Nvidia now stands alone at the top of the business world. The chipmaking giant is the first company ever valued at $5 trillion. This landmark beats all financial markets and technological competitors. The company’s meteoric rise presents how artificial intelligence (AI) converts hype into hard capital — and how one firm leads the way.

At the centre of it all stands Jensen Huang, Nvidia’s charismatic CEO, whose GTC AI keynote in Washington, D.C. laid out the company’s next chapter: expanding its chips and software into everything — from cell phone towers and factories to self-driving cars and quantum supercomputers. Nvidia’s vision powers AI — and the AI century’s infrastructure.

What’s Happening & Why This Matters

The $5 Trillion Milestone

Nvidia’s stock (NVDA) jumped another 3% after markets opened Wednesday, cementing its position as the world’s most valuable public company. It took just three months to climb from a $4 trillion valuation to $5 trillion, following a stretch of 13 months between the $3 trillion and $4 trillion marks. The company’s stock is up 50% in 2025 alone and consistently ranks among the top S&P 500 performers.

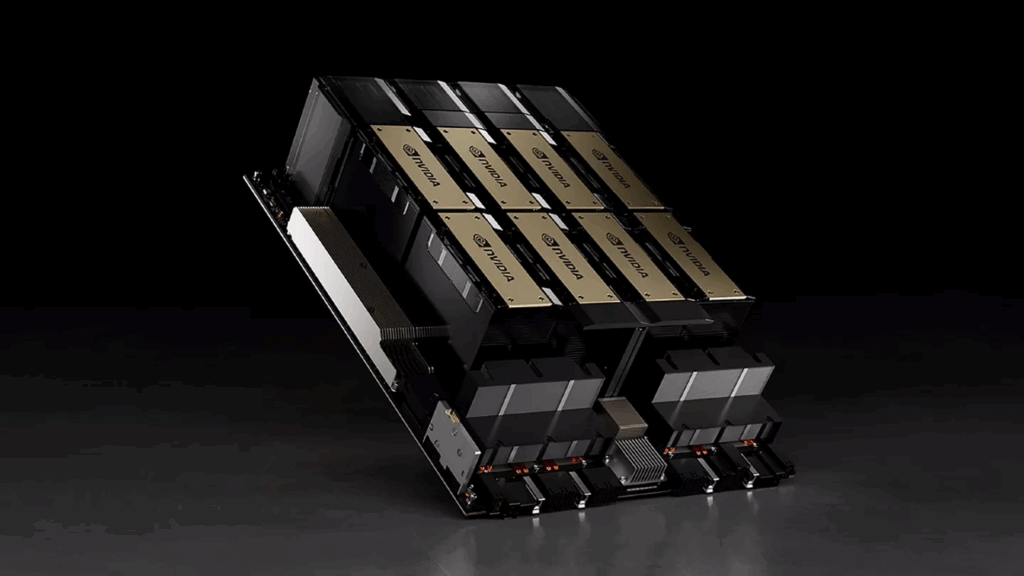

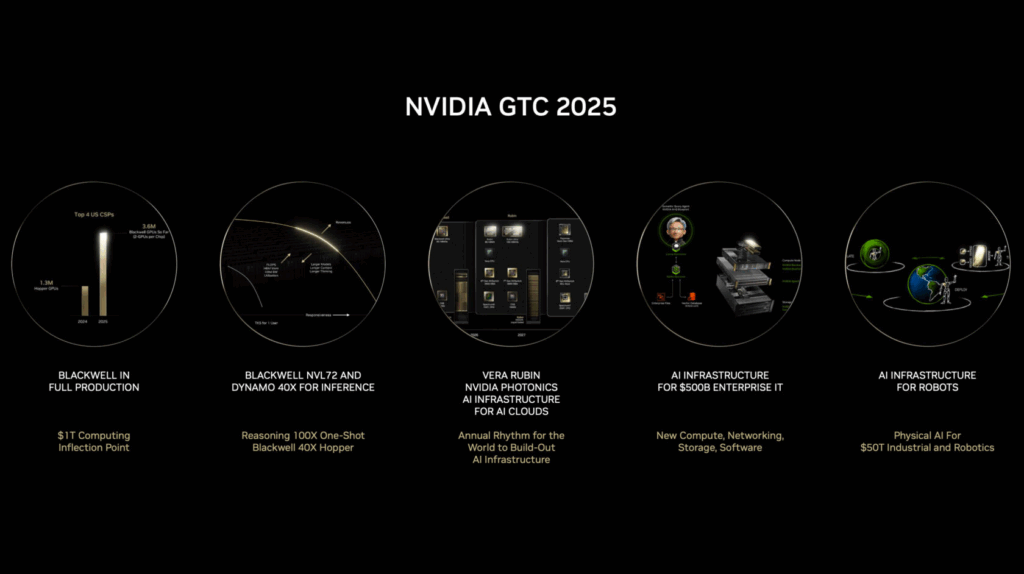

Fueling the surge: unrelenting demand for AI chips that power massive data centres run by Microsoft, Google, Amazon, and OpenAI. Nvidia’s chips, especially those in its Blackwell architecture, have become the backbone of the global AI economy — and investors can’t get enough.

