AI Investment Frenzy Sends Shockwaves Through Traditional Sectors

Artificial intelligence companies are minting astronomical valuations. At the same time, entire industries tied to office work and commercial property are losing market value. The contrast feels almost surreal. One side attracts billions in capital. The other sheds billions in equity.

The latest example comes from Anthropic, creator of the Claude AI models. Its new funding round pushes valuation levels into territory once reserved for the world’s largest public companies. Meanwhile, shares of major property services firms tumble amid fears that AI will reduce demand for offices and white-collar labour.

This moment illustrates how rapidly AI is reshaping economic expectations. Investors are no longer betting only on technology growth. They are also betting on which industries might shrink.

What’s Happening & Why This Matters

Anthropic’s Valuation Skyrockets

The AI startup Anthropic raises roughly $30 billion in fresh funding, lifting its valuation to about $380 billion. That figure more than doubles its previous valuation from just months earlier.

Investors backing the round include Singapore’s sovereign wealth fund GIC and hedge fund Coatue Management. These heavyweight participants signal deep institutional confidence in enterprise AI platforms.

GIC’s chief investment officer, Choo Yong Cheen, describes Anthropic as

“the clear category leader in enterprise AI.”

Revenue growth reinforces that perception. Anthropic’s annualised revenue reaches about $14 billion after expanding more than tenfold over three consecutive years. A major driver is Claude Code, the company’s AI coding assistant, released in 2025.

Such explosive growth helps justify enormous valuations. Yet it also reflects enormous costs. AI companies burn cash at unprecedented rates due to computing expenses and talent competition.

Anthropic expects to reduce that burn over time and achieve profitability by 2028.

Meanwhile, rival OpenAI reportedly pursues a funding round that could reach $100 billion and a valuation near $830 billion.

The numbers dwarf many traditional corporations. Investors treat frontier AI firms as foundational infrastructure rather than niche software companies.

Investor Sentiment Turns Volatile

Despite enthusiasm, not everyone feels comfortable.

Some observers warn that soaring valuations may outrun real-world economics. Veteran technology investor James Anderson calls the rapid price increases “disconcerting.”

Public markets also showed signs of unease. Shares of major tech firms fluctuated amid concerns about AI spending and competition. Alphabet dropped over 4% during the week. Meta declined modestly. Markey leader, Nvidia, slipped slightly in the broader market anxiety.

Russ Mould of AJ Bell describes the mood:

“Association with AI has gone from party to peril as investors reappraise what the technology means.”

In other words, enthusiasm coexists with fear. Investors want exposure to AI growth, but worry about costs, disruption, and bubbles.

Property Services Stocks Slide

While AI companies climb, commercial property services firms face a sharp sell-off. Shares of major real estate service providers drop across both U.S. and European markets.

In London, estate agency Savills fell more than 7%. International Workplace Group, owner of Regus office spaces, dropped about 9%. Major developers British Land and Landsec saw declines.

Across the Atlantic, the stock descents grew. CBRE plunged more than 12%. Jones Lang LaSalle fell nearly 11%. Cushman & Wakefield sank over 9%.

The fallout was not a single-company issue, but sector-wide.

Analysts attribute the sell-off to fears that AI will reduce demand for office space and administrative staff. If fewer people work in offices, the value of those offices declines.

