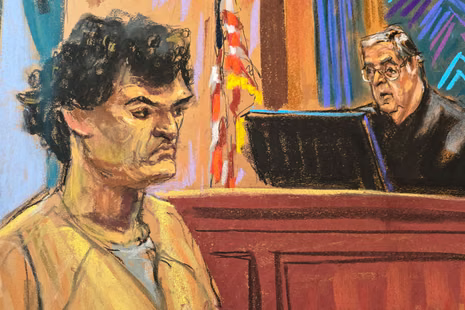

Kwon joins a growing list of high-profile crypto executives brought down by legal action after the 2022 crash. This includes Sam Bankman-Fried, who received 25 years in prison for his role in the FTX scandal. These cases underscore how regulatory agencies are stepping up oversight and enforcement in the digital asset space.

TF Summary: What’s Next

Do Kwon’s guilty plea marks a turning point for accountability in cryptocurrency. His sentencing will be noted by other crypto executives skirting the rules. For the markets, the case reinforces the urgent need for transparency, stablecoin regulation, and investor protection. This is crucial in an industry still reeling from repeated scandals.

TF expects renewed scrutiny on stablecoins and algorithmic backing models. Governments are enacting crypto legislation faster, and investors are more cautious about promises that seem too good to be true.

— Text-to-Speech (TTS) provided by gspeech