Microsoft (MSFT) joins an exclusive corporate club: companies valued at over $4 trillion! MSFT becomes the second U.S. company to reach the financial milestone. The valuation follows a strong earnings report, rapid growth in cloud computing, and massive investments in artificial intelligence (AI). The achievement is a reflection of Microsoft’s continued dominance in enterprise software, AI innovation, and cloud services.

What’s Happening & Why This Matters

On Thursday, Microsoft’s stock surged nearly 4.5%, pushing its market capitalisation to approximately $4.01 trillion. The performance rise comes after a year and a half since Microsoft first reached the $3 trillion valuation, denoting steady, sustained growth. Microsoft follows Nvidia, which recently became the first $4 trillion tech company; it stands ahead of Apple, currently valued at around $3.12 trillion.

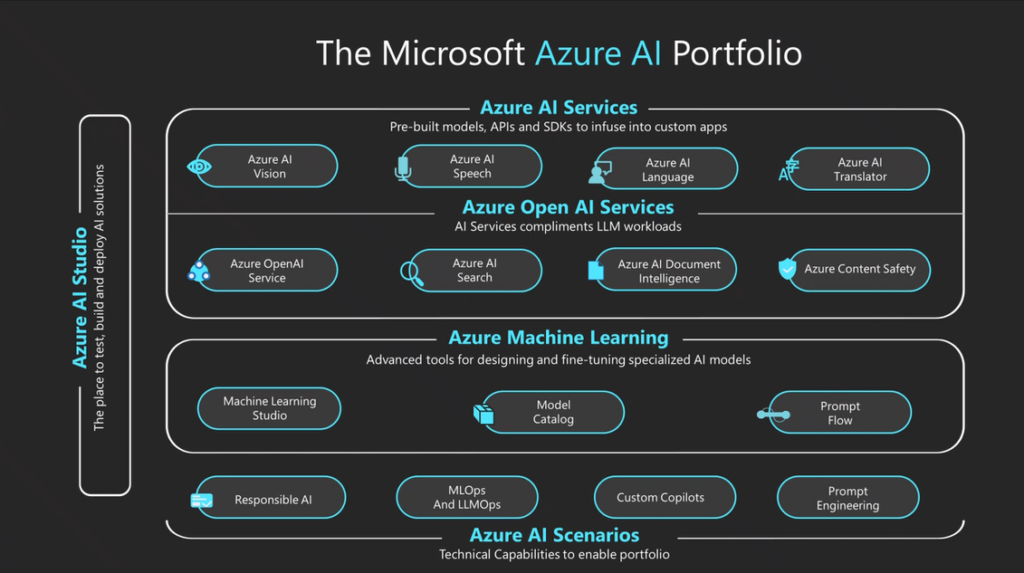

Microsoft forecasts a record $30 billion capital expenditure in the current fiscal quarter, focusing heavily on AI infrastructure. The company’s cloud platform, Azure, reports booming sales, making it Microsoft’s leading revenue generator. Additionally, Microsoft’s AI-powered Copilot chatbot drives growth in its flagship Microsoft 365 enterprise software.

MSFT’s growth contrasts with Nvidia’s rapid valuation increase, which tripled in value in about a year, highlighting different paces among tech giants. Yet Microsoft’s steady approach is proving effective, especially amid improving trade talks that bolster investor confidence in U.S. markets.

Microsoft rebounded strongly from market lows in April 2025 caused by U.S. tariff tensions. Its multibillion-dollar partnership with OpenAI has transformed its offerings. Microsoft integrates OpenAI’s generative AI models across Office products and Azure cloud services, giving it a technological edge over competitors like Google Cloud and Amazon Web Services.

Wall Street applauds Microsoft’s consecutive record revenue quarters since late 2022. The stock rally also benefits from strategic workforce reductions. Microsoft cut roughly 9,000 employees in July 2025, about 4% of its workforce, following a previous cut of 6,000 workers in May. The company credits AI-powered productivity improvements for the layoffs, with CEO Satya Nadella revealing that AI generates 20-30% of Microsoft’s software code.

These investments and cost controls position Microsoft to be a leader in AI-driven enterprise technology. Despite concerns over tariffs, Microsoft’s strong earnings show resilience and adaptability in a competitive global market.

TF Summary: What’s Next

Microsoft’s rise to a $4 trillion valuation underscores its leadership in cloud computing and AI innovation. Its heavy investment in AI infrastructure and integration of OpenAI technologies set the stage for continued dominance.

As Microsoft leverages AI to boost productivity and streamline operations, the company remains well-positioned to shape the future of enterprise software and cloud services. Investors will watch how Microsoft balances innovation, growth, and workforce management in an evolving tech landscape.

— Text-to-Speech (TTS) provided by gspeech