Nvidia is investing $5 billion in longtime rival Intel to accelerate innovation in artificial intelligence (AI) infrastructure and personal computing. The financial decision comes shortly after the Trump administration took a 10% stake in Intel. The U.S. government’s active role in shaping the future of the chip industry.

What’s Happening & Why This Matters

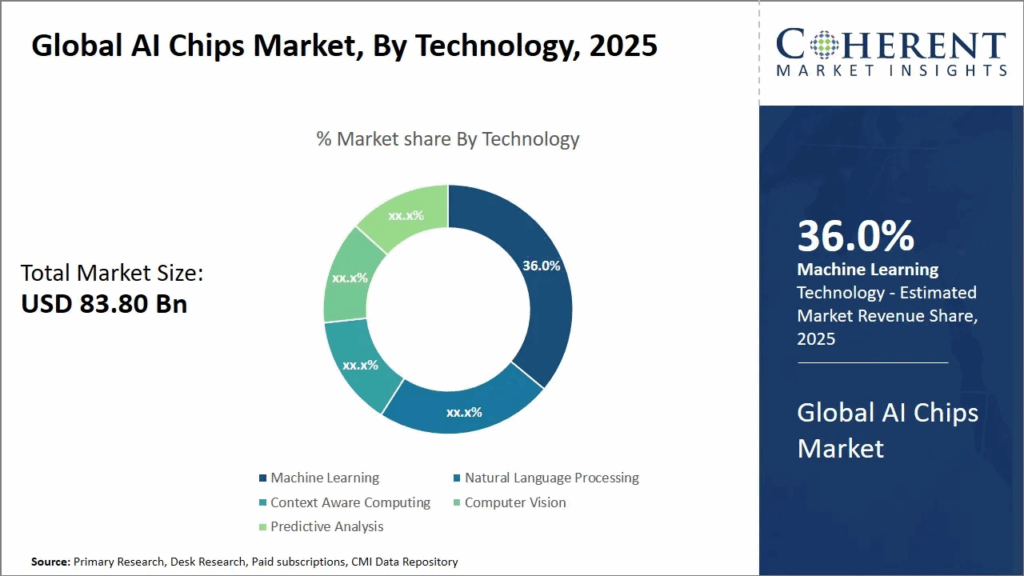

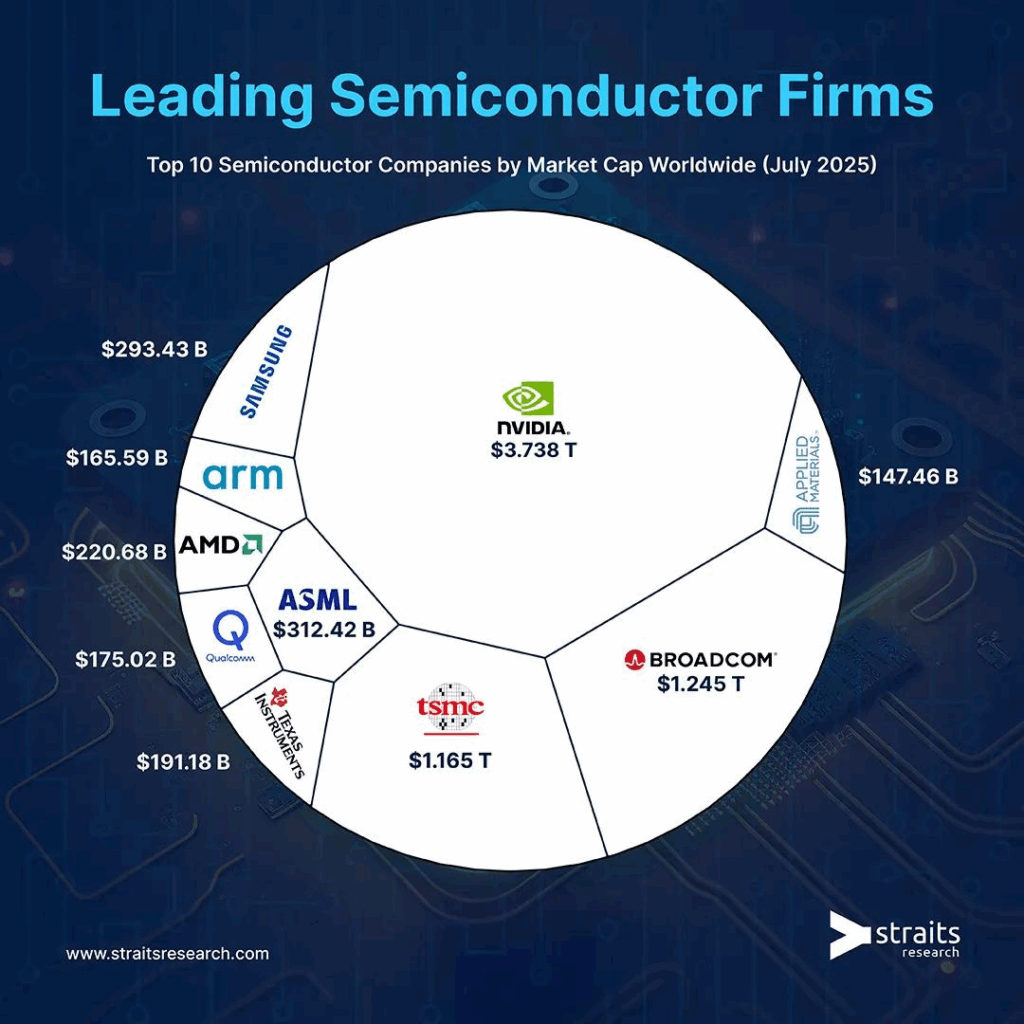

Nvidia, now valued at over $4 trillion, dominates the AI chip market thanks to its powerful graphics processing units (GPUs), which power everything from AI models to advanced gaming systems. Intel, on the other hand, has been struggling. Once the titan of the PC processor world, Intel fell behind during the mobile computing era triggered by the iPhone’s 2007 debut and has since been outpaced during the recent AI boom.

This partnership offers Intel a much-needed lifeline. Nvidia will purchase Intel’s common stock at $23.28 per share, pending regulatory approval. The collaboration focuses on two areas:

- AI data centres: Intel will design custom chips for Nvidia’s AI infrastructure platforms, boosting efficiency and performance.

- PC products: Intel will produce processors that integrate Nvidia’s advanced technologies, setting the stage for next-gen computing experiences.

This historic collaboration tightly couples Nvidia’s AI and accelerated computing stack with Intel’s CPUs and the vast x86 ecosystem — a fusion of two world-class platforms. Together, we will expand our ecosystems and lay the foundation for the next era of computing.”

Jensen Huang, Nvidia’s CEO.

A Boon for Intel

Intel’s recent performance has been dismal. The company lost $19 billion last year and an additional $3.7 billion in the first half of this year. It plans to cut 25% of its workforce by the end of 2025. The partnership is a turning point, helping Intel regain relevance in the fiercely competitive semiconductor market.

