The U.S. Push for Semiconductor Independence Faces Delays

Taiwan Semiconductor Manufacturing Company (TSMC) is ramping up its U.S. manufacturing efforts, but the process is far from immediate. The chip giant is investing heavily in Arizona, building state-of-the-art fabrication plants to support companies like Apple, Nvidia, AMD, and Qualcomm. Despite this commitment, TSMC’s most advanced semiconductor technologies remain rooted in Taiwan. The company prioritizes domestic expertise before shifting cutting-edge chip production to the United States.

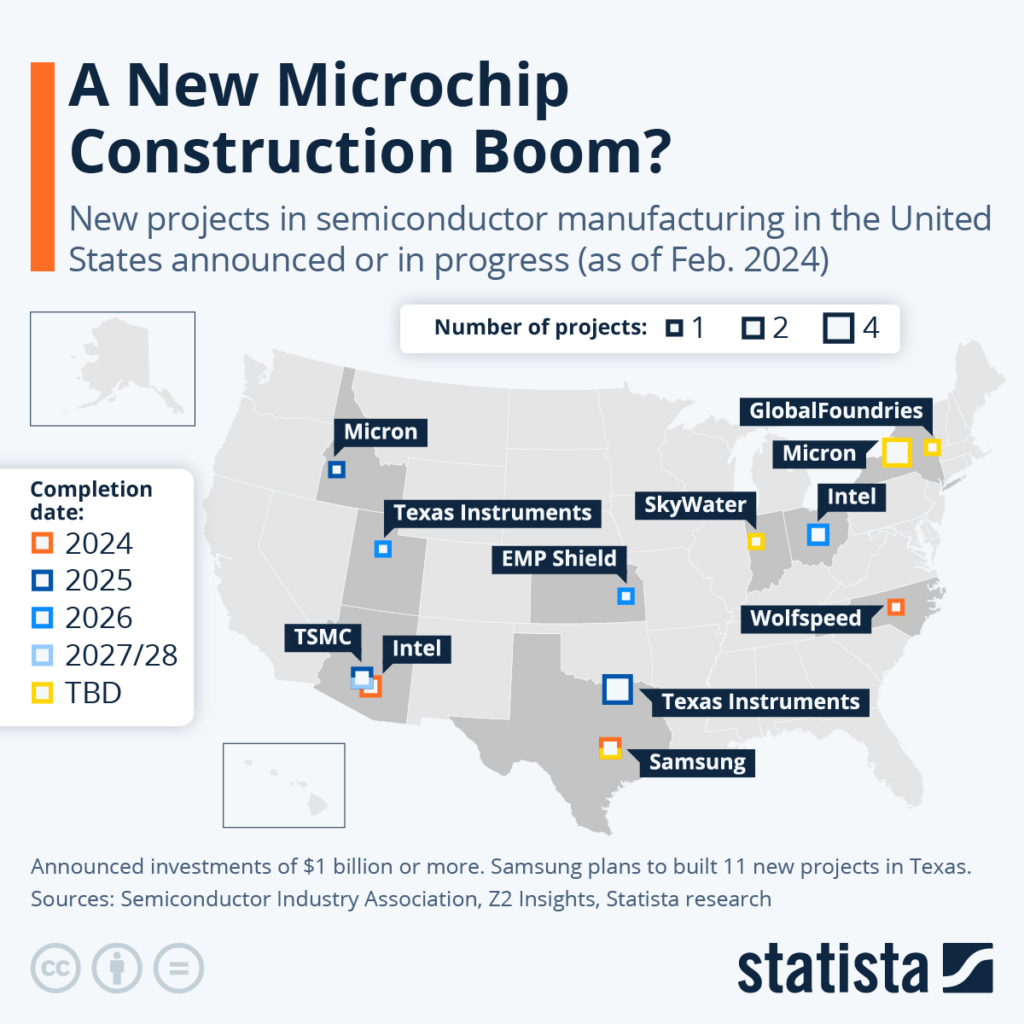

TSMC’s expansion is part of a broader effort by the U.S. government to reduce reliance on foreign chip manufacturing. However, long lead times, workforce challenges, and strategic decisions keep Taiwan’s most advanced 3nm and upcoming 2nm process nodes first. Even as U.S. policymakers push for semiconductor self-sufficiency, delays in scaling production mean that the impact of these new factories won’t be immediate.

