U.S. Trade Policy Strikes at Semiconductor Imports

The United States is ramping up efforts to reduce reliance on foreign semiconductor production, implementing a 25% tariff on imported chips. This policy, spearheaded by former President Donald Trump, is designed to pressure global chip manufacturers to shift production to U.S. soil. While the goal is to strengthen domestic supply chains, the impact could be felt across consumer electronics, electric vehicles (EVs), and artificial intelligence (AI) development.

Industry leaders warn that the move may increase prices on smartphones, GPUs, EV batteries, and AI chips, creating supply chain disruptions while accelerating manufacturing shifts to alternative locations such as Vietnam and India.

What’s Happening & Why This Matters

Tariffs Directly Target the Semiconductor Market

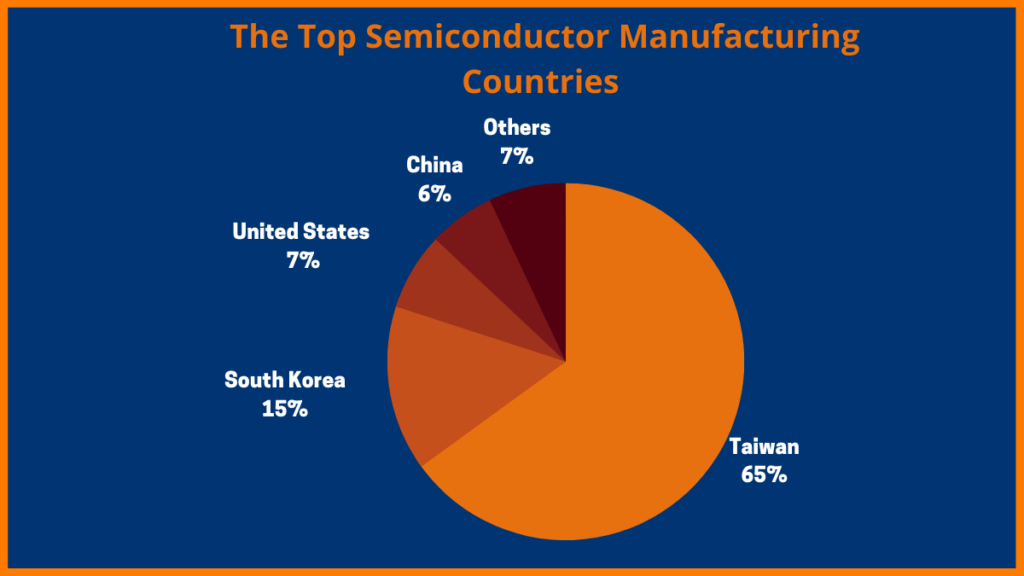

Trump’s proposed 25% tariff on imported semiconductors is a new chapter in the U.S. pushing for chip production self-sufficiency. With TSMC, Samsung, and Intel dominating the global semiconductor market, these tariffs aim to force investment in domestic fabrication plants (fabs).

- The initial tariff rate is set at 25%, but Trump has suggested it could increase further.

- The goal is to incentivize chipmakers to build manufacturing facilities in the U.S., avoiding tariffs and benefiting from government incentives.

- Trump stated, “We want to give them a little bit of a chance to come in, build factories, and avoid tariffs.”

These tariffs align with the U.S. CHIPS Act, which already offers billions in subsidies for domestic semiconductor manufacturing. However, long-term industry shifts take time, meaning price hikes could hit consumers and businesses in the short term.

Prices: PCs, Smartphones, GPUs, and AI Chips

The tech industry is already feeling the pressure, with manufacturers preparing for cost increases across various devices.

- Smartphones and PCs: Chips from TSMC and Qualcomm power the latest smartphones and laptops. Tariffs could increase costs for Apple’s A-series processors, Qualcomm’s Snapdragon chips, and AMD’s Ryzen CPUs.

- Gaming & AI GPUs: Nvidia’s GeForce RTX 5000 GPUs and AI accelerators used in machine learning models could face price surges.

- Electric Vehicles (EVs): Tesla, Rivian, and other EV makers depend on imported chips for battery management and autonomous driving systems. Higher tariffs may lead to more expensive EVs.

Consumers should expect price hikes on flagship devices, while companies must decide whether to absorb costs or pass them on.

Rivian’s Georgia Plant Faces Political Uncertainty

The semiconductor tariff announcement coincides with concerns over Rivian’s $6.6 billion Georgia plant loan, a project backed under the Biden administration.

- Rivian’s R2 and R3 EV models are scheduled for production in 2026 and 2028, but financial uncertainty could alter those plans.

- Georgia Governor Brian Kemp voiced concerns about the loan’s future, saying, “I don’t really know where that stands right now.”

- Rivian remains committed to its expansion but acknowledges that changing federal policies could disrupt mass production schedules.

A potential rollback in EV subsidies and federal loans could impact Rivian and other manufacturers, slowing U.S. efforts to compete in the global electric vehicle market.

Eyeing Vietnam & India for Semiconductor Production

While the U.S. aims to increase chip production, many companies are already looking for alternative manufacturing hubs to bypass tariffs.

- Vietnam and India are emerging as key destinations for chip production, offering lower labor costs and government incentives.

- Apple, Nvidia, and other tech firms have begun shifting parts of their supply chains away from China to less restrictive trade regions.

- TSMC and Samsung have delayed some U.S. projects, citing labor shortages and higher operational costs.

Moving production to new players is a global restructuring of semiconductor manufacturing. Tariffs could accelerate regional diversification rather than centralize production in the U.S.

TF Summary: What’s Next?

The 25% chip tariff plan is set to reshape the tech, AI, and EV industries, creating immediate cost concerns while attempting to drive long-term semiconductor investment in the U.S. Consumers should brace for higher prices on PCs, GPUs, smartphones, and EVs. At the same time, manufacturers weigh the financial trade-offs of domestic production versus outsourcing.

If companies continue moving production to Vietnam and India, the tariffs may shift supply chains rather than bring chipmaking back to America. Meanwhile, Rivian and other EV startups face a future with uncertain government incentives, impacting U.S. leadership in electric mobility.

The semiconductor battle is far from over, and its effects will reverberate across the global tech landscape.

— Text-to-Speech (TTS) provided by gspeech