The announcement immediately impacted the stock market. Intel’s shares jumped nearly 30% in premarket trading, the commodity’s best single-day performance since 1987. Nvidia also saw a 3% increase, reaffirming its dominance.

Context & Impact

The investment also reflects geopolitical dynamics. President Donald Trump has prioritised strengthening the U.S. semiconductor industry, including threatening 100% tariffs on imported chips and negotiating export deals for AI chips with countries like China. Under these agreements, companies such as Nvidia and AMD are allowed to sell lower-capacity AI chips to China in exchange for the U.S. government receiving 15% of the revenue from those sales.

Earlier this year, Softbank, a leading Japanese tech investor, took a 2% stake in Intel worth $2 billion. Softbank’s investment is an indicator of global interest in reviving Intel’s fortunes. Nvidia’s stake cements the narrative that Intel is a strategic player despite recent setbacks.

The AI Arms Race

Analysts believe Nvidia’s interest validates its leadership while offering Intel a critical boost. Dan Ives, tech analyst at Wedbush, stated:

With AI infrastructure investments expected to reach $3–4 trillion by the end of the decade, Nvidia controls the chip landscape. Everyone else is paying rent as sovereigns and enterprises queue up for the most advanced chips in the world.”

The partnership demonstrates how crucial AI-driven innovation is for the global economy. It positions Nvidia at the source of the coming technological evolutionary wave.

TF Summary: What’s Next

Nvidia’s investment not only revitalises Intel. Through the Intel-NVIDIA deal, America’s position in the global AI race strengthens, too. Intel now has the resources and expertise to compete in a sector increasingly dominated by other specialised chipmakers. For Nvidia, the partnership extends its technology lifespan and secures its leadership in AI infrastructure.

MY FORECAST: Expect Nvidia to deepen its influence over Intel, possibly paving the way for a full acquisition if Intel fails to recover independently.

— Text-to-Speech (TTS) provided by gspeech