President Donald Trump announces a stunning new 100% tariff on imported chips and semiconductors. This steep increase from the previously discussed 25% tariff aims to bring chip manufacturing back to the U.S. The move coincides with Apple’s massive $600 billion investment pledge in domestic manufacturing. Yet, the chip industry watches closely as exemptions and impacts unfold. Will any companies escape the tariffs unscathed? And what will this mean for consumers and the global supply chain?

What’s Happening & Why This Matters

On 7 August 2025, President Trump declared that the U.S. is imposing a 100% tariff on all imported chips and semiconductors. The aggressive action drastically ups the stakes for global chip suppliers and tech giants. The White House clarifies that companies committing to or already building production facilities in the U.S. will avoid these tariffs. Trump emphasised, “If you’re building in the United States of America, there’s no charge.”

The announcement follows Apple’s expansion of its domestic investment, which now totals $600 billion over the next four years. Apple CEO Tim Cook announced partnerships to build advanced production lines, including a new smartphone glass factory in Kentucky with Corning. The decision is a prominent one, localising parts of Apple’s supply chain, even though final assembly for products like the iPhone remains overseas.

Many leading chip makers like TSMC and Samsung manufacture primarily in Asia. Both companies plan new factories in the U.S. Taiwan’s National Development Council confirms TSMC will likely be exempt due to its U.S. fab investments. Likewise, South Korea’s trade officials expect Samsung and SK Hynix to avoid tariffs, preserving their critical roles in the supply chain.

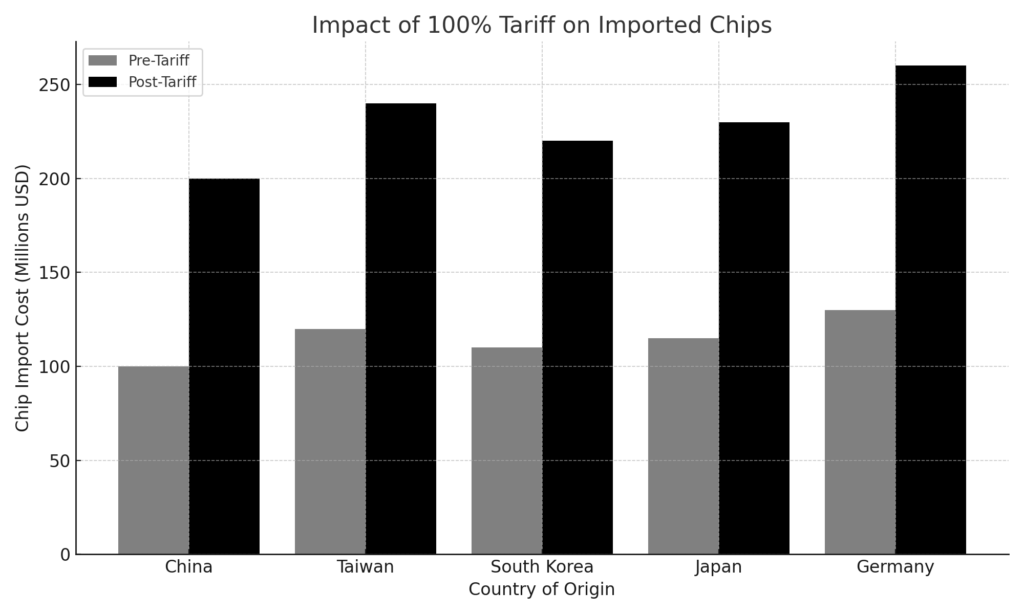

The tariffs could immediately shift the semiconductor market. By taxing imported chips at double the previous rate, the U.S. government pushes for reshoring manufacturing to reduce dependency on Asia. However, the risk of increased production costs may ripple through the technology market. Consumers could face higher prices as manufacturers adjust to new supply chain expenses.

Tech leaders express cautious optimism. Apple’s commitment signals confidence in U.S. manufacturing but also acknowledges the complexity of moving assembly lines back home. Nvidia and AMD, other major chip buyers, remain impacted by global supply dynamics and tariff policies.

Though detailed tariff rules remain undisclosed, the administration indicates the duties could extend beyond chips to include electronic products containing foreign-made semiconductors. This broad scope has raised alarms across industries reliant on global components.

The Tariff Impact: Companies, Consumers, and the Global Supply Chain

The updated tariff policy centres on strengthening American chip production by penalising imports. Its ripple effects will touch multiple stakeholders.

Apple’s $600 billion U.S. investment includes new manufacturing partnerships, such as its collaboration with Corning in Kentucky, which will produce cover glass for iPhones and Apple Watches worldwide. This effort represents a gradual but strategic localisation of supply chains.

TSMC plans six new fabs in Arizona to serve its U.S. customers, including Apple, Nvidia, and AMD. These facilities showcase a shift in global semiconductor production strategies prompted by geopolitical tensions and trade policies.

Samsung and SK Hynix’s expected tariff exemptions reflect their proactive investments in U.S. manufacturing plants. This carve-out aims to reward companies contributing to the American economy while pressuring others to follow suit.

Consumers could feel the pinch if tariff costs lead to price increases on devices and electronics. However, companies may absorb some costs to maintain competitiveness. The final impact depends on how the tariffs are implemented and how supply chains adapt.

Leaders and Officials React

President Trump’s clear message punctuates the administration’s priority: “Companies like Apple, they’re coming home. They’re all coming home.”

Apple CEO Tim Cook notes the progress in U.S. manufacturing but tempers expectations on full assembly returns: “There’s a ton being made in the U.S., but final assembly will be elsewhere for a whlle.”

Taiwanese official Liu Chin-ching confirms TSMC’s exemption, stating, “TSMC is exempted from the chip tariffs because it has set up plants in the U.S.”

South Korean trade negotiators echo similar views on Samsung and SK Hynix, projecting their exclusion from the tariff’s reach.

TF Summary: What’s Next

The 100% tariff on imported chips is yet another wrinkle in U.S. trade policy. It’s intended to compel semiconductor firms to localise production stateside and reset global supply chains. While exemptions for companies investing domestically soften the blow, many downstream businesses face uncertainty about pricing and availability.

Watch for detailed tariff rules and the pace of new U.S. fab construction. Market and consumer responses to the price impacts will forge America’s next chapter in AI chip sovereignty.

— Text-to-Speech (TTS) provided by gspeech