Yet, the milestone also arrives amid questions about sustainability. Analysts warn of a potential AI investment bubble, as companies spend billions on infrastructure without seeing immediate profits. Huang, however, rejects the idea outright: “AI is now profitable,” he told CNN. “AIs are now so good that they deserve to be paid for.”

From Chips to “AI Factories”

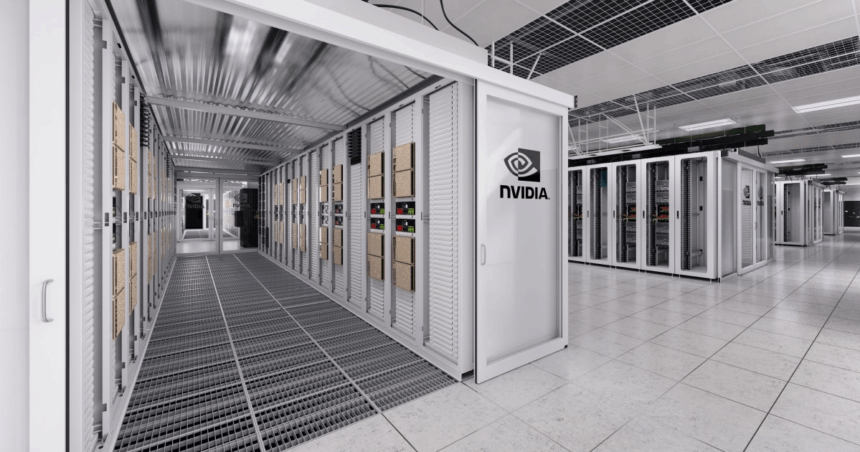

Huang’s keynote unveiled Nvidia’s blueprint for the next decade — one that goes far beyond chip design. The company revealed plans to power “AI factories”, or massive gigascale data centres, for partners like Oracle, Microsoft, and Google. These facilities will use Nvidia’s hardware and software to train and deploy new AI systems at unprecedented scale.

A new Nvidia AI Factory Research Centre in Virginia anchors this vision. The VA factory is a prototype for the next industrial revolution. Nvidia envisions AI as the new electricity — a universal utility driving every sector, from logistics to entertainment.

Expanding the AI Ecosystem

Nvidia’s reach extends deep into multiple sectors:

- Telecom: Collaborating with T-Mobile and Nokia on AI-native 6G cell towers, using Nvidia’s Aerial RAN computing platform. The goal is faster, more intelligent wireless connectivity that powers both smartphones and autonomous machines.

- Mobility: Partnering with Uber to build 100,000 self-driving cars by 2027, running on Nvidia’s DriveOS platform.

- Manufacturing: Joining forces with Siemens to create digital twins — virtual replicas of factories — to improve safety and fill over 500,000 U.S. manufacturing job openings.

- Government & Research: Working with the U.S. Department of Energy to build seven new quantum supercomputers, driving advancements in physics, materials science, and AI-driven simulations.

The initiatives recast Nvidia from a semiconductor monolith into a foundational technology provider — whose ecosystem touches nearly every corner of modern economies.

Navigating Global Politics and Partnerships

Nvidia’s dominance also places it squarely within global trade and political tensions. The company operates at the intersection of U.S. policy and global demand, particularly amid President Donald Trump’s calls for “American-made technology” and trade restrictions on China.

During the keynote, Huang emphasised manufacturing sovereignty: “Wireless technology around the world runs on foreign systems. That has to stop.” Nvidia’s Blackwell AI chips, now in full production in Arizona, represent part of that domestic push — though final assembly still occurs overseas.

Huang meets President Trump this week in South Korea during the Asia-Pacific Economic Cooperation (APEC) summit to discuss expanding U.S.-based semiconductor capacity. Nvidia also seeks approval from both Washington and Beijing to restart certain AI chip sales to China, a delicate balance between profit and policy.

TF Summary: What’s Next

Nvidia’s $5 trillion valuation cements its position as the world’s dominant technology company — and the architect of AI’s future. Its partnerships, political leverage, and sheer scale reshape how nations, industries, and individuals use artificial intelligence.

MY FORECAST: Nvidia’s next decade underpins the infrastructure of intelligence. Expect the company to integrate deeper into telecom, mobility, and defence, claiming the pedestal as the “Intel of the AI era.” While competition intensifies and talk of an AI bubble lingers, Nvidia is monetising the moment — one chip, one data centre, one robot at a time.

— Text-to-Speech (TTS) provided by gspeech