U.S. Federal Reserve Chair Jerome Powell isn’t convinced that artificial intelligence is inflating a financial bubble. Speaking to reporters after the latest interest rate cut, Powell drew a clear line between today’s AI-driven tech surge and the speculative dot-com crash of the 1990s.

“This is different,” Powell said. He pointed out that the leading tech companies driving today’s AI expansion — such as Amazon, Nvidia, and Microsoft — generate real earnings and maintain sustainable business models. This, he argued, separates the current market boom from the purely speculative frenzy of the past.

What’s Happening & Why This Matters

Economic Confidence and the AI Sector

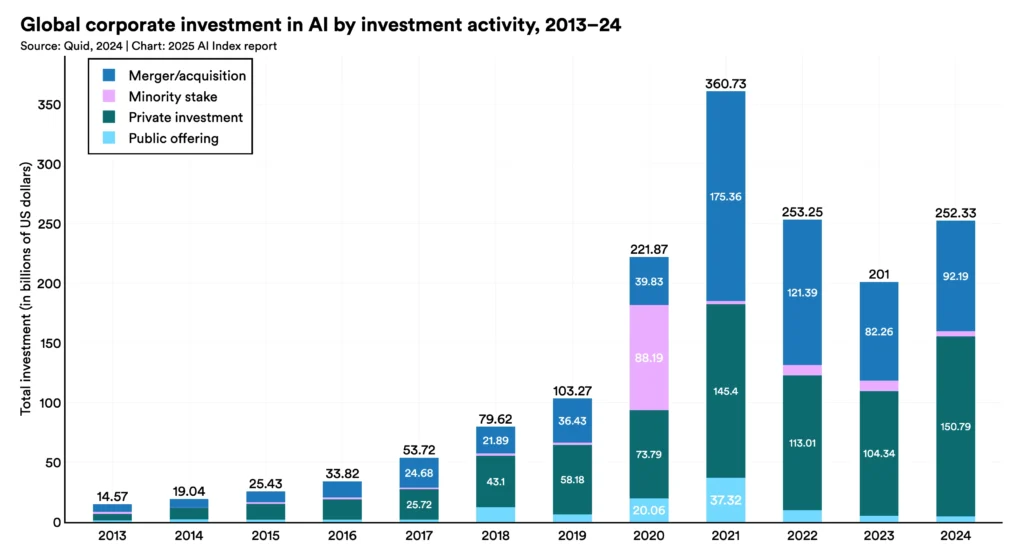

Powell views today’s AI economy as grounded in tangible results rather than hype. Companies now invest billions into physical infrastructure — particularly data centres — hinting confidence extends beyond stock speculation. Earlier this year, OpenAI, Oracle, and SoftBank pledged to invest $500 billion in AI data centres under the Stargate project. Similarly, Amazon just opened an $11 billion data hub in Indiana, while Google, Meta, and Microsoft plan comparable facilities.

These projects drive short-term job creation through construction and equipment supply chains. “The investment we’re getting into equipment and all the things that go into creating data centres and feeding AI — it’s clearly one of the big sources of growth in the economy,” Powell said.

Despite this optimism, he admitted uncertainty about long-term outcomes: “I can’t say if these investments will work out, but they don’t seem to affect rates either way.” The Fed’s primary decision was a quarter-point interest rate cut to encourage business growth and consumer confidence.

Layoffs, AI Spending, and Job Creation

While AI fuels economic activity, it hasn’t sparked a hiring boom. Amazon reduced 14,000 corporate jobs, targeting efficiency and redirecting funds toward AI infrastructure. Meta invested $14.3 billion in ScaleAI and recruited its founder to lead its AI division, but still cut 600 employees as part of internal restructuring.

Powell acknowledged that AI-driven automation could influence future employment trends. “It’s too soon to tell,” he said, though the Federal Reserve continues to monitor layoffs and jobless claims. “You see companies announcing hiring freezes or layoffs, and they’re talking about AI and what it can do. It could absolutely have implications for job creation.”

For now, Powell noted that jobless claims remain stable and employment data shows limited change. However, delays in federal reporting caused by a government shutdown have left the Fed relying on “anecdotal” insights from corporate earnings and private sector job reports.

Inflation, Tariffs, and Market Pressure

Powell also addressed inflation concerns linked to tariffs affecting tech imports, including Apple devices. “Higher tariffs are pushing up prices in some categories,” he said. He described inflationary effects as likely “short-lived,” but acknowledged risks of longer persistence. “Our obligation is to ensure that a one-time increase in price levels does not become an ongoing inflation problem.”

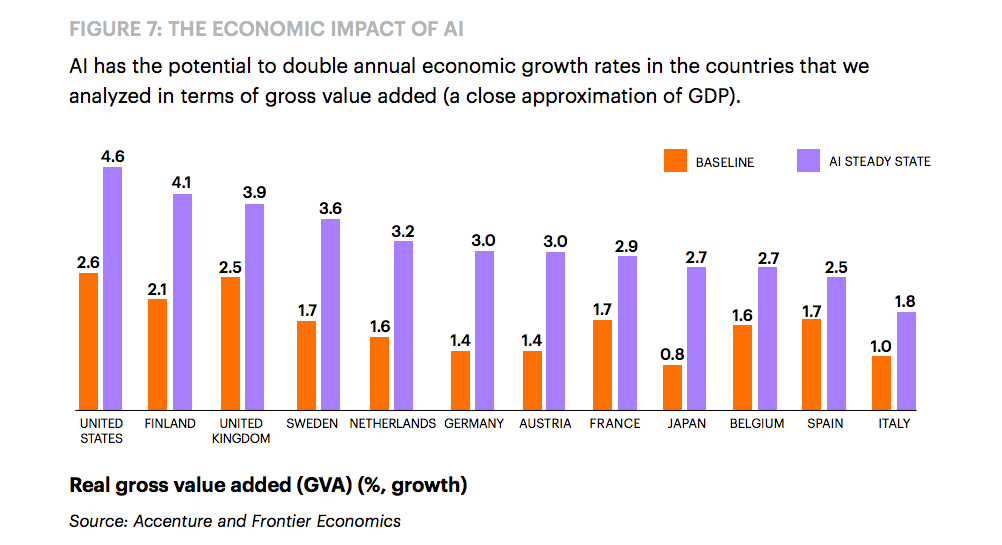

In Powell’s view, the AI economy differs from prior bubbles because its value is derived from functioning revenue models, not speculative assets. “If you go back to the ’90s, those were ideas rather than companies,” he explained. “Now, these are businesses with profits.”

TF Summary: What’s Next

Powell’s message reeks of cautious optimism: AI investment is accelerating, data centres are expanding globally, and corporate profits remain strong. Yet, the connection between AI-driven productivity and employment stability is uncertain. Inflation control holds as the Fed’s top concern, but confidence in AI’s long-term role appears unwavering.

MY FORECAST: Expect continued AI innovation and infrastructure growth through 2026. Nvidia, Amazon, and OpenAI lead the core of U.S. AI dominance. Rate cuts likely boost investment, strengthening the tech sector’s stability — not a bubble.

— Text-to-Speech (TTS) provided by gspeech