Satellite internet experienced a fast pivot for customers. Two central stories arrive at once, and reshuffling the power map in orbit. Viasat launched its new F2 satellite. EchoStar have a deal that sends Hughesnet customers directly into the arms of Starlink. Both actions smacked a sector already under pressure from scale, speed, and aggressive pricing. The strain across the market feels real, and the stakes rise sharply.

What’s Happening & Why This Matters

Viasat’s new F2 enters the fight

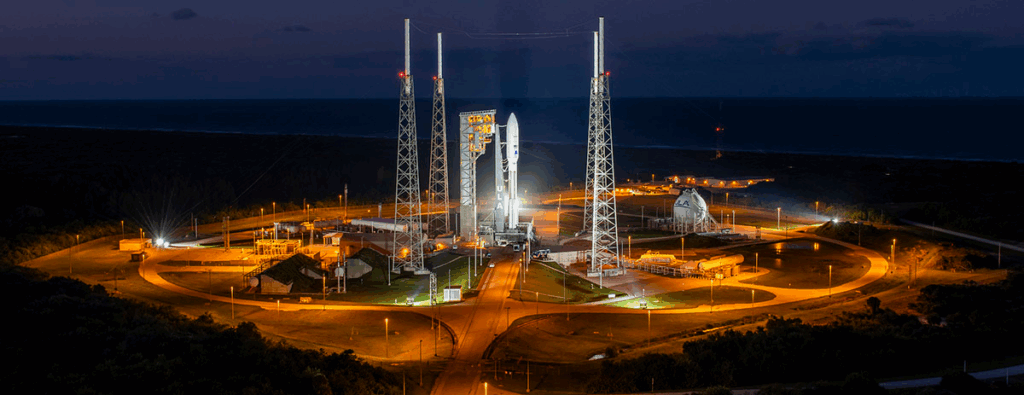

Viasat puts its new F2 satellite into orbit on top of a United Launch Alliance Atlas V551. Engineers confirm contact fast after separation. The satellite weighs 6,000 kilograms and carries over 1Tbps of network capacity. It targets users across the Americas with a design built for power, coverage, and commercial reach.

The company forces past a rough chapter. Its previous F1 satellite suffered a severe malfunction. That issue reduced Viasat’s capacity and frustrated its long-term network plan. F2 is a reset. It boosts bandwidth. It helps Viast re-enter commercial aviation, maritime services, and enterprise contracts.

F2 circles Earth in geostationary orbit at 22,000 miles. The satellite uses more than 1,000 steerable spot beams to target customers with efficient signals. Viasat expects stronger retention of business clients and a chance to regain ground in the United States, where Starlink leads consumer satellite internet.

Executive teams frame F2 as essential. They argue the satellite opens space for faster speeds above 100 Mbps and fills major performance gaps created over the past year.

EchoStar’s deal pushes Hughesnet users toward Starlink

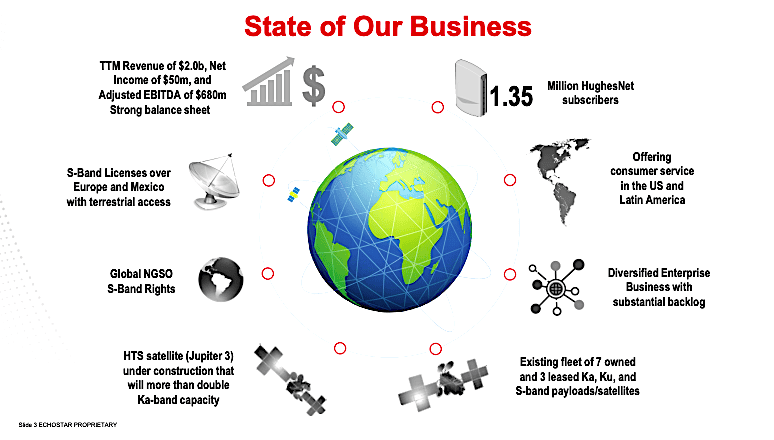

The second story is quietly revealed in a regulatory filing. EchoStar confirms an important radio-spectrum transaction with SpaceX. The document explains a referral program. Hughesnet customers can move directly to Starlink for better performance.

Hughesnet’s parent company wants to step back from consumer satellite internet. Leadership says low-Earth-orbit networks—especially Starlink and Amazon’s Kuiper — create too much pressure on cost, latency, and pricing.

The numbers tell a clear story. Hughesnet counts 783,000 subscribers. That number fell from 912,000 one year ago. Executive notes inside the filing note the business lacks cash with doubts about sustaining operations. Echostar warns about liquidity and signals a U-turn towards enterprise contracts.

EchoStar’s spectrum deal with SpaceX still needs federal approval. But the referral program adds real competitive weight. HughesNet customers gain a new path to faster LEO service. Starlink gains more demand. EchoStar frees itself from consumer losses.

TF Summary: What’s Next

Viasat’s F2 adds strength to the geostationary market. EchoStar’s deal sends a decisive message: LEO networks take control of consumer access. Competition is amplified as network upgrades, large satellites, and spectrum deals restructure the market.

MY FORECAST: F2 gives Viasat new breathing room, but LEO networks offer greater reach, faster. Expect more carrier partnerships, more spectrum negotiations, and harder battles for enterprise and aviation contracts.

— Text-to-Speech (TTS) provided by gspeech