Why AI Threatens Commercial Real Estate

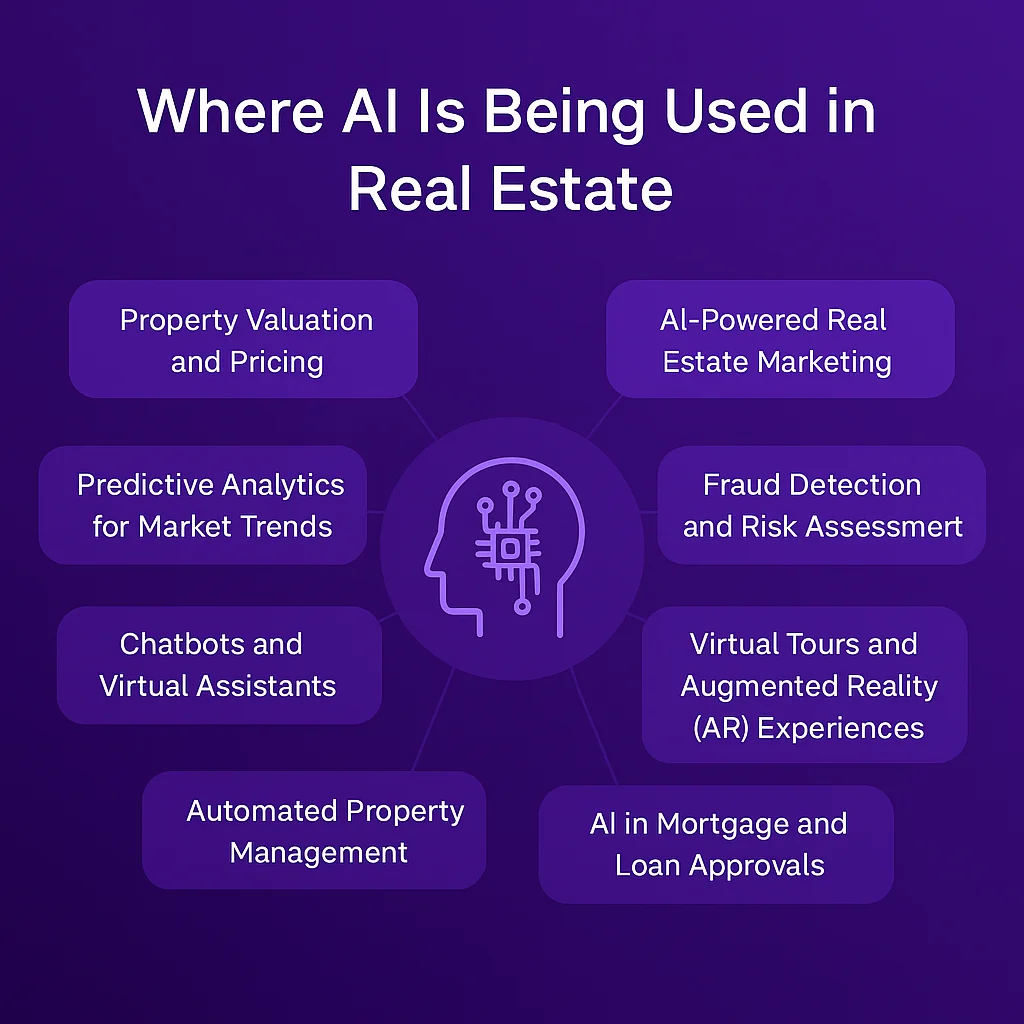

Artificial intelligence automates many white-collar tasks traditionally performed in office environments. Customer support, data analysis, scheduling, document processing, and even software development increasingly rely on AI tools.

If companies need fewer employees, they need less space.

Jade Rahmani of Keefe, Bruyette & Woods explains that investors are rotating away from “high-fee, labour-intensive business models” vulnerable to AI disruption.

He cautions that the immediate impact may be overstated. Complex real estate transactions still require human expertise. Yet long-term uncertainty weighs heavily on valuations.

This creates a paradox. AI infrastructure construction boosts demand for certain types of real estate, especially data centres. At the same time, office demand may decline.

Not All Property Firms See Doom

Some executives believe AI could benefit their businesses.

CBRE CEO Bob Sulentic argues that the firm’s advisory and transaction services rely on creativity, negotiation skills, and relationships that machines cannot easily replicate.

He states:

“None of this seems likely to be replaced by AI in the foreseeable future.”

CBRE also reports strong revenue growth, driven partly by expanding data centre demand.

AI does not destroy all real estate value. It redistributes it. Traditional office space may weaken while digital infrastructure real estate strengthens.

An Economic Sign

The simultaneous rise of AI firms and decline of property services companies reflects a broader shift in capital allocation. Investors move money toward sectors expected to grow exponentially and away from those perceived as structurally threatened.

The pattern mirrors earlier technological transitions. During the internet boom, telecom infrastructure surged while print media struggled. Today, AI infrastructure plays a similar role.

Anthropic positions itself as a safety-focused alternative in the AI race. Founded by former OpenAI leaders Dario and Daniela Amodei, the company notes responsible deployment alongside technical capability.

Its earlier backers include Amazon and Google, both of which provide computing infrastructure.

Such partnerships reinforce the idea that AI development requires massive industrial support. These are not garage startups. They are global-scale operations.

TF Summary: What’s Next

Anthropic’s massive funding round underscores investor belief that AI platforms will underpin the future economy. At the same time, the sell-off in property services firms shows how quickly markets price in disruption risk. Capital flows toward perceived winners and away from potential losers.

In the near term, volatility will likely continue. AI leaders pursue further funding and eventual public offerings. Traditional industries assess how to adapt rather than resist. Over time, the divide between AI-enabled sectors and labour-intensive services may widen.

MY FORECAST: Expect a gradual transformation rather than an overnight collapse of office demand. Hybrid work persists. Automation expands. Data centres multiply. Property portfolios shift toward digital infrastructure. The companies that integrate AI into their services will survive. Those who ignore it risk becoming relics of a pre-AI economy.

— Text-to-Speech (TTS) provided by gspeech | TechFyle