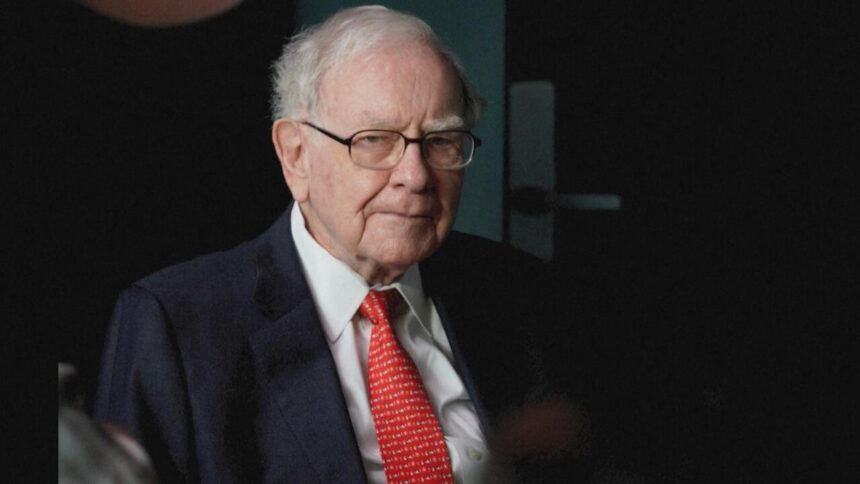

At 94 years old, Warren Buffett, often called the “Oracle of Omaha,” announced that he will retire as CEO of Berkshire Hathaway at the end of this year. This marks the end of an era for one of the most successful investors in history. Known for transforming Berkshire Hathaway from a failing textile company into a $1.16 trillion investment giant, Buffett’s decision to hand over the reins to Greg Abel, his trusted Vice Chairman, dawns a new chapter for the company. As Buffett prepares for his swansong, his legacy as a visionary investor remains firmly intact.

What’s Happening & Why This Matters

Warren Buffett’s retirement announcement came during the annual meeting of Berkshire Hathaway in Omaha, Nebraska, in front of around 40,000 attendees. His announcement was met with a standing ovation, showcasing the high esteem shareholders and business leaders hold him. Buffett shared that he had decided to step down, believing it was time for Greg Abel to take over the company’s leadership. This change comes after Buffett handpicked Abel as his successor four years ago, although he hadn’t indicated any immediate plans to retire.

Despite stepping down, Buffett emphasized that he has no intention of selling any shares of Berkshire Hathaway. His shares will be donated rather than sold. The crowd applauded this statement, underlining Buffett’s commitment to ensuring that the company remains strong even after his departure.

Buffett’s legacy is not just in his wealth—though with a net worth of $154 billion, he remains the fourth wealthiest person in the world—but in the investment strategies and philosophies he has shared over the decades. His long-term, value-driven investing method has influenced generations of investors, and his humility and commitment to philanthropy continue to inspire those who follow in his footsteps.

The announcement also comes as Buffett has been vocal in his opposition to President Trump’s tariffs. He warned that trade wars could hurt global relations, suggesting that the U.S. should focus on creating mutually beneficial trade partnerships rather than using trade as a weapon. This statement reflects Buffett’s belief in open, global markets and a commitment to international cooperation.

TF Summary: What’s Next

As Greg Abel prepares to take over the role of CEO of Berkshire Hathaway, the company will likely continue to evolve with a strong focus on Buffett’s guiding principles. Buffett’s legacy of sound investment strategies and ethical business practices will remain the foundation of Berkshire Hathaway’s operations. However, it remains to be seen how Abel will steer the company as he steps into one of the most prominent leadership roles in the business world. With Buffett’s commitment to philanthropy and his steadfast belief in value investing, his influence will continue to buoy Berkshire Hathaway and the global investment community for generations to come.

— Text-to-Speech (TTS) provided by gspeech