Apple reaches a new level of dominance. The tech titan just joined the $4 trillion club, becoming the third publicly traded company in history to cross that threshold — after Microsoft and Nvidia.

The milestone follows a volatile year for Apple, characterised by tariff pressure, AI delays, and manufacturing stumbles. Yet, the iPhone 17’s strong sales, especially in China, power a rebound that restores investor confidence and keeps Apple’s iconic status intact.

What’s Happening & Why This Matters

Apple’s ascent to $4 trillion exhibits how powerful its brand and ecosystem remain, even as competitors outpace it in artificial intelligence. Shares rose 0.1% Tuesday, continuing a rally that began after the iPhone 17 launch sparked renewed consumer excitement.

Apple’s Path to $4 Trillion

Apple’s journey reads like a timeline of tech milestones.

- 2018: First company to reach $1 trillion in market value.

- 2020: First to hit $2 trillion.

- 2022: Reaches $3 trillion, closing above that mark in mid-2023.

- 2025: Completes its climb to $4 trillion, cementing its place as one of the most valuable companies in history.

The company’s resurgence contrasts with a rough start to 2025. Earlier this year, Apple lost over $310 billion in a single trading day amid trade pressures from President Donald Trump’s tariff policies and growing competition from AI-first companies.

But the turnaround reinforces a core truth: the iPhone still drives Wall Street’s excitement, even when Apple lags in AI innovation.

AI Frenzy and Market Dynamics

Apple’s $4 trillion valuation arrives during a boom in tech markets driven by artificial intelligence. The two companies that reached the milestone before Apple — Nvidia and Microsoft — owe much of their surge to AI.

Nvidia dominates the chip supply powering generative AI, while Microsoft holds the software advantage through its partnership with OpenAI. Their rise underscores how much investors value AI over hardware.

By comparison, Apple’s success relies on its consumer ecosystem, not AI breakthroughs. However, analysts expect that to change. Wedbush Securities’ Dan Ives notes, “It’s clear to us that (CEO Tim) Cook & Co. finally found success with iPhone 17, and now the Street awaits the grand strategic AI roadmap to be unveiled.”

The Rebound Story

Despite its massive market cap, Apple’s stock gain this year is modest — up about 7%, compared to a 17% rise in the market and a 30% leap in 2024. Yet, the turnaround renews faith in Apple’s ability to stabilise amid global headwinds.

Investors view the $4 trillion threshold as symbolic. It confirms that even without leading the AI revolution, Apple maintains its gravitational pull on global markets. The company’s steady growth, cash reserves, and product ecosystem continue to anchor tech portfolios worldwide.

TF Summary: What’s Next

Apple’s $4 trillion valuation signals both triumph and challenge. It proves the company’s unmatched resilience — but also highlights its lag in AI strategy compared to rivals. The iPhone drives profits today, but the Street wants more than hardware.

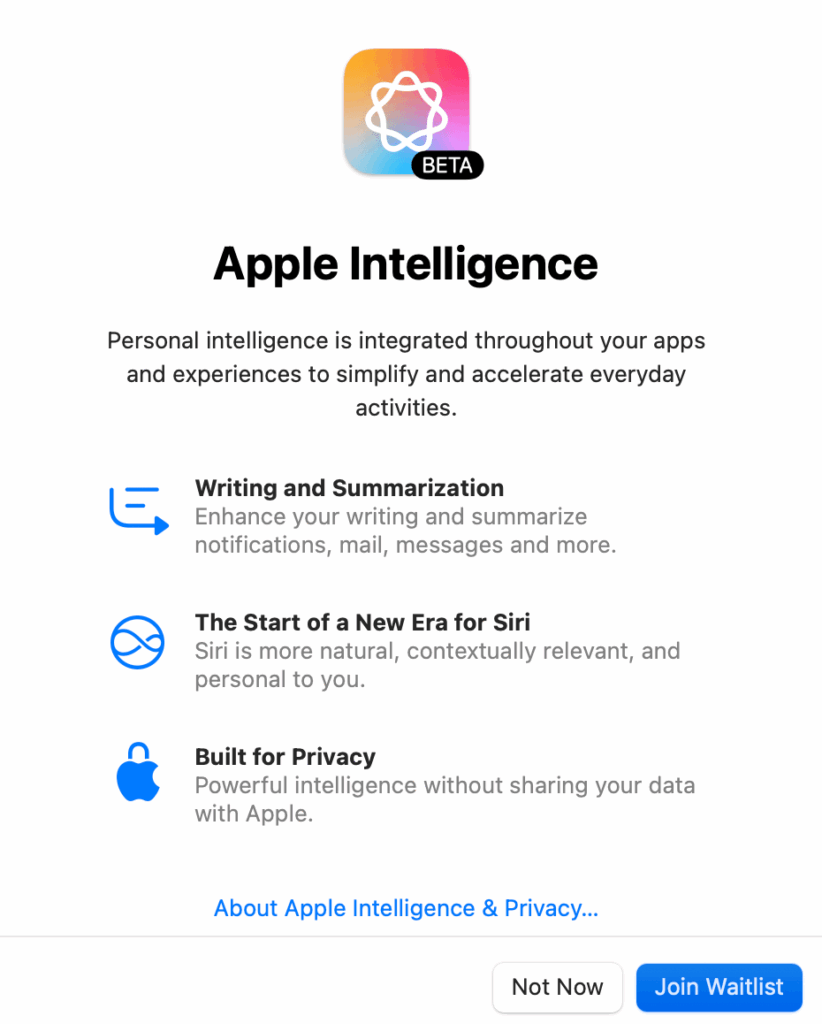

MY FORECAST: Expect Apple to unveil its comprehensive AI strategy by mid-2026. Whether through its Apple Intelligence platform or deeper cloud integrations, the company prepares to reclaim its innovation crown. As competitors race to dominate AI, Apple’s next leap depends on how it fuses intelligence with design — not just devices.

— Text-to-Speech (TTS) provided by gspeech