More U.S. Drivers Are Looking East

American drivers are warming to Chinese-made vehicles. The numbers show a surge in interest. According to AutoPacific, more than half of U.S. car buyers now say they would consider a Chinese brand for their next vehicle; that’s a jump of nearly 25 percent from last year, clearly indicating the burgeoning demand for Chinese autos.

Growing acceptance comes despite rising political and privacy concerns over data collection and potential cybersecurity risks tied to Chinese tech. Yet, for many consumers, innovation, price, and digital experience outweigh geopolitical hesitation.

What’s Happening & Why This Matters

Shifting Attitudes

AutoPacific’s 2025 Future Attribution Demand Study surveyed 18,000 prospective car buyers planning to buy or lease a new vehicle in the next three years. The findings reveal that 65 percent of U.S. consumers now recognize Chinese auto brands — up from 53 percent last year — and 51 percent would consider buying one. The reporting indicates a demand increase for Chinese autos among American buyers.

That familiarity is translating into real intent. Last year, only 41 percent said they would consider a Chinese vehicle. This year, the number climbs into the majority.

Tech, Design Lead the Charge

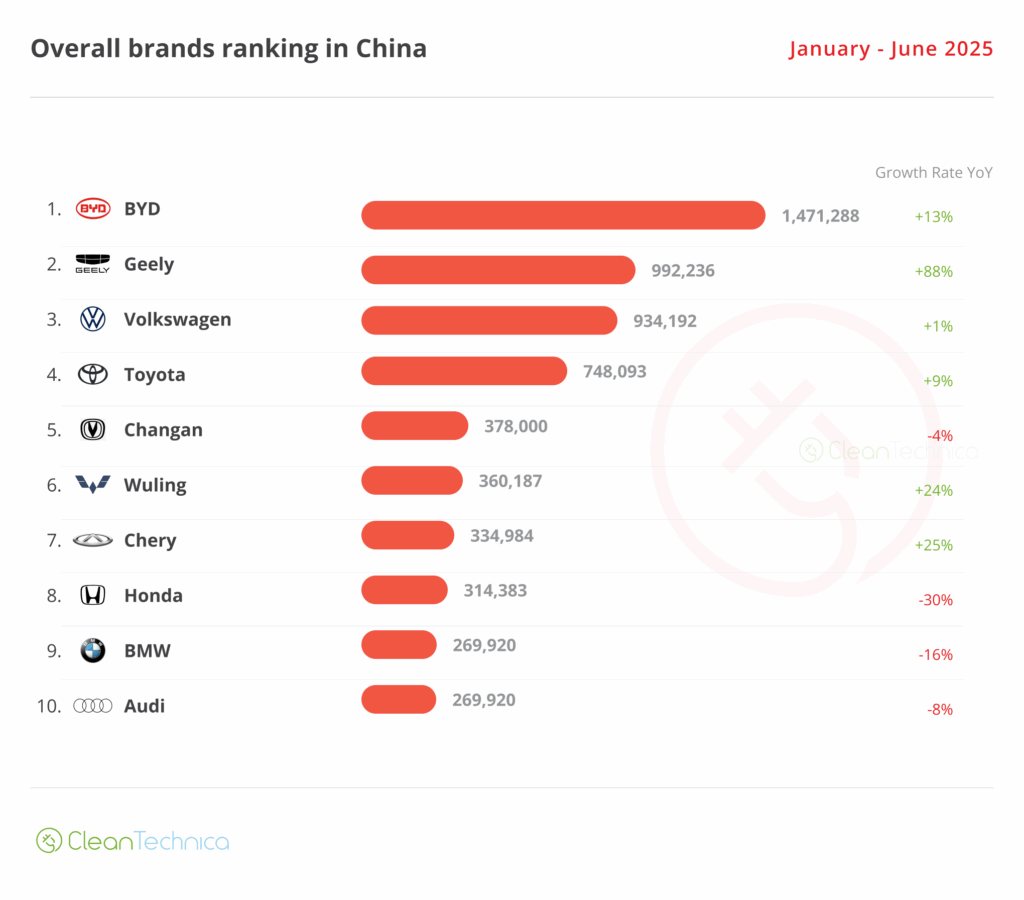

Chinese automakers like Huawei, Xiaomi, and BYD dominate early recognition lists. Huawei leads with 27 percent of American respondents willing to consider its cars, followed by Xiaomi at 23 percent, and BYD in third with 19 percent. The demand for Chinese autos stems from their appeal beyond affordability.

Their appeal isn’t limited to affordability. Chinese manufacturers push boundaries in digital integration, automation, and in-car entertainment. Many American buyers cite advanced AI-based driver assistance systems, intuitive infotainment interfaces, and native app compatibility as key differentiators.

Automotive journalist Kevin Williams explains the appeal clearly:

“Aside from the responsiveness of screens… people here hate them because they’re not done well. In China, it feels intuitive. The support for popular apps is seamless.”

He recalls his time inside the Xiaomi SU7, where the system supported full-service Apple Music and Chinese TikTok equivalents without lag or system strain. In his words, “it looked like what I’d get on a computer.”

Automation and Connectivity Reign Supreme

AutoPacific’s data shows that partially automated driving systems — such as General Motors’ Super Cruise, Ford’s BlueCruise, and Tesla’s Autopilot — now rank among the most-desired features, with 43 percent of buyers demanding hands-free driving capabilities.

The same percentage wants rear automatic emergency braking, swaying towards driver-assist safety. Meanwhile, wireless device charging, last year’s top-ranked feature, didn’t break the top 15 this year. These signs further represent strong demand for features synonymous with Chinese autos.

The trend points to one clear insight: the car is no longer a simple conveyance — it’s a connected digital experience. Chinese automakers have capitalized on that better than most.

Privacy!? What Privacy??

While interest in Chinese cars surges, so do national security discussions. U.S. officials continue to raise concerns about data sharing, location tracking, and potential surveillance through vehicle connectivity systems.

Still, consumers appear largely unfazed. Price-sensitive buyers prioritize value and innovation, particularly as Chinese EVs undercut Western rivals by thousands of dollars.

The paradox — trust concerns versus technological appeal — defines the next competitive phase in global auto manufacturing, accentuating the soaring demand for Chinese autos.

TF Summary: What’s Next

Chinese automakers now play on the same field as legacy brands from the U.S., Japan, and Europe. Their advantage lies in software-driven innovation and fast feature rollout, not electric drivetrains only. As U.S. consumers seem more comfortable with smart vehicles and semi-autonomous driving, the division between imported tech and national loyalty blurs.

MY FORECAST: The next year brings an intriguing test. Regulatory pressure is rising, but so is consumer fervor for Chinese autos. If Huawei, Xiaomi, and BYD sustain their growth, can it be long before Chinese EVs occupy American garages — and soon its highways?

— Text-to-Speech (TTS) provided by gspeech