Apple surprises Wall Street by beating profit and revenue expectations in its third fiscal quarter of 2025. Despite risks including slowing AI progress, a store closure in China, and mounting U.S. tariffs on its supply chain, Apple reports strong growth. The revenue call reveals it faced an $800 million tariff cost this quarter and announces plans to boost AI investments. The quarter is a critical moment in Apple’s journey to stay competitive in a fluid and competitive marketplace.

What’s Happening & Why This Matters

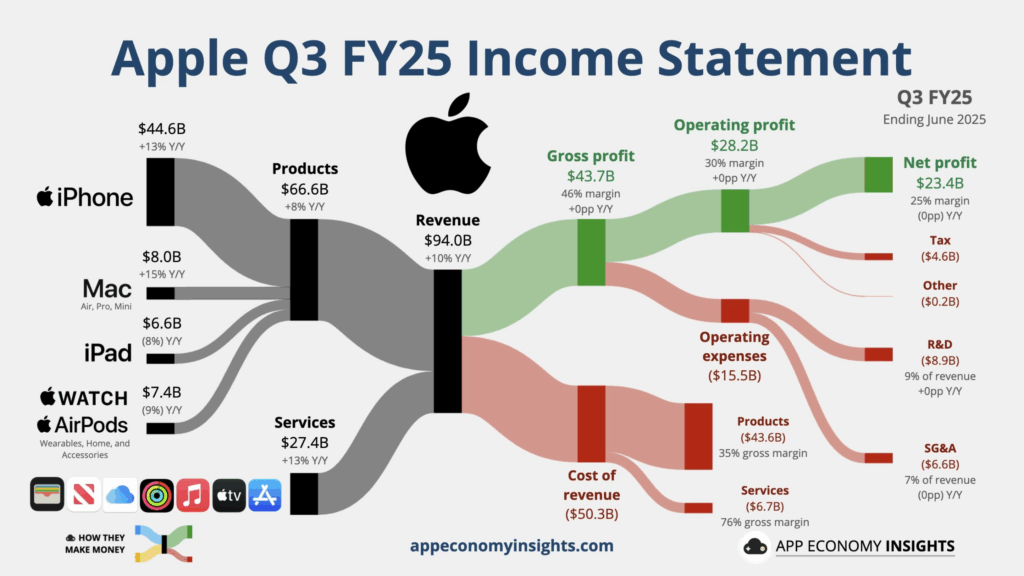

Apple’s Q3 2025 earnings show revenue of $94.04 billion, a 10% increase year-over-year. Earnings per share hit $1.57, surpassing analysts’ forecasts of $89.3 billion revenue and $1.43 EPS. This represents Apple’s strongest revenue growth since 2021. The company’s iPhone sales grew 13% compared to the same period last year, further lifting overall results.

CEO Tim Cook expresses pride in the “June quarter revenue record,” with growth in iPhones, Macs, and services. Despite mounting challenges, Apple’s robust financial performance quiets fears about stagnation.

Analyst Dipanjan Chatterjee notes that Apple’s high-margin services business helps mask weaker hardware innovation. Apple’s AI rollout has lagged behind competitors, with its voice assistant Siri seeing only incremental updates. Many promised AI features remain unreleased, as Apple prioritises quality over speed, says Craig Federighi, Apple’s VP of software engineering.

Tariffs imposed by U.S. President Donald Trump add pressure. Approximately 90% of iPhones are assembled in China, and tariffs are expected to add over $900 million to costs this quarter. Apple has shifted some production to India and Vietnam, but new tariffs on India threaten these plans.

On the earnings call, Cook commits to investing $500 billion in the U.S. over the next four years and reassures investors about progress toward a more personalised Siri, expected to launch next year.

Apple’s stock suffered a 15% drop this year due to geopolitical concerns and competitive pressures, but gained 2.5% in after-hours trading following the earnings announcement.

In a separate announcement, Cook reveals Apple’s plan to significantly increase AI investments, reallocating staff to develop Apple Intelligence features. He stated that Apple remains open to acquiring startups that accelerate its AI roadmap, though no major deals are yet confirmed.

Apple celebrated a noteworthy milestone: selling over three billion iPhones. Only Samsung is likely to surpass this figure given its longer handset history.

TF Summary: What’s Next

Apple beats market expectations despite an $800 million tariff impact and slow AI rollout. The company’s commitment to ramping up AI investments and diversifying production signals a strategic push to maintain tech leadership.

Investors will watch how Apple accelerates AI innovation, manages geopolitical risks, and competes against fast-moving rivals. Apple’s demonstration of strong services revenue and enhanced hardware remains a sustaining factor in its growth.

— Text-to-Speech (TTS) provided by gspeech