What’s Happening & Why This Matters

TSMC’s Arizona Expansion and Strategic Investments

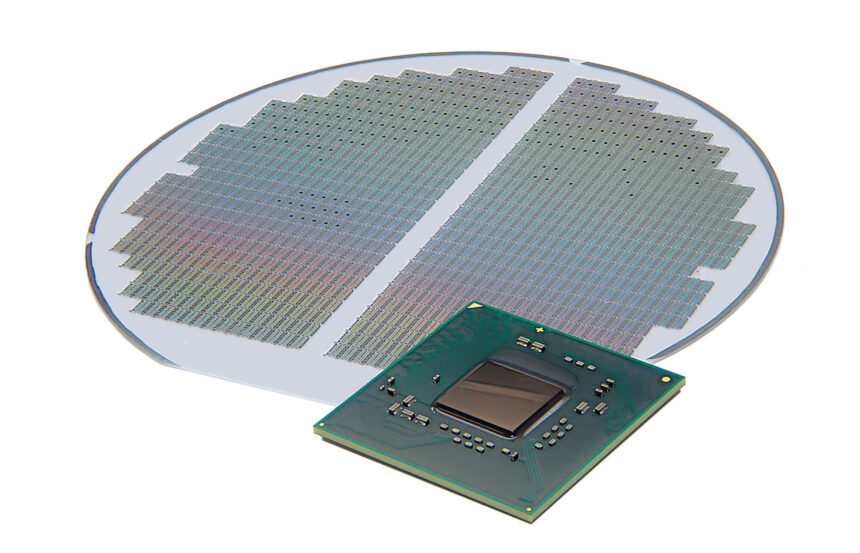

TSMC has committed over $100 billion to global semiconductor manufacturing, focusing on increasing U.S. production capacity. Its Arizona expansion includes six fabrication plants designed to strengthen domestic chip supply chains and reduce dependence on Taiwan. The project is being built in phases, with the first fab now producing 4nm chips and plans for 3nm and 2nm production in later stages.

The U.S. has positioned these investments as a safeguard against geopolitical risks, particularly concerning Taiwan and China. If China were to disrupt Taiwan’s semiconductor industry, global supply chains would be at risk. By building infrastructure in the U.S., TSMC is providing an alternative supply source, though it will take time for production to reach peak capacity.

Why Taiwan Remains the Center for Advanced Chips

Despite U.S. investment, TSMC’s leadership remains hesitant to immediately transfer its most advanced chip technology outside Taiwan. Taiwan has developed deep expertise in semiconductor manufacturing, supported by a robust network of engineers, supply chains, and R&D facilities. The company has stated that keeping its latest chip technologies in Taiwan first allows it to refine the processes before rolling them out globally.

The Taiwanese government also actively ensures that TSMC’s most advanced technology remains a domestic priority. The government has encouraged TSMC to maintain its research and development headquarters in Taiwan while expanding production abroad without compromising its technological edge.

U.S. Tariffs, Politics, and the Long Road Ahead

The Arizona expansion comes amid growing political pressure from U.S. leaders to boost domestic semiconductor manufacturing. Former President Donald Trump and other policymakers have criticized reliance on foreign-made chips, warning of national security risks and potential supply chain disruptions. The Biden administration has continued these efforts, offering federal incentives under the CHIPS Act to encourage U.S.-based semiconductor production.

However, recent discussions about new tariffs on foreign-made chips could further complicate the situation. If tariffs are imposed on Taiwan-made chips, efforts to shift manufacturing to U.S. soil could be accelerated. Yet, TSMC focuses on long-term technological competitiveness, meaning it will not rush to relocate its most advanced production lines overnight.

Scaling Up U.S. Semiconductor Manufacturing

While TSMC’s investment in Arizona is a step toward strengthening U.S. semiconductor independence, challenges remain. Training a skilled workforce, establishing supply chains, and refining production techniques takes time.

Unlike Taiwan, which has spent decades perfecting semiconductor fabrication, the U.S. still needs to develop its expertise. The availability of engineers, technicians, and supply chain partners in the U.S. is improving, but it is not yet at the level needed to replicate Taiwan’s success.

The company has acknowledged that its U.S. fabs won’t reach full capacity for several years. Even as the first phase in Arizona begins mass-producing 4nm chips, it will be at least 2026 or later before 3nm chips are produced in the U.S. on a larger scale. The 2nm process—currently in early development in Taiwan — will take longer to reach American fabs.

TF Summary: What’s Next

TSMC’s Arizona expansion is vital to reducing reliance on foreign chip production, but the most advanced semiconductor technology will remain in Taiwan first. While the U.S. is pouring billions into semiconductor infrastructure, TSMC is gradually ensuring quality and efficiency before shifting its top-tier chip production overseas.

As geopolitical tensions, trade policies, and supply chain concerns continue to evolve, the speed of TSMC’s U.S. expansion will depend on government incentives, workforce development, and the global demand for cutting-edge chips. In the meantime, Taiwan remains the undisputed leader in semiconductor innovation.

— Text-to-Speech (TTS) provided by gspeech