Sorry Starlink! Verizon is throwing its full weight behind AST SpaceMobile to bring satellite-to-phone connectivity directly to everyday users. In a decisive move for the U.S. mobile provider, Verizon signed a commercial agreement with the Texas-based space startup to begin offering direct satellite-powered voice, video, and data services starting next year.

What’s Happening & Why This Matters

This deal builds on the “strategic partnership” the two companies announced last year, but this time, it comes with a real commercial rollout plan. Verizon’s move signals a confident bet that AST’s satellite network, not SpaceX’s Starlink, will lead the charge in connecting users outside traditional coverage zones.

AST SpaceMobile’s technology allows standard smartphones — no special hardware or modifications required — to connect directly to orbiting satellites. This could mean seamless coverage for Verizon customers in rural areas, mountains, deserts, and even offshore locations where traditional cell towers can’t reach.

From Partnership to Full Commitment

Verizon’s commitment to AST SpaceMobile includes a $100 million investment and access to a portion of its radio spectrum to power satellite connectivity. That partnership laid the foundation, but until this week, there hadn’t been a formal commercial agreement — prompting industry speculation that Verizon might pivot toward SpaceX, which has been expanding its own Starlink cellular service through T-Mobile.

Those rumors can now be put to rest. Verizon’s announcement confirms it’s all in with AST, staking its future on the company’s BlueBird satellite network — even as AST races to expand its constellation.

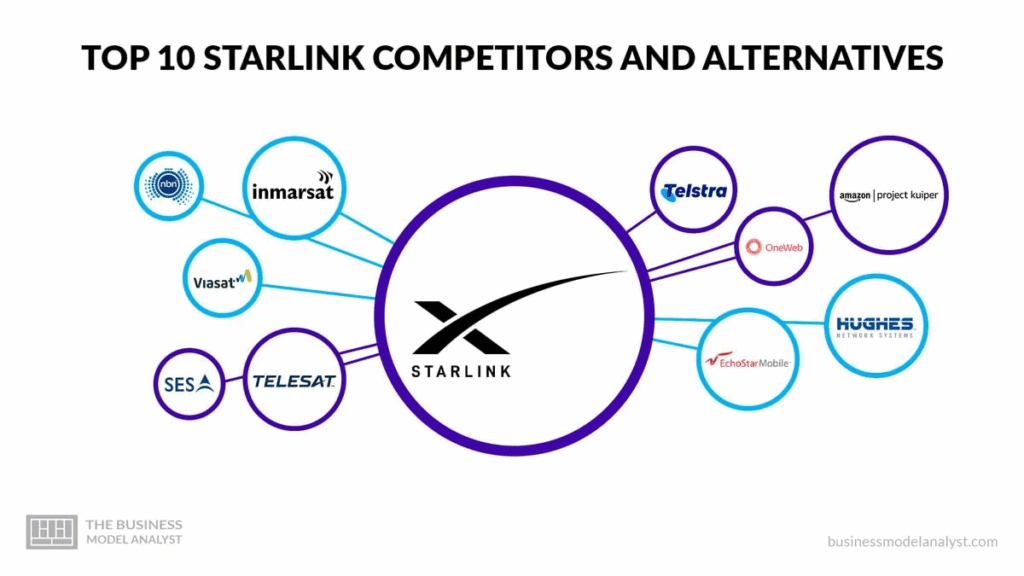

Meanwhile, SpaceX already operates over 650 cellular Starlink satellites and began offering service to T-Mobile users earlier this year, first as a beta and then as a commercial launch in July. Still, Verizon’s strategic play is about long-term flexibility — AST’s model promises universal connectivity across unmodified devices, avoiding the specialized hardware or licensing hurdles that competitors face.

AST’s BlueBird Network — Ambitious, But Behind Schedule

AST SpaceMobile’s BlueBird satellites are the backbone of this new service. These massive spacecraft, each roughly the size of a tennis court when unfolded, are designed to deliver direct voice and data to smartphones without intermediaries. The company has successfully demonstrated Voice over LTE (VoLTE) calls between Verizon devices in Texas and New Jersey, confirming that standard phones can connect to satellites with clarity and stability.

“The tests show our satellites can complete direct voice and video calls, as well as two-way RCS messaging, between standard, unmodified smartphones,” AST said in a statement. “A crystal-clear VoLTE call was made between two Verizon smartphones using an AST SpaceMobile satellite. These successful tests represent a leap in satellite-to-cellular technology and pave the way for a future of ubiquitous connectivity.”

Yet hurdles remain. AST currently has only five BlueBird satellites in orbit, a far cry from the 45 to 60 needed to provide continuous U.S. coverage. The company’s next-generation prototype, FM1, was slated for launch in August but has been delayed until December or January. Still, AST is moving fast — another BlueBird satellite, BlueBird 7, is scheduled to ship to Cape Canaveral for launch this month.

If AST can achieve its deployment goals by the end of next year, it could leapfrog ahead of rivals, including Starlink and AT&T, which also signed a multi-year agreement with AST extending through 2030. The carrier race for universal coverage is officially on.

Satellite-to-Mobile Gets Competitive

The battle for the satellite-to-smartphone market is skyrocketing. SpaceX’s Starlink, AST SpaceMobile, and players like Lynk Global are vying to build the first truly global direct-to-device network. For telecoms like Verizon, these partnerships aren’t just about coverage — they’re about staying relevant in the next generation of mobile connectivity, especially as rural and developing regions become key growth markets.

Elon Musk’s SpaceX has already secured a $17 billion deal to acquire new radio spectrum via EchoStar, parent company of Boost Mobile, bolstering its Starlink Cellular plans. By contrast, Verizon’s approach with AST focuses on interoperability and scalability — a model that could potentially integrate with future 5G and 6G architectures.

Analysts see Verizon’s strategy as a long-term investment in universal coverage, even if AST’s constellation lags behind today. Once its satellite fleet is operational, Verizon could deliver uninterrupted service from downtown Manhattan to the Grand Canyon — without requiring users to change devices or networks.

TF Summary: What’s Next

Verizon’s decision to double down on AST SpaceMobile is the beginning of a new era in satellite-to-cellular communication. If AST can meet its ambitious launch schedule and secure enough satellites in orbit, Verizon may gain a serious competitive edge against SpaceX’s Starlink.

MY FORECAST: Expect expanded pilot programs through mid-2025, followed by a nationwide rollout in 2026. The race for sky-to-phone supremacy is officially underway — and Verizon just made its play.

— Text-to-Speech (TTS) provided by gspeech