After five quarters of losses, Micron Technology, a U.S.-based chipmaker, is now benefiting from the surge in artificial intelligence (AI) spending. The company’s recent financial results have positioned it as a major player in the AI chip boom, spurred primarily by the success of Nvidia, a dominant force in the AI industry. Micron’s resurgence comes after a challenging period but now seems poised to capitalize on rising demand for high-performance memory chips.

What’s Happening & Why This Matters

Micron recently reported impressive financial figures for the quarter ending August 29, with revenue reaching $7.75 billion—nearly double its revenue from the same quarter the previous year. This surge can be attributed to the high demand for its high-bandwidth memory chips, a key component used in AI technologies. As AI applications continue to grow, the need for efficient memory solutions like those provided by Micron becomes essential, placing the company in a favorable position.

During an earnings call, Micron CEO Sanjay Mehrotra expressed optimism about the future, stating that the company is entering fiscal 2025 with the strongest competitive positioning it has ever had. He also highlighted how the rise of AI has created unprecedented opportunities in the memory and storage sectors. Mehrotra further projected record revenues in the last quarter of 2024, estimating between $8.5 billion and $8.9 billion, surpassing analysts’ expectations.

Micron’s resurgence is a positive sign for the chip industry as a whole, which has faced challenges in recent years due to fluctuating demand, particularly in the smartphone and personal computer markets. For much of 2022 and 2023, Micron struggled with oversupply issues, resulting in five consecutive quarters of losses. However, the company’s focus on AI-related technologies has turned its fortunes around, and it now stands as one of the winners of the AI-driven market.

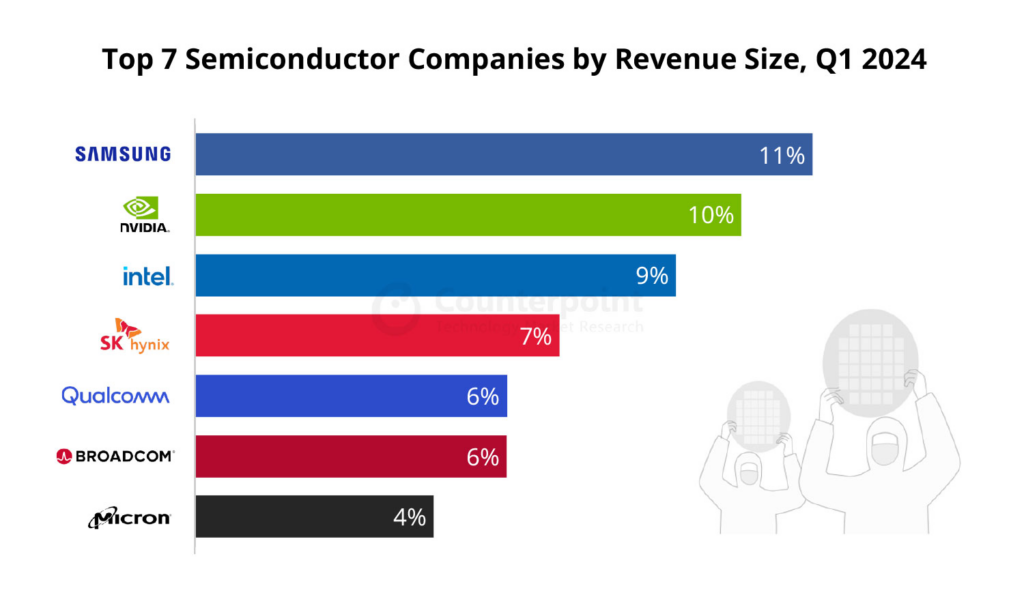

The impact of Micron’s success has been felt globally. Other major chipmakers like Samsung Electronics and SK Hynix in South Korea saw their shares rise following Micron’s report, reflecting investor optimism about the broader memory chip market. Tokyo Electron, a leading Japanese semiconductor company, also experienced a boost in stock prices.

Wedbush analysts have noted that Micron’s positive outlook is expected to spread optimism across the chip industry, particularly in the memory segment. Analysts believe this momentum will further benefit companies like Hynix, which already holds a lead in high-bandwidth memory production.

TF Summary: What’s Next

Micron’s recovery, fueled by AI investment, demonstrates the growing importance of memory and storage solutions in AI technology. The company’s financial projections suggest continued growth in the final months of 2024, signaling that Micron is positioned to thrive in the evolving AI market. Investors and industry experts will be watching closely to see if Micron can maintain its momentum and what impact this will have on the global chip market, especially as AI continues to drive demand for more advanced technologies.