SpaceX’s Starlink and AST SpaceMobile are in a heated race to deliver the best satellite internet coverage. Both companies are focused on providing high-speed internet to remote and underserved areas, but their approaches and progress are markedly different.

What’s Happening & Why This Matters

Starlink’s Progress

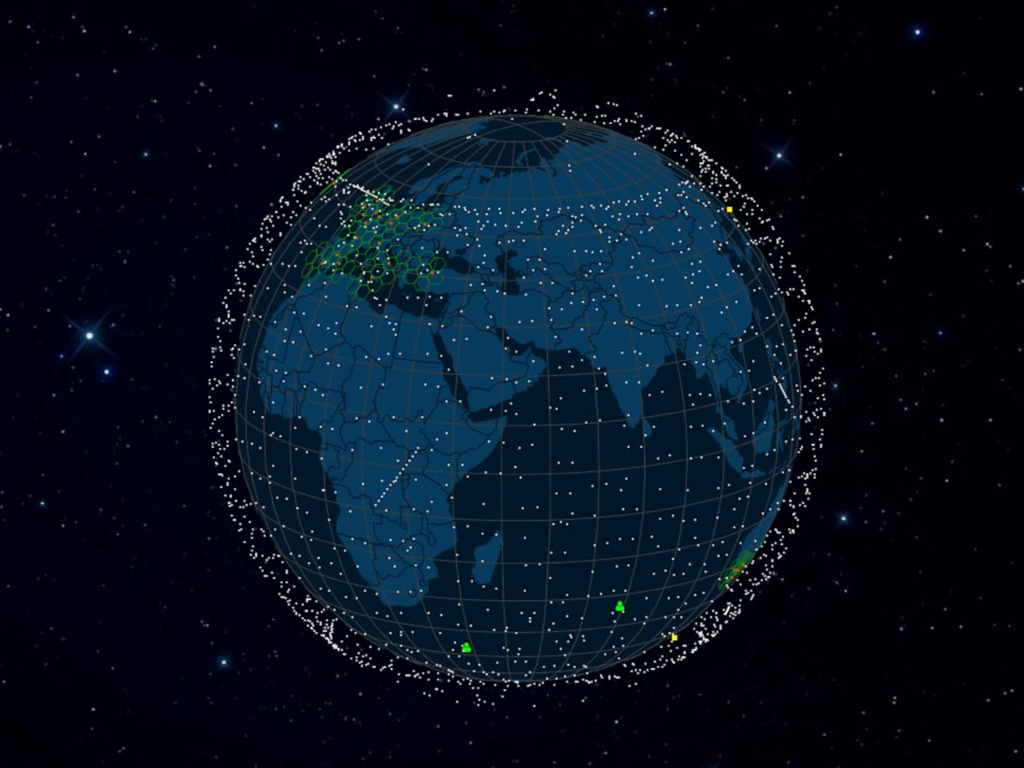

SpaceX’s Starlink project has successfully launched around 100 satellites, establishing a robust network to offer internet access to unmodified phones. Partnering with T-Mobile, Starlink plans to launch its service this fall, pending regulatory approval. However, a recent malfunction with SpaceX’s Falcon 9 rocket may delay the launch, affecting their timeline.

Starlink has also introduced the Starlink Mini dish in Europe at a lower price than in the U.S., reflecting its growing market reach. In Europe, the Starlink Mini dish costs about $433, significantly cheaper than the $599 price in the U.S. This price difference is part of SpaceX’s strategy to manage network load in high-usage areas like the U.S.

AST SpaceMobile’s Ambitious Plans

AST SpaceMobile is preparing to launch its first commercial satellites, known as Bluebirds, in September. These satellites are designed to deliver broadband to mobile phones, addressing connectivity issues in cellular dead zones. Initially delayed due to supply chain issues, the company is now ready to ship its first batch of five satellites to Cape Canaveral, Florida.

The CEO of AST SpaceMobile, Abel Avellan, noted that completing the manufacturing assembly and environmental testing for these satellites is a milestone in their mission to deliver connectivity to those who need it most. However, AST SpaceMobile must deploy between 45 and 60 satellites to ensure continuous coverage in the U.S., highlighting the challenges ahead.

AST SpaceMobile has partnered with AT&T and Verizon to leverage its satellites for customers in areas with poor cellular coverage. This collaboration underscores the company’s commitment to bridging the digital divide and providing high-speed internet access to underserved regions.

Competitive Landscape

While AST SpaceMobile is making progress, it still trails behind SpaceX’s extensive satellite network. Starlink’s established presence and substantial customer base in the U.S. and Europe give it a competitive edge. The introduction of the Starlink Mini dish in Europe, at a more affordable price, demonstrates SpaceX’s strategy to expand its market reach.

In Europe, the Starlink Mini dish is available through the Starlink Roam tier, enabling consumers to use the device on the go. The dish costs €399 (about $433), with even lower prices in some countries like France (€339 or $368). In contrast, the U.S. version of the dish costs $599. European subscribers also benefit from lower monthly internet fees: €40 for 50GB of data or €59 for unlimited data. U.S. subscribers, however, pay $50 for 50GB of data or $150 per month for unlimited data. This price disparity is meant to prevent overloading the Starlink network in high-usage areas like the U.S.

SpaceX has indicated that the price difference is necessary to manage the additional demand on the satellite network in the U.S. Meanwhile, in Europe, the company has enough network capacity to sell the Mini dish at a more affordable rate. However, the product is not yet available everywhere on the continent, with sales still pending in countries like the UK, Switzerland, and Poland.

To receive the lowest price on the Mini dish, consumers must be based in one of several countries in Latin America, where the dish costs only $200 but requires an $84 monthly fee for internet access. SpaceX has also started selling the dish in Africa, further expanding its global reach.

TF Summary: What’s Next

The competition between Starlink and AST SpaceMobile is poised to intensify as both companies continue to expand their satellite networks. Starlink’s head start and established customer base provide a significant advantage, but AST SpaceMobile’s focus on addressing connectivity issues in cellular dead zones offers a unique opportunity to capture a niche market. Future developments will depend on successful satellite launches, regulatory approvals, and the ability to provide reliable and affordable internet access worldwide. The race for satellite dominance is ongoing, and consumers globally will benefit from the advancements in this technology-driven competition.

— Text-to-Speech (TTS) provided by gspeech