Google Joins Other Tech Stars as Most Valuable Companies

Alphabet did not stumble into the $4 trillion market cap club by accident. The company reached the milestone after a year of relentless investor optimism around artificial intelligence, renewed confidence in Google’s core businesses, and a series of strategic wins that reframed its competitive position. Markets rewarded scale, cash flow, and execution. Alphabet delivered all three.

The moment also marked a psychological turning point. Once seen as a legacy giant under threat from newer AI-native players, Alphabet now sits firmly alongside Nvidia, Microsoft, and Apple as one of the defining forces of the current tech cycle.

What’s Happening & Why This Matters

From AI Anxiety to AI Momentum

Alphabet spent much of the previous year playing defense. The debut of ChatGPT rattled Google’s dominance in search and forced a rapid internal reset. That reset now shows results. Google pushed forward with Gemini, refined its product cadence, and reasserted relevance across AI research, consumer tools, and enterprise services.

The release of Gemini 3 quickly changed sentiment. Independent benchmarks show improved reasoning accuracy, stronger multimodal responses, and more capable code generation. Google also integrated Gemini directly across Search, Workspace, Android, and developer tools, reducing friction and expanding daily usage.

Investor confidence surged further once Apple selected Gemini AI as part of Siri’s next-generation upgrade. The deal signaled trust at the highest level. Even without public financial terms, the endorsement carried weight. It told markets that Google’s AI stack is competitive at a global scale.

Search, Cloud, and YouTube Still Print Money

Despite the AI headlines, Alphabet’s valuation still rests on fundamentals. Search advertising continues to anchor revenue. YouTube grows both ads and subscriptions. Cloud now operates as a serious profit engine rather than a long-term experiment.

Recent earnings underline that balance:

- Google Cloud revenue jumps over 30% year-over-year

- YouTube ad revenue posts double-digit growth

- Operating margins expand despite heavy AI investment

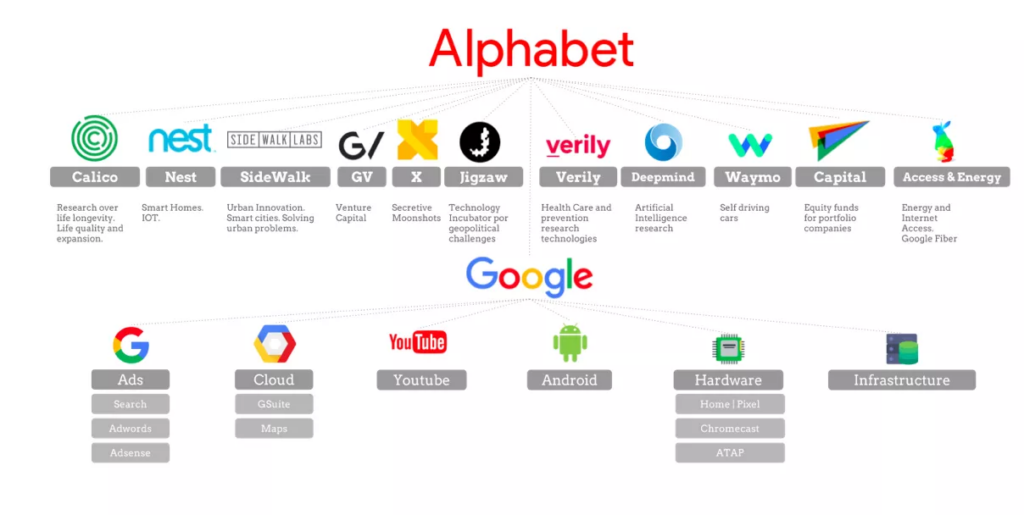

As Ben Barringer of Quilter Cheviot notes, Alphabet remains “a sum-of-the-parts company.” Search, cloud, YouTube, and autonomous driving all contribute. No single bet carries the entire valuation.

Antitrust Pressure Eases — For Now

Legal overhang mattered more than many admitted. Alphabet faced years of regulatory uncertainty around search dominance and ad tech practices. A recent U.S. court ruling forced data sharing but stopped short of a structural breakup. That outcome removed a central downside scenario.

With Chrome intact and core operations untouched, investors recalibrated risk. The company still faces scrutiny, but existential threats have receded. Markets responded accordingly.

Danni Hewson of AJ Bell summed it up cleanly: Alphabet adapts rather than freezes. The company expands beyond its comfort zone while defending its base.

AI Infrastructure: Strategic Weapon

Alphabet also leverages a quiet advantage: funding. Unlike many AI competitors, Google does not rely on constant capital raises. Advertising and cloud profits bankroll research, custom silicon, and global data centers.

That advantage shows up in deals such as supplying advanced AI chips to Anthropic, expanding Google Cloud’s appeal to startups and enterprises alike. Infrastructure scale serves as both a moat and a growth lever.

TF Summary: What’s Next

Alphabet enters the $4 trillion tier with momentum, not nostalgia. AI execution stabilizes confidence. Core businesses continue to scale. Regulatory risk cools. The company now operates from a position of strength across consumer, enterprise, and infrastructure layers.

MY FORECAST: Alphabet uses this valuation milestone as leverage, not a victory lap. Expect faster Gemini rollouts, deeper enterprise AI penetration, and continued pressure on rivals across search, cloud, and autonomous systems. The $4T moment marks a checkpoint, not a ceiling.

— Text-to-Speech (TTS) provided by gspeech